Weekly Savings Plan – Holidays are expensive. You don’t want us to tell you that, do you? But with the right savings plan, you can save enough for a great vacation without breaking the bank.

We stumbled upon this Facebook meme a while ago, and if you have a small income (or any income) it’s a good idea:

Weekly Savings Plan

In fact, it’s a great way to save money on Christmas gifts or other things that will come in handy next season.

Weekly Saving Money Plan!!

But we want to raise the stakes and make room for a great weekend. For some, this is obviously more expensive and requires more planning and budgeting. However, by combining this with our travel credit card (it’s a Visa card, but we collect points that we can redeem on flights, hotels, and etc.), with Amanda’s surprise at the best price of Airbnb flights and preservation, and manage to create more capital.

Since Amanda is a teacher, we always plan our summer vacation. So we start from the first week of July 1 (or next Monday) and do the deposit every week. Best practice: invest in high interest loans (2.5% or more) so your money grows more.

That’s almost $8,000 in savings per year. It sounds like a lot, but a little extra money never hurts. Of course, if this is the limit of your normal budget, you need to adjust the numbers to fit what you can manage. Just use the spreadsheet and start with the number that works for you. You can do this in monthly payments if it suits you.

It will take a little longer. When we get to the holiday season, we cut back on eating out and do a little more of the couponing to make sure we cover those payments. But when you plan to save in the year, it really puts your goal in focus and makes it easier to understand the “why”. As a bonus, it gives you clear progress from week to week.

How To Create A Savings Plan

And hey, if you don’t go on vacation, there’s nothing to prevent you from buying something nice, building a small house, and even putting that money in your nest. However you cut it, a clear savings plan that gradually increases is the best way to plan for a big goal!

Comment below and let us know what you are doing to save the family fun or personal goals. Last year, the 52-week austerity plan emerged as a new model in the world economy and finance. You know, where you save $1 week of the year, $2 the second week, etc. Heck, I even wrote about the plan and tried it myself.

Thank you for visiting 4 Hats and Savers! Be sure to sign up for our newsletter for more easy money saving ideas for 2015!

I said I tried because I didn’t succeed. Yes, this person who likes money and money does not get the job done. There are big reasons why I don’t go (mainly because the prices go up closer to the holiday season) but I found that there are a few ways to achieve this type of savings.

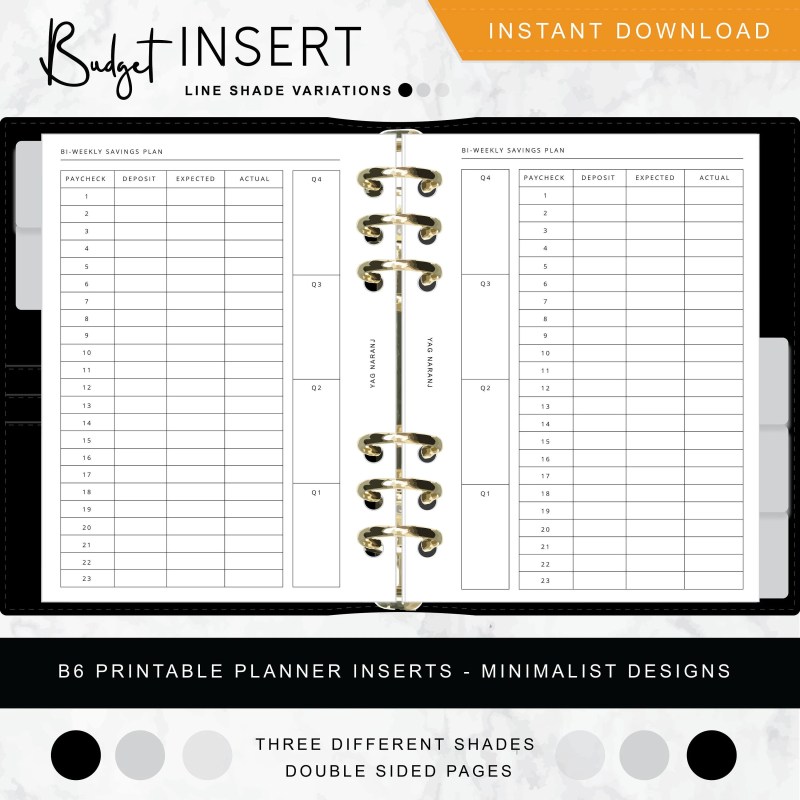

Save $1,300 A Year With This Weekly Savings Budget Plan

I actually came up with 3 new 52 week savings plans that will work better in the long run.

This is the easiest way to take advantage of last year’s 52-week savings plan and not feel burned out at the end of this year. It seems easy to save a little each week until summer (and your vacation) starts to hit the account.

Since the summer, the price has increased and you start to worry about even a little of the money you left.

Before Thanksgiving, Christmas, and Hanukkah come, all you want to do is take the money you should have saved and use it for other things.

Week Money Challenge: How To Save $1,378 In A Year

In that direction, saving $52 in the first week and $51 in the second week is setting you up for success. You are already eager to save because it is the new year and you know that the number will decrease.

This is my new favorite way to save because it focuses on what our children use to save every year. This plan is also great for those of us who are on a tight budget and just can’t put the money away in the usual 52 week savings period.

This is similar to recurring savings, but you choose one savings each week of each month. Since it is 12 months and you started in January, you will save $12 every week in January. You will save $11 per week in February and $10 per week in March.

This plan works for children because of the change every month. As the price is lower, you don’t have to worry about putting them all together. Later in the week I will write a more detailed article about how this works well for children.

Money Saving Days Hacks And Challenges * Trene Allen

Note: all numbers refer to savings in the account on Friday. Some months have 5 Fridays, which explains why some are 5 weeks old instead of 4.

As a freelance writer and artist, it can be very difficult to achieve 52-week savings when you don’t have a steady paycheck. One way to fix this is to set monthly payments.

For example, if you add weekly income to the Savings Plan, it will be $250 for January. Since my paychecks come in every 30 to 60 days, this one-time savings is better for me than fighting for the dollar every week. Piam.

This amount will be reduced month by month, so when I finally get treatment from the work contract, I can take care of 2 or 3 months at a time.

K Savings Challenge Tracker

By the time I get to December and only have to save $4 for the whole month, I will more than double, triple, or even increase tenfold. Again, you are planning for success and you are motivated to save more.

Will you join a 52-week savings plan this year? Are any of these options more beneficial to your lifestyle than regular plans? Let me know in the comments below.

Do you want to book a good year’s vacation? Find out how to plan your year in one day! Click on the image below. Opening a savings account can be difficult for people in their 20s and 30s. Most of us are new to our profession and haven’t made “a lot of money” yet, some are still paying off their student loans, and others are just starting to learn about budgeting and finance. I’ve always been financially conscious, but I’m not worried about saving money at age 20 – I want to travel the world! So travel (and spend your travel money) I did. But now that I’m a little older, I’m starting to worry that I don’t have a lot of emergency cash – I’d like to think that I’m incompetent, but the truth is that emergencies (and debt planning ready) happens. and it is better to be prepared than not. With that in mind, I challenged myself to save another $1,000 in 2015 to give myself a little bit of financial peace, and I think I’ve found a way to do it!

For some of you, $1,000 might not seem like a lot, but for me it can be hard to get some extra money because I have endless student loans (think) and live in a very expensive city. (two bedrooms). Putting away small amounts of money for a while is less of a burden for me than throwing away hundreds of dollars at once, so this is how I build my savings.

Meal + Budget Bundle

I start and end the year with a very low budget because that’s where most people’s financial burden is – sometimes it takes a while to recover from Christmas gifts and expenses around, do you know? But the sooner you start saving regularly, the easier it is to get into the habit – even if it’s just a few dollars a week.

The possibilities are endless! And if you’ve decided to open a new checking and/or savings account to raise some extra cash, now is a great time to do so – Capital One 360 is offering a bonus Good luck to new customers this Black Friday weekend!

Visit their website for more information

Weekly savings, savings plan weekly, weekly christmas savings plan, weekly savings challenge, easy weekly savings plan, weekly savings plan 52 weeks, weekly savings plan for 52 weeks, bi weekly savings plan, weekly savings plan for a year, weekly savings plan chart, bi weekly savings plan chart, publix weekly savings