Warranty Deed Texas Form – An Alabama special warranty deed is a legal document that transfers title to a property from a seller to a buyer, guaranteeing that the seller will indemnify the buyer in the event of a title claim. If the seller is married, the spouse must also sign over the property. Such shares may be tenants by the entirety, co-owners, or such spouse may have a share in the homestead. If the spouse does not have a share, this must also be stated in the deed.

(1) The name of the Alabama preparation. In some cases, a party may be responsible for providing the information required by the Alabama real estate grantor for release. If so, the creator should be identified at the beginning of this release.

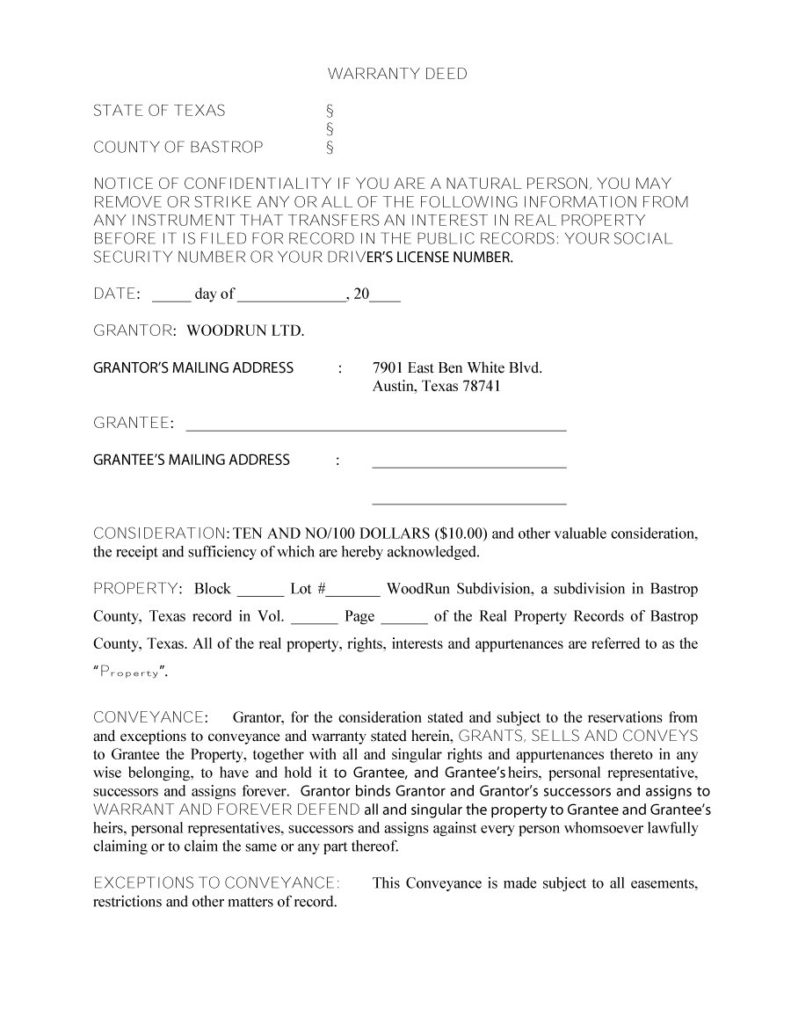

Warranty Deed Texas Form

(2) Address Alabama Preparer. An official business address at which the person submitting this form can be contacted by mail is necessary for proper identification.

Free Deed Forms For Property Transfer

(3) The name of the recipient of the Alabama document. After the County of Alabama responsible for registering this version has completed its task, this document will be returned or sent to the specific party (ie, the grantee). The full name of the recipient of the documents submitted is required for the title of this release.

(4) The address of the recipient of the Alabama Act. You must provide the exact mailing address where this document should be sent after the Alabama Probate Judge has finished filing it.

(5) Alabama ID. The grantor will be the party currently in possession of the property and will waive such claim once its claim is satisfied. Alabama will need to identify a performer in this role after the application opens.

(6) Grantee’s address in Alabama. Grantee’s Alabama physical location must be documented by recording the building number, street/road/avenue, and apartment/apartment number found at his home address.

Printable Gift Deed Form Texas: Fill Out & Sign Online

(8) Review. As mentioned earlier, a person who grants title in Alabama usually places conditions on the release of their title. In most cases, such a release will be made in exchange for a certain amount of money. This document must clearly declare this amount, so write it down if necessary and then enter this amount numerically in the brackets provided in this statement.

(9) Identity of the grantee. A party must be named to remit the amount specified herein to the appropriate Alabama party recipient in exchange for ownership of the real property. Identify the grantee by its full name in the space provided.

(10) Address of grantee. The recipient’s name must be accompanied by their home address (building number, road or street name, unit/apartment number). Go to the next available area and then delete this address.

(11) Residence of the grantee in the county and state of Alabama. Complete the grantee description with the county report and indicate where the grantee’s Alabama home address is located. Two different areas were presented to obtain this information.

Free Warranty Deed Forms

(12) Country property is exempt. State the name of the Alabama county where the real property conveyed under this lien exemption is physically located.

(13) Alabama property description. Naturally, when a title to real property in Alabama is released, transferred, sold, or otherwise transferred from one party to another, an accurate description of the property involved must be disclosed. This requires that the physical address of the Alabama property being transferred, as well as its legal description, be provided in the body of this notice. In most cases, the legal description of property in Alabama can be found in the current deed. It is strongly recommended that this deed be made available to the grantor of this property, even if a copy must be obtained from the county heritage office or registrar responsible for the land records of this property, as the legal description of the property must be transcribed exactly as it appears on the books.

(14) Signature and name of grantor from the State of Alabama. The person securing the Alabama property must sign this document to officially transfer the property to the grantee named above. Its signature must be completed under the supervision of a valid licensed notary public or one adult witness. In addition, the Alabama grantee must print his name directly below the signature. Please note that there is enough space for two Alabama State Grants for this signature process. This will allow more than one grantee to participate in this agreement. In the State of Alabama, each party who has a claim or title to the property transferred must affix his signature to confirm his intention to release the property in question.

(15) Grant’s address in Alabama. The grantee’s Alabama address must be provided when he or she signs this document.

Joint Tenancy Warranty Deed

(16) Signature and name of the witness. Many consider it appropriate to have the receiver affix his signature in front of one witness along with the notarization. A witness looks at Grant Alabama’s signature on this document. After the execution of this act the witness shall seal his name as evidence of his presence at the execution of this release.

(17) Alabama Special Warranty Deed Notarized. Finding a licensed notary public will be easy because their contact information is recorded and is often considered a reliable way to verify the identity of the Alabama grantee signing these documents and the date of that signature by using the field provided (exclusively) for the notary public.

By using the website you consent to the use of cookies to analyze website traffic and improve your experience on our website. In the state of Texas, promissory notes are a way to bridge loans between lenders and borrowers. A promissory note can be secured or unsecured depending on the amount of the loan and the agreement.

:max_bytes(150000):strip_icc()/Enhanced-Life-Estate-Deed-56aa10bb3df78cf772ac382f.jpg?strip=all)

Regarding the form of promissory note, Texas law recognizes both secured and unsecured promissory notes, as set forth in Texas Business and Commerce Code § 26.02.

Texas Deed In Lieu Of Foreclosure Form

Under Section 302.001 of the Finance Code, Texas promissory notes may be classified as “secured.” A secured promissory note is a promissory note that has an agreement between the borrower and the lender.

In a Texas secured promissory note, the borrower agrees to post a form of collateral to secure the loan.

Depending on the note and what it is used for, the security may vary depending on whether it is real estate, personal property, or other forms of collateral.

If collateral is used in conjunction with a promissory note, the secured promissory note will need to detail the subject of the security. If not documented, the borrower may not be required to surrender the lien if the note is in default.

Warranty Deed Form

Secured promissory notes are usually detailed and thorough. You can find a free Texas promissory note, and most include things like:

Unlike a secured promissory note, an unsecured promissory note contains no collateral. Instead, an unsecured promissory note is an agreement between two persons acting in good faith.

Generally, borrowers and lenders will have their relationship as collateral, and this will usually be sufficient to enforce the note.

In Texas, a promissory note is a legally binding document that is signed once by both parties.

Warranty Deed With Vendor’s Lien Form Texas

Although it does not have to be notarized, a witness must be present to give it legal effect.

There are several options for collecting a promissory note. There may be initial contact with the borrower and then filing a lawsuit in the court system.

In extreme cases, the lender may send a bill to the debt collector, but the fees may vary depending on the services you receive.

Yes. The statute of limitations for most promissory notes in Texas is four years. The limitation period starts from the date of expiry of the note.

Texas Deed Forms

Interest rates on promissory notes in Texas depend on whether the interest rate is stipulated in the written contract. If it is in writing, the maximum interest rate that can be applied is around 18%.

However, there are some exceptions to the law. If the promissory note interest rate is not specified in writing, the maximum amount of interest that can be charged is 6%. Also having trouble finding a general warranty deed form template that fits the specifics of your job in Texas? People have reached out to us and shared their struggles to create a simple yet comprehensive Texas General Warranty Document Template. That’s why we’re working on a generic Texas Warranty Deed form template that’s easy to use and customizable to meet the needs of all potential Texas buyers and sellers.

The Texas Warranty Deed form is used in Texas real estate transactions when the seller can provide clear evidence of title. A general warranty deed transfers property from grantee to grantee

Missouri warranty deed form, texas special warranty deed form pdf, nc warranty deed form, georgia warranty deed form, alabama warranty deed form, warranty deed form free, general warranty deed form texas, warranty deed form, ohio warranty deed form, illinois warranty deed form, texas warranty deed form, warranty deed form oklahoma