Voluntary Payroll Deduction Authorization Form – Uniform Style Certification Date: First Name: Last Name: Department Store: Please deduct a total of $ from each paycheck for my uniform order. Total Pay Deduction (Circle One) 1 2 3

Employers will use your personal information for various business purposes. We strongly recommend completing an employee profile. We are required to retain such information for a period of 1 year. If you do not complete the form completely, the employee profile may be deleted and no further action may be taken after notification to us. Employee Profile As a condition of employment, I, Tony’s Direct HR, hereby acknowledge and agree that my employment relationship with Tony is at my sole discretion. Any questions regarding my rights as an employee may be directed to Tony’s Human Resources Department. I understand that any request or information regarding my employment must be made in writing and sent to Tony, Director of Human Resources, within 30 days of my employment. I understand that the employee profiles are created by me and my employees and I take full responsibility for the completeness and accuracy of the About Me section. If I find the information incorrect, I will return your signed version to you by certified mail, return receipt requested. Tony’s may change employee profiles upon notification to Tony’s Human Resources Department. I agree to allow the Company to record certain information in my employment agreement by notifying Tony within 30 days of the termination of my employment or by changing my position in the business that permits the recording of the information. I will report any violation of the terms of my employment contract to Tony’s Human Resources Department within 30 days.

Voluntary Payroll Deduction Authorization Form

UWC/UMF Staff Salary Deduction Form Part 1: Order Form Please print and complete a separate order form for each fish order Name Please select

What Are Payroll Deductions?

If you provide an FFI with a Form W-9 to document a joint account, any account holder who is a resident of the United States. Form W-9 must be provided. what did you see

Finder Agreement Between Your Company Name Company Address and Plaintiff’s Name Plaintiff’s Address 1. Your company name (hereinafter referred to as Searcher) is retained.

Central Drug Standard Control Organization Directorate General of Health Services, Ministry of Health and Family Welfare, Government of India Page 1 of

Gingerbread House Auction Business Name: Contact Name: Address: City: Post: Phone: Email: Donation House Sponsoring Decorator ($50.00 to supply) I would like

Florida Payroll Deduction Authorization Form Download Fillable Pdf

S Gingerbread Baby 2008 Teachers Clubhouse, Inc. www.teachersclu bhouse.com Name Date # Follow the instructions below to create the Gingerbread Baby Glyph

Christmas meeting graham cracker candy house craft materials. See the craft sheet for a list of materials for Game 1. Santa’s beard on teams. One person per team

SPEED Long Island Challenge April 2426, 2015 Penalty #150401 Invited Teams: ABF(NE), AQUA, BAC, BAD, BGN, CONDORS, MAG(NE), NEW(NJ), SAC, TS, Other TV

Food and Agriculture Organization of the United Nations Evaluation Office National Forest Monitoring and Evaluation of Tanzania (NAF ORMA) GCP/GO/194/MUD

Form 2159 (rev. 7 2018). Payroll Deduction Agreement: Fill Out & Sign Online

If you believe this page should be removed, please follow our DMCA takedown process here.

Download One-Stop Forms & Templates In this catalog, we have curated 150,000 of the most popular fillable documents across 20 categories. To make it easier to find and archive forms related to issues, select a category and keep all relevant documents in one place. Edit professional templates, download them in any text format, or send them via advanced sharing tools Open list →

This site uses cookies to improve site navigation and personalize your experience. By using this site, you consent to our use of cookies as described in the updated Privacy Notice. You can change your choices by visiting our Cookie and Advertising Notice. … Read more Readless Send by email, link or fax. You can also download, export or print it.

The best editor to change your document online. Follow this simple guide to edit payroll deduction form in free PDF format online:

Western Carolina University Payroll Deduction Authorization For Parking Permit

We have answers to the most popular questions from our customers. If you cannot find an answer to your question, please contact us.

Payroll deductions are wages deducted from an employee’s gross income to pay taxes, garnishments, and benefits such as health insurance. This deduction is the difference between gross pay and net pay and may include: Income tax.

The law clarifies that federal documents such as I-9s and W-4s can be completed electronically, as long as the protocol for valid electronic signatures is followed.

Fill out an IRS W-4 form and give it to your employer so they know how much tax to withhold from your paycheck. W-4 You can increase or decrease your net pay. If you want a larger refund or smaller balance due to tax time, you’ll have more money on hold and see less take-home pay in your paycheck.

Fillable Online Payroll Deduction Uniforms09

A salary withholding authorization form is a written agreement that employees must sign if they want to take certain voluntary deductions from their pay. This form should be as clear and specific as possible so that employees know how much money will be voluntarily deducted from their pay.

Payroll Deduction Form Says Voluntary Payroll Deduction Form Authorization for New Employee Payroll Deduction Form Payroll Deduction Authorization Form for Damaged Equipment Benefit

Visit the Internal Revenue Service (IRS) website to access the W-4 form that you can download. Fill in the blank fields on the W-4 form by clicking your mouse in the field and entering the appropriate information. If you want, you can print a blank PDF file and fill it out manually.

Individuals do not need to complete a new TD1 each year unless there is a change in the amount of their federal, provincial or territorial personal tax credit. If there are changes, they must complete a new form seven days after the change.

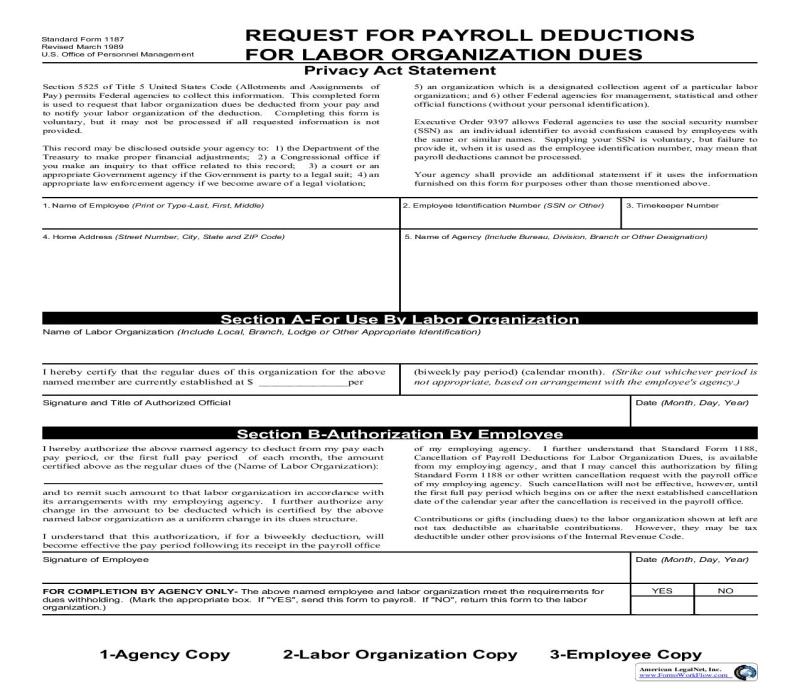

Request For Payroll Deductions For Labor Organization Dues {sf 1187}

Who needs a W-4? Most employees will need to complete a W-4 for their employer. If you have multiple tax-deductible jobs, you must complete a W-4 for each job. Generally, if you are self-employed, independent, or an independent contractor, you do not need to file a W-4 for your company.

A W-4 is a form that employees fill out to tell employers how much to withhold from their paychecks when they are hired. A W-2 is a form that employers fill out to record how much an employee is paid each tax year and how much tax is withheld.

Form W-4 tells you, as the employer, the employee’s filing status, any job adjustments, credit amounts, other income amounts, withholding amounts, and any additional amounts withheld from each paycheck to use to calculate the federal income tax amount. Deductions from the employee’s salary.

This site uses cookies to improve site navigation and personalize your experience. By using this site, you consent to our use of cookies as described in the updated Privacy Notice. You can change your choices by visiting our Cookies and Advertising Notice. Direct Deposit Authorization Form Complete this form, print and sign below, then forward it to your payroll company. Your Name SSN Landline Telephone Office Telephone Information Financial Institution: The

Payroll Deduction Form: Fill Out & Sign Online

Payroll Frequency (RCPG) Payroll frequency. (Km.) Payroll Frequency. (Revenue) Payroll frequency. (DVD) Payroll Frequency. (Proof) Type of Savings Account Savings and Loan Account Savings and Loan Account Savings and Loan Account Savings and Loan Account Savings and Loan Account Credit Card Account Credit Card Account Credit Card Account Credit Card Account Credit Card Account Credit Card Account Cash Value Account Value Cash Value Account Cash Value Account Cash Value Account Cash Value Other Account Other Account Other Account . = Payroll frequency is the number used to calculate payroll deductions. Deduct 10.00 payroll from employer’s check for more information. A 15.00 deduction can be reduced to 20.00 using this method. When using this method, it is important to calculate your deductions correctly to ensure a favorable income-to-salary ratio (payroll tax). Income must be for business purposes. What is the amount of your salary deduction? A 15.00 deduction can be reduced to 20.00 using this method. What is the amount of your salary deduction? 15.00 deduction can be deducted up to 20.

Today we are going to learn how to fill out the Payroll Check Direct Deposit Form first thing you need to do and this is for new hires or employees looking to change their current salary payment method. is saved so at the top you put your first initial or middle name and your last name right below that you put the last four digits of your social security number then you go to the box that says bank account. number, and you’re going to put in your account number you choose your type of account is it a checking or savings account in this case we’re going to say it’s a checking account and then you’re going to put in the name. You are going to move to another bank

Authorization for payroll deduction form, payroll deduction authorization, voluntary payroll deduction, payroll authorization form, sample payroll deduction form, payroll deduction authorization template, payroll deduction authorization form, voluntary payroll deduction form, employee payroll deduction authorization form, deduction form for payroll, generic payroll deduction authorization form, payroll deduction authorization form template