Stock Gift Acknowledgement Letter Sample – A donor acknowledgment letter is more than a “thank you” letter. Most tax-exempt organizations must comply with certain requirements, including a donor “receipt,” often called an acknowledgment letter.

Donors who contribute more than $250 at a time to a tax-exempt nonprofit organization must obtain a written acknowledgment from the organization to claim the deduction on their individual income tax return.

Stock Gift Acknowledgement Letter Sample

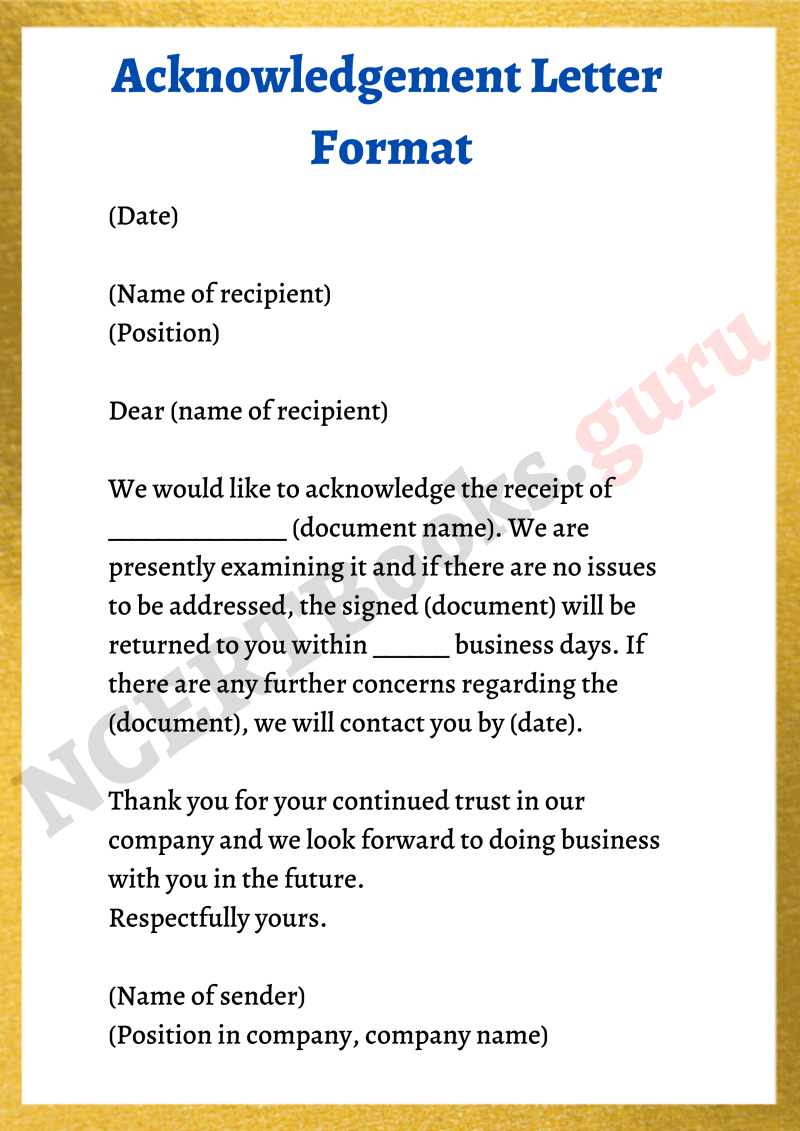

Appropriate written acknowledgment can take many forms – letters, emails, or postcards. There is no official IRS form that an exempt organization must complete.

Matching Gifts Best Practices

According to IRS Publication 1771, the IRS requires that the acknowledgment be “in writing, submitted at the time of application or receipt of payment, and in such a manner as to be brought to the attention of the donor.”

For the letter to be considered a “simultaneous” contribution, “the donor must receive the acknowledgment by the earlier of the following dates: the date the donor actually files his or her individual income tax return for the year; or the return due date ( including expansion).

Generally, most non-profit organizations submit a written acknowledgment by January 31 of the year following the receipt of the contribution.

We recommend that organizations give written confirmation to donors in time – as close to receiving the gift as possible.

Free 4+ Share Subscription Agreement Forms In Pdf

Again, the IRS requires that a tax-exempt organization send an official acknowledgment letter for any donation that exceeds $250. Donors use this letter as proof of their donation to claim tax deductions.

“Thank you for your support with the date (insert cash donation amount). No goods or services are offered

You can also make this fun! I would also like to include some of the required language related to non-profits:

This donor received no benefit in return for this contribution…other than the joy of giving to an organization that supports programs for children. We are an exempt organization under Section 501(c)(3) of the Internal Revenue Code; EIN ##.”

Acknowledgement Hi Res Stock Photography And Images

“Thanks for contributing a used table and a set of six oak chairs that NP received on the date. No goods or services are provided in exchange for your consent.

The IRS denied tax deductions to donors who were not recognized as qualified nonprofits. Two recent Tax Court cases illustrate the importance of nonprofits following the letter of the law. (Read the Chronicle of Philanthropy article, “IRS Crackdown Focuses on Gift Records”). Help make it easier for your donors.

When a tax-exempt organization provides goods or services in exchange for a donation of more than $75, the nonprofit must (1) notify the donor in writing of the fair market value of the goods or services and (2) the donor Be informed that the donation is only for fair share which is more than the market value is tax deductible.

The nonprofit makes a good estimate of the fair market value of the good or service and communicates it to the donor. Generally, a nonprofit organization’s good faith estimate of the cost of goods and services is considered fair market value, and the donor can rely on that estimate (as long as the donor knows the estimate is unreasonable). .

How To Write The Perfect Donation Letter (+ Examples & Template)

Help the donor understand how their precious gift was used. We advise our clients not only to share gift tax language.

Mollie Cullinane is happy to speak with national organizations of fundraisers to help them understand their legal obligations. Contact us for more information.

Mollie Wettstein Cullinane is an award-winning attorney who works with nonprofits of all sizes, from emerging local charities to international foundations. Texas Super Lawyers – Nonprofit Law (Thomson Reuters, 2021, 2012-2014). Molly’s work focuses on creating and managing strong and legally compliant nonprofit organizations that have a strong foundation for long-term success. It provides practical solutions for risk management and sound governance. It helps non-profit organizations, foundations and professional organizations that want to achieve positive change. Learn More Any time your nonprofit receives a donation, it’s important to show your gratitude — no matter how big or small the contribution. But if an individual donates more than $250, the IRS requires the organization to provide an official acknowledgment letter that the donor can use for tax purposes. These letters should be mailed or emailed to your donors by January 31st of each year.

A donor confirmation letter should include a few specific elements to help the donor and your organization comply with IRS regulations:

Donor Acknowledgment Letters

In addition to these specific items, your organization can use a donor acknowledgment letter to engage donors and share information about your nonprofit’s mission, accomplishments, and future goals.

Thank you for your generous donation to [ORGANIZATION NAME], a tax-exempt organization under section 501(c)(3) of the Internal Revenue Code ([EIN #]).

On [DATE], you supported our mission with [AMOUNT]. We have processed this gift as a credit card transaction.

No goods or services are provided in exchange for your consent. Your payment is fully tax deductible to the extent permitted by law. Please keep this letter for your tax records.

How To Write The Perfect Church Donation Letter (with Templates)

On [DATE], you donated [DESCRIPTION – WITHOUT MONETARY VALUE]. This gift is greatly appreciated and will be used to support our mission.

In exchange for this contribution, you receive [goods or services – ESTIMATED FAIR MARKET VALUE]. Your payment is tax deductible to the extent that it exceeds the value of the goods and services provided by our organization in return. Please keep this letter for your tax records. While eating breakfast, Caitlin sees a Facebook ad sharing a photo of an injured rescue cat. Caitlin loves cats and her cat Mr. Paws died a few months ago. She doesn’t seem ready to adopt or foster yet, but she is motivated to donate and help the animals she loves so much! He is moved and eager to help and quickly donates $50. And then… nothing happens. Caitlin isn’t sure if the donation went through, so confusion reigns. Two days later, she sees the Facebook ad again and wonders if her donation helped save the cat’s life or the nonprofit she donated to. It was a “legitimate” non-profit organization in the first place.

Effective fundraising activity management is essential to effective fundraising by identifying, thanking and supporting donors. But it can also be difficult to manage, especially when it’s added to the workload of stressed nonprofit teams.

Simply put, a donation receipt is a written record that acknowledges the donor’s financial or non-financial contribution. This recognition is given by the recipient non-profit organization. Grant notes have legal significance for donors and practical significance for nonprofit organizations. In the United States, non-profit organizations are not legally required to recognize their contributions. However, donors cannot claim tax deduction without a written acknowledgment. Therefore, it can be considered a proven practice in donor care that the organization supports its donors in a timely manner with written acknowledgment of donations.

Donor Acknowledgement Letter For Donations: Complete Guide

Not sending donations and optimizing your donation income essentially means leaving valuable funds and donor relationships on the table.

In recent years, the IRS has taken a tougher approach to tax deductions. While nonprofits are not subject to IRS penalties for failure to issue donor acknowledgments, donors’ tax deduction claims can be denied for inadequate donor acknowledgments. And it can threaten donor relations. It’s important to include all the correct information on your donation receipt so donors can claim their charitable deduction and keep track of their donations and finances.

Like Katelyn from the beginning of our article, donors want to know that their donations are well received – and donation receipts help achieve just that. Unique, immediate and well-designed donation receipts can help increase revenue and increase donor retention in the long run.

Donation receipts allow you to track donors’ donation history with your organization, which can serve many purposes down the line. For example, if you have more information about your donors’ giving history, you can better customize and personalize your future communications. Donation receipts can also help keep your nonprofit’s financial records clean and accurate. By understanding the importance of donation receipts and optimizing the issuance process, you can raise more funds for your organization, and faster.

How To Handle Stock Donations

For donations of less than $250, donors can claim a tax deduction with their bank records. If the donation is more than $250, the donor needs a written acknowledgment of the donation from the nonprofit organization to which they donated.

A donation receipt is also required if the donor received goods or services in exchange for a one-time donation of more than $75.

When a donor’s donation is deducted from their paycheck, donors can use the following to claim their tax benefits:

A written acknowledgment of donation is required for non-cash donations of $500, unless the items are placed in non-human fundraisers such as Goodwill boxes.

Donor Relations Director Resume Samples

Non-monetary contributions of $500 require a donation receipt and records of how and when the non-profit received the items. Non-monetary contributions that

Sample acknowledgement letter for donation, sample donor acknowledgement letter, letter acknowledgement sample, gift acknowledgement letter sample, acknowledgement of resignation letter sample, acknowledgement receipt sample letter, sample letter of acknowledgement, sample for acknowledgement letter, gift acknowledgement letter, sample nonprofit gift acknowledgement letter, donation acknowledgement letter sample, sample donation acknowledgement letter non cash