Single Owner Llc Operating Agreement – A member’s LLC formation agreement puts important information about your LLC in writing. Many websites try to sell you LLC forms and services that you will perform that if you do not have a strong agreement to become an LLC member you will lose protection. That is a complete lie.

Protecting your assets depends on two things: the LLC’s state plan and its separation from your single member LLC. Your employment contract won’t change any of this—but it will come in handy for many everyday tasks, like opening a bank account.

Single Owner Llc Operating Agreement

We have taken several steps to simplify and reduce the ambiguity and obtuse language often found in single member LLC formation agreements. We have created a minimum bond for a family. You can easily fill out this form in less than 5 minutes. Like all our forms, this form is intended for personal use.

California Single Member Limited Liability Company Llc Operating Agreement

We also offer LLC operating agreements for specific types of LLCs, such as multi-family LLCs and limited liability LLCs. As a single member LLC operating agreement, these templates are easy to fill out and understand.

An employment contract is an internal document. So, unlike your articles of association, you will not need to file this form with any government agency. However, your bank may require your consent to open an account. Other business partners may ask to see it.

A common, common mistake about forming a single member LLC is that this document provides more power than it actually does. In fact, your employment contract will not violate the law, no matter what it says. So, you won’t lose your limited coverage because you don’t have a contract. Also, you won’t be in violation of the law because you say shady behavior (like using your business account as your piggy bank) is okay in your contract.

You can still! He is not hurt. If anything, taking a moment to read through our service agreement will help you make sure you’re thinking through the first steps (like offers) and the possibilities (like cancellations). Your bank may want to accept it, and it’s free, so you might as well accept it. But please do yourself a favor and don’t pay for the contract to form a single member LLC.

Single Owner Llc Operating Agreement

If you are paying for something, include a service that will benefit your LLC the most. We offer LLC registration services in every state. We offer online tools to help make your LLC compliant. We also form an LLC for $100 plus government fees.

A single family agreement should include information on contributions, storage, administration, liquidity and more. A free member LLC operating agreement includes the key LLC points you need:

Even if you are the one who formed your LLC, you must “buy in.” In other words, you will contribute money or other assets to the LLC (primary contribution) to receive its benefits. You will list your contributions in this section.

You’re running a business to make money—this section explains how and when you get your money. Profits and losses are determined and distributed annually. After paying the fees and all the debts, you can withdraw the share at any time. If your company or member interests are liquidated, the distribution will be subject to financial regulations.

Free Llc Operating Agreements

As the sole member, he runs the show. This section outlines your powers (Management, guidance, direction, action, etc.) and your responsibilities (signing contracts, keeping records, etc.).

This section also states that (assuming you act in good faith), you will not be liable for any loss or damage to the LLC or any costs resulting from any lawsuits or other actions against the LLC.

While you may feel like you and your LLC are one and the same, it’s important to make the difference clear. This article states that if you spend out-of-pocket expenses or provide services to your LLC, you may be entitled to a refund or refund.

This section explains how to keep financial records, including capital and dividends. At the end of the year, you will close the books and prepare a group statement (yes, just for you, but this kind of document is important).

Free 5+ Operating Agreement Contract Forms In Pdf

Imagine a worst-case scenario where your LLC is sued by creditors—and then offered members benefits. This provision states that such interest does not include the right to participate in the management or operations of the LLC. Creditors only receive a portion (and until the debt is repaid).

You can terminate your LLC at any time through the dissolution process. This section states that upon dissolution, the LLC is responsible for paying debts prior to registration.

This is the signature page. By signing, you acknowledge that you agree to be bound by the terms of this Agreement.

At the end of a member’s employment contract, there is also a fill-in-the-blank. The display includes a field where you can list your team information (your name, address and ownership percentage) and details of your contribution.

Llc Meeting Minutes Template: Get An Editable Sample

An LLC member can lose its liability protection if the owner does not maintain a bona fide separation from the LLC. Meaning: if you are a single member LLC owner who pays all of your expenses out of the LLC checking account, you open yourself up to the possibility that you and the LLC are the same entity.

No LLC member will save you if you use the LLC bank account to pay for personal expenses such as entertainment, food, vacations, etc. If you use your LLC account as your piggy bank, you’ll need liability protection—even if you pay a lawyer $5,000,000 for a good single-family LLC deal.

The best way to protect your assets in an LLC is to keep everything separate. It’s easy. Pay for your items with your own money. If the single member LLC has funds, the single member LLC pays those funds out of the single member LLC’s checking account.

We did! We have templates for meeting minutes, Agenda Items and more. Or select “LLC Form” from the full list of free LLC forms.

Business Operating Agreement

We keep track of why our website is needed to function, and we will not sell that information to third parties. To learn more, see our Privacy Policy or read about Privacy by Default®. The articles of association of an LLC member regulate the business, management, and ownership of the company (membership). We created an agreement to strengthen it helps to strengthen the position of the company as a private company.

Acknowledgment of a Notary – It is required that the employment contract of a member of the notary to show its authenticity and the date it was signed.

A sole proprietorship LLC is a company that has one (1) owner and is responsible for tax planning and classification of ownership and corporate assets and liabilities. All income earned by the LLC, after proper use, will “pass through” to the same tax as the owner.

The IRS definition “A LLC is an entity created by state law… An LLC with only one member is treated as a disregarded entity separate from its owner for corporate income tax purposes (but as separately for income tax and income tax purposes), unless you file Form 8832 confirming that you are treated as a corporation. ” Source: IRS (Single Member Limited Liability Company) Single Member LLC vs Sole Proprietorship

Multi Member Llc Operating Agreement Template

Although employment contracts are widely required, they are only required in the states of California, Delaware, Maine, Missouri, and New York.

An LLC is not taxed at the corporate level (unless there is a state LLC tax). Profits from the LLC go through the owner and are paid on the IRS 1040.

Yes, by filing IRS Form 2553 within 75 days of the effective date or in the tax year before March 15th.

Never. By definition, a single member LLC has one (1) owner. However, adding a partner requires an amendment to the company’s operating agreement that will convert it into a multi-member LLC.

California Llc Operating Agreement [free Pdf]

Yes, an LLC member can add members. Otherwise, this will result in a multi-member LLC, which will need to renew the operating agreement.

Yes. The word of a member only means that he is the owner 1. He can have as many employees as he wants.

Yes. A member LLC can pay rent to the owner if, for example, the owner is also the landlord. Although property cannot be owned by an LLC member, it must be owned by a separate owner.

Yes. Because a member pays self-employment tax on earned income, he is required to pay the estimated tax throughout the year (April 15, June 15, September 15, and January Day 15). This can be done by registering with the IRS through their online form (EFPTS).

Llc Operating Agreement Template

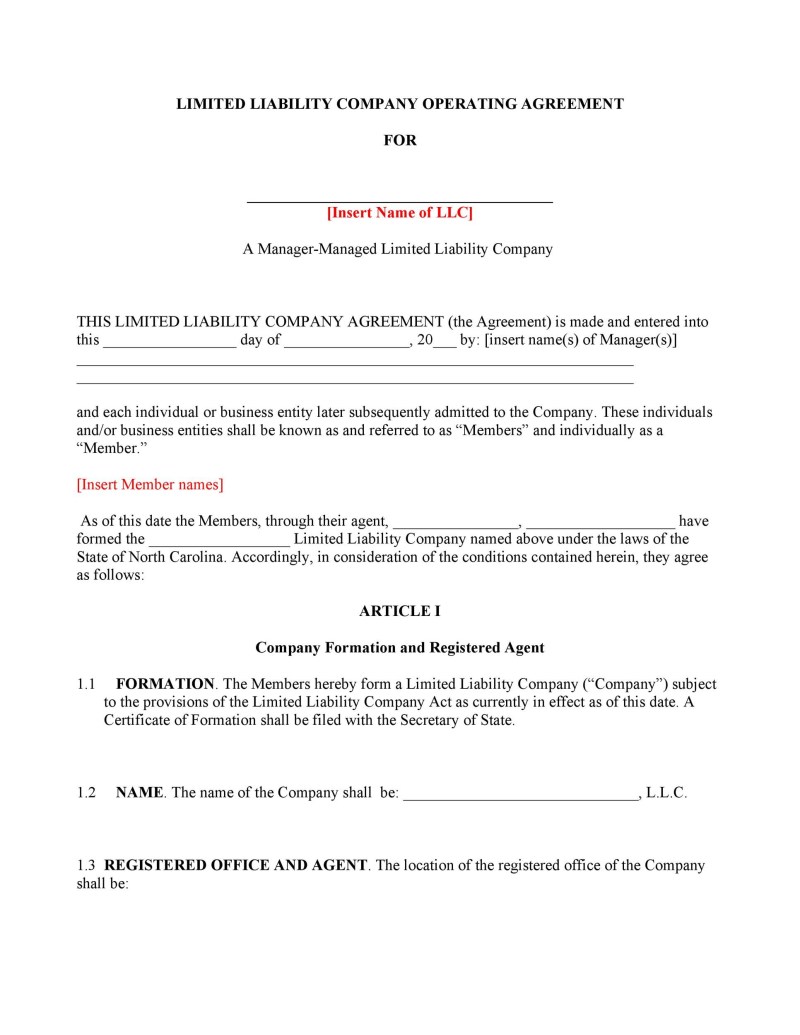

THIS USER AGREEMENT (“Agreement”) has been entered into and is effective as of [DATE], on behalf of [NAME OF LLC], a sole proprietorship (“Company”) and property of [name of members ] (the “Party”) hereby declares the following:

Now, therefore, for good and useful thoughts,

Single member llc operating agreement, texas llc operating agreement single member, colorado llc operating agreement single member, single member manager managed llc operating agreement, sole owner llc operating agreement, single member llc operating agreement template, single member llc operating agreement template free, sample operating agreement for single member llc, florida single member llc operating agreement, free operating agreement for single member llc, simple operating agreement for single member llc, single member llc operating agreement georgia