Self Employment Income Verification Form – Section A is to be completed with the employee’s family account number, I authorize the release of employment information for purposes of determining KidCare eligibility. Employee Signature Date Employee Name Employee SSN Please Print Guidelines This information is needed to help determine eligibility for KidCare Health Insurance. 1 Number of hours worked in a week Number of days worked in a week 2 How much the employee is paid daily Once a week Once in a week Once in a month Twice in a month Other explanations 3 Gross rate of pay …

Submit the Drugs to Child Care Florida application by e-mail, link or fax. You can also download, export or print it.

Self Employment Income Verification Form

The perfect editor for updating your documents online. Follow these simple instructions to edit the Florida Child Care Income Verification Form in PDF format for free:

Florida Kidcare Self Employment Form: Fill Out & Sign Online

We have answers to our customers’ most popular questions. If you can’t find the answer to your question, please contact us.

Florida KidCare also covers Medicaid for children. Visit www.floridakidcare.org or call 1-888-540-5437. The table below describes the four components of Florida KidCare. Determines eligibility for Medicaid.

It may take up to 30 days for your application to be processed (if you require a disability determination).

Florida children are eligible for coverage from birth through age 18. It’s free to apply, and with year-round registration, there’s always time to apply.

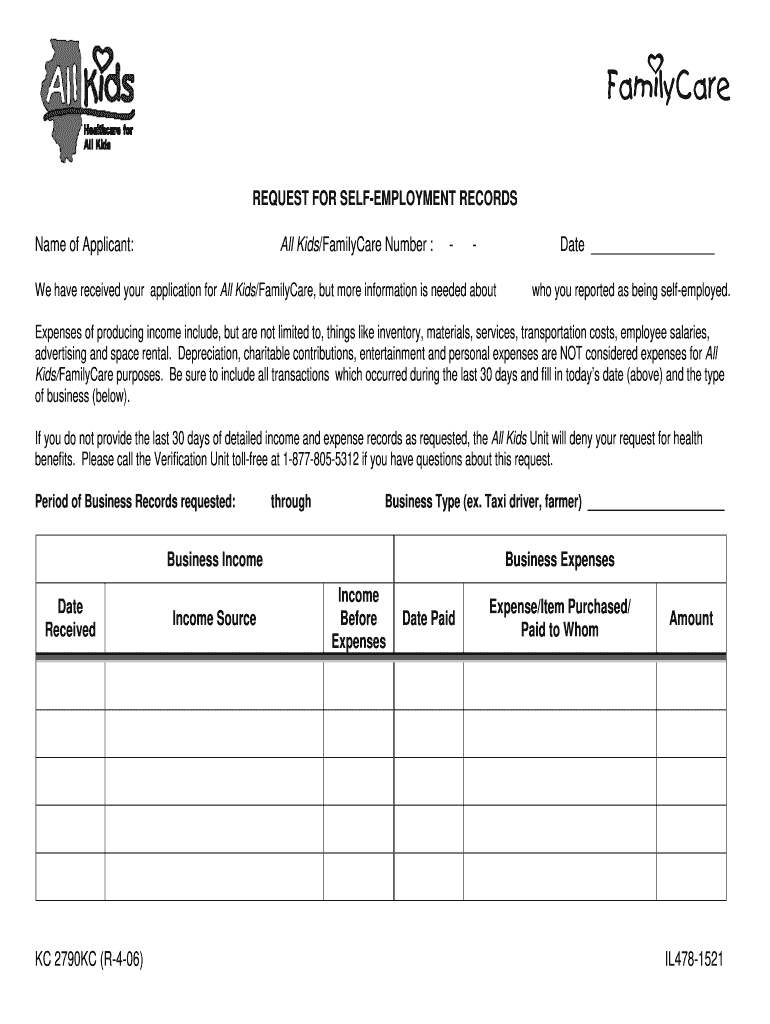

Illinois Self Employment Form

Take the total income (money earned in a 12-month calendar year before any deductions) for each person in your household and add them together. This amount will be your annual family income.

Florida Childcare Eligibility Florida Childcare Salary Florida Childcare Income Eligibility 2022 Florida Childcare Application Florida Childcare Phone Number Florida Childcare Login Florida Childcare Provider Florida Self Employment Form

Section 1. To be completed by the employee I wish to apply for access to the Short Working Year Scheme under the …

In Florida, the Department of Health (Agency) is responsible for Medicaid. The agency successfully implemented a statewide Medicaid Managed Care (SMMC) program in 2014. Under the SMMC program, most Medicaid recipients are enrolled in a health plan.

Proof Of Employment Letter Samples (verification Forms)

Parents in a family of three reading the table would be correct to assume that if their annual income exceeds $43,920 (200 percent of the 2021 FPL), they will not qualify for subsidized premiums.

Based on the child’s age, household size and family income, we automatically match each child with four Florida KidCare programs. All children over age 1 are eligible for Florida KidCare coverage through the subsidized or full-pay program, whether one or both parents work. Email, link or fax a signed affidavit verifying self-employment in the state of Texas. You can also download, export or print it.

The largest editor for editing your documents online. Follow these simple instructions to edit a Texas Self-Employed Income Verification Letter in PDF format for free:

We have answers to our customers’ most popular questions. If you can’t find the answer to your question, please contact us.

Income Verification Letter

10 forms of pay stubs of proof of income. A pay stub, which most people in corporate jobs receive at the end of each pay period, is the most common form of proof of income. … bank statements. … tax returns. … W2 form. … 1099 forms. … employer letter. … unemployment documents. … disability insurance.

3 types of documents that can be used as proof of income Annual tax return. Your federal tax return is solid proof of what you made during the year. … bank statements. Your bank statements should show all your payments from customers or sales. … profit and loss statement.

Quick Overview: How to Show Proof of Income When Self-Employed Use a 1099 form that shows how much you earned from your client. Create a profit and loss statement for your business. Provide bank statements showing that funds have been deposited into the account. Submit a federal tax return from the previous year.

Self-Employed Income Verification Form 1049 Self-Employed Texas Medicaid Self-Employed Income Form Proof of Employment Form Texas Health and Human Services Your Texas Benefits Self-Employed Form Snap Self-Employed Form

Tips On Proving Income When Self Employed

Effective date audit fee refund required. This form must be submitted within 30 days of termination or cancellation…

However, payment of withholding tax is required on the lump sum annual distribution and…

The most common proof of employment is a letter of confirmation of employment from the employer that includes the employee’s dates of employment, job title, and salary. It is often called “Employment Letter”, “Job Confirmation Letter” or “Employment Letter”.

An employment verification letter is written by a current or former employer to confirm that an employee or former employee is employed by the organization. This request may come from an employee, government agencies, prospective landlord, mortgage lender, prospective employer, or collection agencies.

Income Verification Letter Samples (& Proof Of Income Letters)

Wage and Tax Return (1099) for Self-Employed. These forms prove your wages and taxes as a sole proprietor. Because it’s a legal document, it’s one of the most reliable proofs of income you can get. Profit and loss statement or ledger document. Nowadays, the opportunities for growth and development are huge: people have the power to expand their residences, organize new business ventures and generally improve their living conditions. One of the best ways to get extra funding is to apply for the required amounts or enroll in certain programs. However, if the applicant relies on favorable loan terms, they will need to confirm that the prospective loan will be repaid on schedule. A smart decision is to submit an Employment Verification Form (EVF for short) to verify your earnings.

Documents confirming employment may have different names: certificate from the workplace, salary (income) confirmation letter, employment (work) confirmation letter. However, the gist remains the same: employment verification forms are primarily required when a person has to prove that their income meets the requirements of financial or housing programs. This means that applicants must confirm that they are able to pay rent or loan interest regularly and on time.

Traditionally, income verification letters are seen as the last step before an applicant is approved for a loan or a position at a new company. This measure ensures that information is not falsified and provides additional protection for creditors. In addition to proof of income, applicants are authorized to submit the documents listed below based on employment status.

If the applicant provides services for another company or individual, these documents can serve as proof of earnings:

Professional Letter Of Employment Verification

If the applicant is officially registered as an individual entrepreneur, submit the following documents as additional support:

Need more business PDF forms? Check out the options below to see what you can fill out and edit. Also, remember that you can download, fill out, and edit virtually any PDF document.

We invite you to create, fill and download the required income verification template using our online tools to create a PDF file. As employment letters are created for different reasons, such as funding or housing applications, the templates may also vary. We have prepared the following guide to make it easier for you to prepare the required documents.

Some farms have different structures that indicate who has the authority to operate each part. However, if the composition is more of a deal – don’t worry. Employment verification reports are relatively independent and allow for variation.

Free Employer Proof Of Residency Letter

Here, the preparer should enter the owner’s name and physical address. List street and lot (or its alternate) number, city, state and zip information.

In the next step, the preparer must enter the work data of the employee (as a rule, the applicant). List the following parameters:

Collect the employee’s signature and post the current date to confirm their consent to the release of confidential employment information.

Complete the title section by identifying the manager who oversees the finance, housing, or other type of program. Enter the agent’s name and signature (if applicable).

Free 30+ Income Statement Forms In Pdf

Once the verification is complete, provide the details of the recipient to whom the form has been returned. The person’s full name and postal address or P.O. List box details.

After the header information is ready, the drafter can proceed to fill in the worker information. Allow the recruiter or HR department to fill in the required information.

In this section, it is recommended that you specify whether the applicant is currently employed by the referred employer. If yes, enter the date of employment. If the applicant appears to be a former employee, enter the date the applicant was last hired.

If the employer plans to make changes to the applicant’s rate of pay within the next year, enter the potential revision in this section. Also specify the calendar date when the changes take effect.

What You Need To Know About Proof Of Income

Here, the employer should clarify that the applicant works in cycles. If the employee performs duties seasonally, include schedule details or duration.

Use this section if you have any information about applicant duties, responsibilities, or fees that the employer would like to share with program administrators.

Employment income verification letter, self employed income verification, self employment income tax form, employment income verification, self employment verification form, verification of employment loss of income form, self employment income form, employment and income verification, employment income verification form, self employment income report form, self employment verification, self employment verification letter