Sample Balance Sheet Reconciliation Template – Standardized balance sheet reconciliation is a well-known best practice. Improve the efficiency of your month-end closing process by implementing a consistent and reliable framework. This balance sheet reconciliation is fully featured – dynamic formulas, conditional formatting and is based on a simple methodology. This balance reconciliation is free to download and contains no macros – just a simple but effective tool!

Assigning specific individuals to specific accounts. Make sure the owner has a full understanding of the account being reconciled, that the objectives of the reconciliation and escalation process are understood.

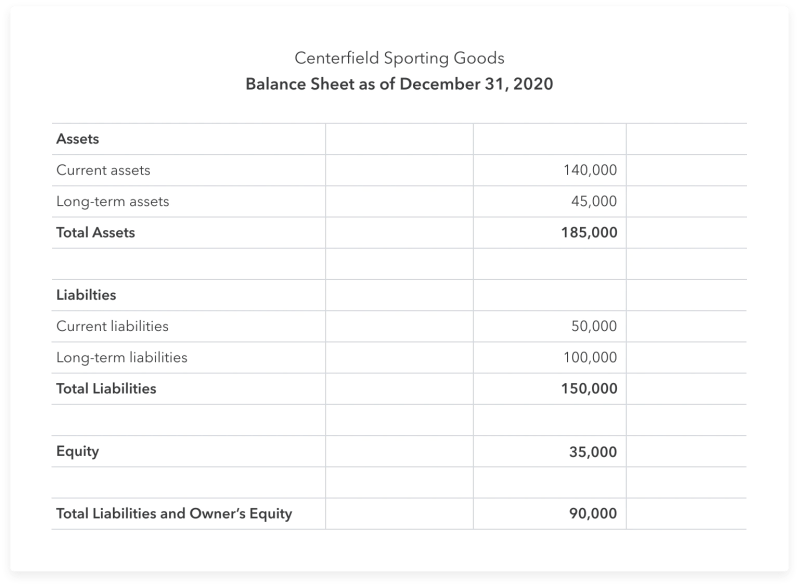

Sample Balance Sheet Reconciliation Template

A few years ago we created a bank reconciliation template that has been the most downloaded template since we’ve been tracking downloads. (as of the date of this publication).

Supplier Statement Reconciliation

Our last template was the month-end closing list. To follow this checklist, we decided to create a common balance sheet reconciliation form.

We used the bank reconciliation template, but kept it in two columns for simplicity. Since it’s best practice to have consistent formats and functionality – it just made sense.

One key element of this reconciliation template that helps both preparer and reviewer is the two-column layout. Just like the bank reconciliation template, this balance reconciliation template gives the user a quick understanding of what is happening with the account. Are the problems in the general ledger or in the subledger (or if there is no subledger, in the master detail)?

Since one section focuses on the general ledger and the other on the sub-ledger, you can see where problems develop. Whenever a difference occurs and there is a corrective entry, be sure to evaluate why. Once the root cause is identified, it may be possible to correct or modify it in some way (ie a change in controls or some kind of automation) that will eliminate this problem.

Using Balance Sheet Simulation Dashboards To Streamline The Modelling And Forecasting Process

After downloading the reconciliation, make copies for each of your balance sheet accounts that need to be reconciled. The download contains two sections. The first card is blank, ready for reconciliation. The second section includes an example of reconciliation of receivables.

As you think about the different accounts that will be reconciled, try putting together a tip sheet to accompany the reconciliation. We also suggest you consider:

Other than entering information specific to your account, there is nothing special about using this template. For those unfamiliar with grouping, see the image on the left. You’ll notice there are little plus signs at the bottom of the template. They can be expanded by left clicking on them. Under each group we placed a red capital letter. The red capital letter corresponding to each note should be placed next to the reconciliation element in the main body of the template. For those not in use, simply close the group.

What do you do when you have a difference? Sometimes you feel overwhelmed when you are not sure about the first step. Here are some tips to help you:

Financial Close Management

Please note that the data included in this balance sheet reconciliation form is only a sample of the data. There may be elements that are not appropriate for your situation, or elements that will be necessary for your reconciliation may be missing. In addition, assumptions are made about the nature of the matched elements, changes in these assumptions can affect the way a record is recorded.

The Software Product and all related documentation are provided “as is”. makes no warranties, express or implied, and expressly disclaims any representations. Step 1. Compare each amount on your bank statement (or online bank information) with each amount in the company’s cash book and note the differences.

Step 4 Ensure that the bank reconciliation shows Adjusted BANK Balance = Adjusted BOOK Balance.

The final line on both sides of the bank reconciliation must be the same amount. In other words,

Bank Reconciliation Statements

Note: Adjusted BANK balance = Adjusted BOOK balance does not guarantee that the company’s cash is fully accounted for. For example, if an employee stole some of the company’s cash accounts before the money was recorded in the company’s accounts (and apparently not deposited into the company’s bank account), the missing amount would not be detected by a bank reconciliation.

Not recorded on the date of bank reconciliation, the company must record them in its account books.

Is a $25 service charge (this was on the bank statement on May 31, 2021 but not yet recorded in the company’s general ledger), the company should post the following entry:

Note: After recording/posting adjustments to the G/L accounts, it is important to confirm that the company’s cash account G/L balance is indeed equal to the adjusted BOOK balance shown in the bank reconciliation row below.

Cash Flow Reconciliation Template

We will then prepare a bank reconciliation for a hypothetical company using transactions that occur frequently.

In this section, we will prepare the June 30 bank reconciliation for Lee Corp using the five steps discussed above.

Step 1. Compare each amount on the bank statement (or online banking) with each cash account amount in the company’s general ledger and note the differences.

After comparing each item on the bank statement (checks paid, deposits processed, other items) to each item on Lee Corp’s general ledger cash account (checks written, cash received, other items), we listed the differences and other relevant information in a table that follows.

Account Reconciliation & Transaction Matching

Remember that adjustments to the BOOK balance will require accounting entries for items to be posted to the company’s general ledger accounts.

Side of the bank reconciliation, a journal entry is required. Each journal entry will affect at least two accounts, one of which is the cash account in the company’s general ledger.

Below are the required entries for BOOK balance adjustments. We mark each entry as E, F, B, D, G, C or K as indicated on the right side of the bank reconciliation.

The bank statement shows that on June 30, the bank added $8 in interest earned by Lee Corp. Assuming this has not yet been recorded in Lee Corp’s general ledger, the following journal entry is required:

Monthly Balance Sheet With Prior Month And Last Year Comparisons

On June 29, the bank statement showed a bank credit memo of $1,000, resulting in an increase in the checking account balance. We assume that Lee Corp has not yet recorded the collection of the note in its general ledger accounts. Therefore, Lee Corp should increase its cash account balance and decrease its accounts receivable balance. This is accomplished by the following journal entry:

The bank statement shows a service charge of $35 on June 30. Since this decreased Lee Corp’s checking account balance, Lee Corp should credit its cash account and debit the expense as bank fee expense. Lee Corp’s entry is:

A bank statement on June 26 shows that the bank processed an $80 debit note to print checks for Lee Corp. While the bank debits its Customer Deposits debit account to reduce its credit balance, Lee Corp must credit its current account with Cash to reduce its debt. Assuming Lee Corp has not yet recorded the $80 printing cost, Lee Corp would record this journal entry:

On June 29, the bank statement shows a debit note of $40 for the bank’s receivables collection fee for Lee Corp. Because this reduces the balance in Lee Corp’s checking account, Lee Corp will need to reduce the balance in its asset account in the cash general ledger. Assuming this has not already been recorded, the following record is required:

Benefits Of Using Blackline’s Reconciliation Templates

The June 28 bank statement shows that Lee Corp’s checking account balance was decreased by $110 for a check deposited by Lee Corp into its checking account. (The deposited check was not paid by the bank on which it was drawn and was returned.) As a result, Lee Corp must decrease its cash account in the general ledger by $110. Assuming this hasn’t already been recorded by Lee Corp, it will record the following:

On June 27, Lee Corp increased its cash account and sales account by $145. While reconciling its August bank statement, Lee Corp learned that the correct amount was $154. Therefore, Lee Corp should increase its cash account balance by $9 and increase sales by $9. (Instead of subtracting $145 and then adding $154, Lee Corp adds the $9 difference to the bills.)

Note: After the above entries have been posted to the general ledger accounts, it is important to confirm that the balance in the cash account equals the corrected BOOK balance shown in the bank reconciliation.

It is also necessary to contact the bank immediately for any bank errors found so that the bank account can be corrected.

Petty Cash Reconciliation Form: Fill Out & Sign Online

Note: You can get instant access to our PRO materials (visual tutorials, flash cards, quick quizzes, quick quizzes with training, cheats, video training, accounting and management guides, business forms, printable PDFs and progress trackers) when you join PRO.

On selected accounting and bookkeeping topics and

Balance sheet reconciliation template excel, sample church balance sheet template, balance sheet account reconciliation template, balance sheet reconciliation template, balance sheet account reconciliation template excel, excel format balance sheet reconciliation template, balance sheet reconciliation template xls, balance sheet reconciliation sample, sample balance sheet template, balance sheet reconciliation steps, balance sheet reconciliation tool, balance sheet reconciliation software