S&p 500 Graph 100 Years – Want to know how mutual funds work? Mutual funds are portfolios filled with different types of investments (usually stocks) that allow people to invest while reducing the risk of choosing securities.

Instead of asking investors to choose a single stock, mutual funds allow investors to choose only the types of funds that suit them best.

S&p 500 Graph 100 Years

Mutual funds work by combining your money with the money of other investors and investing in a portfolio of other assets (such as stocks, bonds). This means that you can invest in portfolios that you cannot make money on your own because you are investing with other investors.

Secondary Structure Motifs Made Searchable To Facilitate The Functional Peptide Design

For example, there are large, medium and small funds, but there are also funds that focus on technology, telecommunications and even Europe or Asia.

Mutual funds are popular because they allow you to choose an account that contains a variety of stocks, without worrying about putting too many eggs in one basket (as you can if you buy one stock), monitor on file, or continue to maintain. industrial concern. News.

Funds offer direct diversification as they hold different stocks. Most people’s first encounter with mutual funds is their 401k, where they choose from a list of options.

Mutual funds are managed by a fund manager who selects all investments in the portfolio. This is often a big selling point for novice investors who don’t have much experience and prefer to trust an “expert” in the world of mutual funds.

S&p 500 Index

(Anyone who tells you they are an expert and can beat the market is lying because they can’t predict what will happen.)

Because these fund managers manage your money, you’ll sometimes hear mutual funds referred to as “highly managed funds.” They also charge different fees for their work (which I will get into later).

Invest in them by putting your money in their account. They are very motivated to do a good job for you because their job really depends on the money that works well. They also get millions in bonuses if they do a good job.

If you are worried about your personal finances, you can improve them without leaving your couch. Check out my Ultimate Guide to Self-Finance for tips you can implement today.

Bitcoin Ends Q1 Closely Following S&p 500

The number of dollars you earn from each depends on a variety of factors. One of the most important things is the investment fund manager.

As I mentioned before, the manager has a desire to do good work and pick up great assets for the mutual fund – but does that mean that most mutual fund managers can beat the market?

According to Dow Jones, 66 percent of mutual fund managers failed to beat the S&P 500 in 2016 (the numbers were worse for mid-cap and small-cap managers).

And when this study looked at how mutual funds performed over a 15-year period (you know, that’s as long as you’re holding onto your money to save for retirement), more than 90 percent failed at market.

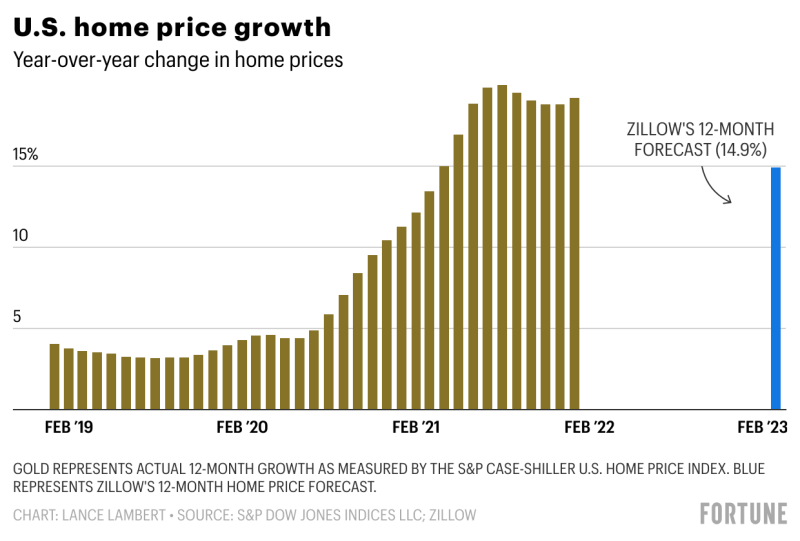

What Home Prices Will Look Like In 2023, According To Zillow’s Revised Downward Forecast

Boy, I wish there was a way to get all the pros and hardly any of the cons. *beard pain*

Bonus: Ready to get out of debt, save money, and build real wealth? Download the free ultimate guide to personal finance.

Mutual funds are like different scents in a Yankee Candle store – there are a crazy number of different types. Each has its own uses and disadvantages.

You can choose mutual funds based on various factors including risk, return, region, investment sector and more. For example, you can invest in a fund focused on various energy services, or a fund focused on emerging markets, or even a medical device fund.

Live Updates: Global Covid 19 Cases Exceed 627 Million

These funds are usually placed in large buckets. Each of them has its own advantages, disadvantages and conditions before you can invest in them. Let’s look at four of them now:

Most mutual funds charge a fee called a “management expense” (or management fee). This is an annual fee that is usually around 0.25% to 2%. Payment is made by returning your account.

This money goes to various places that are mostly BS, including the fund manager, management fees, and distribution fees used to grow your account.

Also, when you buy a mutual fund, you may be charged a commission called a “load,” which comes in two forms:

S&p 500 Closes Higher After Another Lighter Than Expected Inflation Report, Nasdaq Jumps 1.4%

And there is no evidence that they produce any results. In fact, no-load funds are often better than loaded funds. Really, it would be foolish for anyone to go with them.

So what type of mutual fund offers sales, low fees, and doesn’t require an active money manager?

Index funds are a special type of mutual fund that is tracked using software that matches stocks in the market, rather than “experts.” And remember how almost no actively managed mutual fund beats “the market”? Well, the index fund is betting on the “market”.

For example, Charles Schwab has the Schwab S&P 500 Index Fund, which holds all stocks in the actual S&P 500.

Once Weekly Semaglutide In Adults With Overweight Or Obesity

This is it! There are no front or back loading fees, and there are no money managers that can ruin your investment. Just an opportunity to invest directly in the market.

Many brokerages such as Schwab also have index funds that invest in international markets and the top 1,000 publicly traded companies in the United States.

Because index funds invest in the entire market, they won’t fluctuate much – meaning you’ll make money.

. But if you keep your money in the market for the rest of your life, I promise you that you will make money.

Metabolic Control Of Acclimation To Nutrient Deprivation Dependent On Polyphosphate Synthesis

“Always a low-cost S&P fund. It’s always the best thing to do.”

There is a reason why mutual funds are a favorite of financial leaders and thinkers. That’s why they work.

Bonus: Confused about mutual funds or investing in general? Check out my ultimate guide to personal finance. Learn how to make investing easier

Your retirement accounts (Roth IRA and 401k) allow you to buy index funds. To do this through a 401k, you need to talk to your company’s human resources department to set up an investment plan through the mutual fund of your choice. And as I wrote, the S&P 500 fund is a great place to start.

Chapter 3: Investigating Proteins

If you want to invest through a Roth IRA, you need to set it up through a broker.

Check out my video below where I recommend some great things to help you get started with a Roth IRA.

Banks, credit unions and mutual funds offer ways to invest in mutual funds. In fact, there are many interesting brokers that offer a variety of funds for you to choose from.

All of these sites offer a great variety of credit cards to choose from, so you can’t go wrong with them.

Gan Improves Class D Amplifiers

Signing up is ridiculously easy. Just follow the 7-step guide I’ve outlined below (the wording and order of the steps vary from dealer to dealer, but the steps are the same).

Note: Be sure to have your Social Security number, employer address, and bank information (account number and routing number) available when you register, as they will come in handy during the application process.

The application process can take as fast as 15 minutes. At the same time, it is necessary to watch half of it

If you have any questions about money or transactions, contact the numbers provided above. They will connect you with a banker who works with the bank to give you the best advice and guidance.

Trends In Acute Hepatitis Of Unspecified Etiology And Adenovirus Stool Testing Results In Children — United States, 2017–2022

Mutual fund reliability depends on the investor’s goals, risk tolerance and investment objectives. To help you find the right funds, we’ve reviewed the top options and identified the best mutual funds.

Whether you keep your account’s shares in cash or reinvest them in more shares, you must pay taxes on the distribution, including capital gains and dividends. In a registered plan like an RRSP, RRIF, or RESP, you won’t pay taxes on capital gains as long as the money stays in the plan. When money is taken out of the register, it is taxed as income.

Mutual funds are considered to be somewhat less risky than individual stocks. Their diversity allows investors to participate in a large number of company shares without unnecessary risk.

If you want more business strategies to help you manage and earn more money, you’re in luck. I’ve written a free guide that goes into great detail on how to get started.

Explaining Multiple Peaks In Qpcr Melt Curve Analysis

Join the hundreds of thousands of people who have already read and benefited from it by entering your information below to receive a PDF version of the guide.

When you’re done, read it, apply the lessons, and email me with your successes – I read all emails.

Start Designing Your Wealthy Life We’ll show you how by sending our best content straight to your inbox. As I understand it, one of the main signs of a stock market bubble is rising stock prices.

Gold price graph 100 years, stock market graph last 100 years, global temperature graph last 100 years, s&p 500 over 100 years, s&p 500 graph 10 years, s&p 500 chart 100 years, s&p 500 graph 100 years, gold graph 100 years, world population graph last 100 years, global temperature graph 100 years, s&p 500 100 years, economy graph 100 years