Promissory Note Template Word Document – An Idaho power of attorney enables one person to authorize another entity to legally act on their behalf with their resources. Documents here can take many forms and be used for many types of situations, from discreet/limited transactions to long-term daily submissions. What they have in common is the principal, the person who gives the authority, and the agent, the person who acts on behalf of the principal. It is strongly recommended that all parties have an honest discussion of the powers and responsibilities set out in this document before it is finalized and implemented.

Durable Power of Attorney (Statutory) – An agent can and will continue to act on behalf of the principal even if an incapacitating event occurs.

Promissory Note Template Word Document

General Power (Financial) – This type of form is similar to a durable form, except that it becomes invalid if the director can no longer make decisions independently.

Promissory Notes Templates

Limited power of attorney. A legal measure that allows a person to authorize a discretionary transaction or for a specified period of time.

Minor (Children) Power of Attorney – He/she appoints a person or persons as guardians of a minor child for a specified period of time.

Tax Power of Attorney Form – Used by a taxpayer to represent another person with tax documents or related matters. Download: Adobe PDF

Real Estate Power of Attorney – Authorizes an agent chosen by the property owner to make specific or final decisions regarding the management and sale of the property. Download: Adobe PDF, MS Word, OpenDocument.

Demand To Pay Promissory Note Template In Word, Google Docs, Apple Pages

Vehicle Power of Attorney Form (IDT-3368) – Used when the vehicle owner needs someone to represent him or her to power the motor vehicle, for example to register a title.

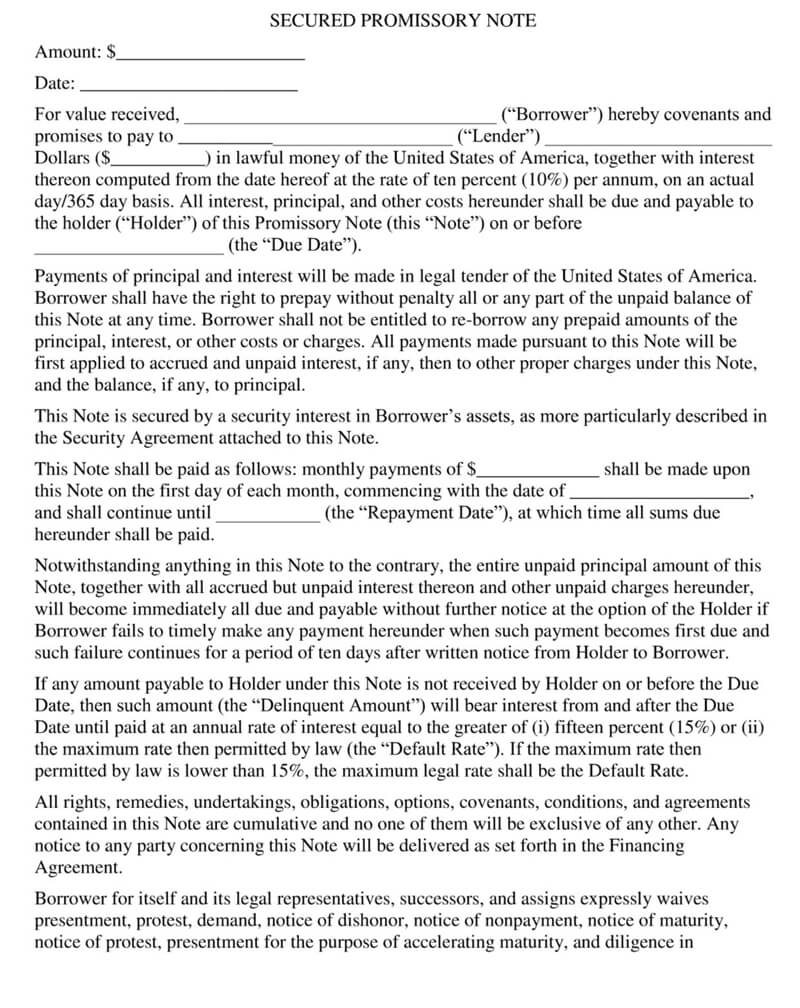

By using the site, you consent to our use of cookies to analyze website traffic and to improve your experience on our site. A promissory note is a document signed by an individual that specifies the amount of money borrowed from an individual or another entity (the Lender). A promissory note is also called a “Promise to Pay” or “Promissory Note Payable”. A promissory note is a legal document and contains all the details of what the Borrower owes to the Lender as well as the repayment structure. In simple terms, with a promissory note, the Borrower “promises” to pay the Lender, in writing, a predetermined amount according to predetermined terms and conditions.

Download the form here and fill it in with PDF Expert. Click the green button to download the application.

As a legal document, a promissory note makes the borrower fully responsible for repayments. The promissory note template is similar to the Loan Agreement template, the latter is much more complex and complicated. Typically, a form of Loan Agreement that both the Borrower and the Lender must sign is binding on both the borrower and the lender, and a promissory note is not binding on the Borrower alone. For these reasons, a promissory note is almost always used for low value transactions, while high value transactions are handled using a form of legal credit agreement.

Free Promissory Note Template In Word & Pdf

Now that we know what a promissory note is, let’s look at the types of promissory notes.

There are two types of promissory notes: an unsecured promissory note and a secured promissory note. As the name suggests, a secured promissory note is a contract that has collateral or security, usually in the form of an asset or property. This means that in the event that the Borrower is unable to repay the amount borrowed, the Lender may claim legal ownership of the asset or property. On the other hand, an unsecured promissory note is unsecured, meaning there is no collateral or security, and if the borrowed amount cannot be repaid for any reason, the Lender has no recourse.

A secured promissory note is a simple promissory note format that is very easy to understand. It is similar to an unsecured promissory note, except without a collateral clause attached.

Here we will take a look at the sample promissory note template provided and understand its contents so that you can download the sample promissory note PDF for free and edit it according to your needs and requirements.

Promissory Note Template 22

Since a promissory note is a legal and contractual agreement between two parties, it must contain detailed information about both parties as well as details of the amount to be repaid.

* The templates here are provided for reference only and you should always speak to a professional regarding all legal questions

The promissory note template below is a certified promissory note PDF template that you can download and edit according to your needs. You can customize the PDF and add your own details using PDF Expert, the best PDF Editor app for iOS and Mac. Download a free PDF Expert to get started with this free PDF promissory note template. A promissory note is created when the borrower accepts money to repay the lender with interest. A promissory note requires and binds the borrower to be responsible for repaying the debt.

Secured promissory note – borrowing money against an asset that has a loanable value that “backs up” the borrowed money, such as a car or house. If the borrower does not return the money within the stipulated period, the lender will have the right to acquire the borrower’s property.

Download Indiana Promissory Note Form

Unsecured promissory note – does not allow the lender to secure the asset against the amount borrowed. This means that if the borrower does not make a payment, the lender must file in small claims court or through other legal processes.

A promissory note is a promise to repay a debt within a certain period. The borrower receives the funds after signing the note and agrees to make payments under the terms specified in the note. The lender will collect interest, which serves as the money to lend.

It is always a good idea to run a credit report on any potential borrowers, as they may have outstanding debts without your knowledge. Especially if the debt is related to the IRS or child support, it will take priority over this promissory note. Therefore, it is essential to run a credit report before entering into any type of contract.

Reporting Agencies – A good idea is to use Experian, which is free to the lender and charges $14.95 to the borrower. Experian is known as the most sensitive credit agency, usually providing the lowest score of the 3 credit bureaus (Experian, Equifax, and TransUnion).

Free Secured Promissory Note Template

If red flags appear on the credit report, the lender may want the borrower to add Security or a Co-signer. Common types of security include cars, real estate (given as a 1st or 2nd mortgage) or any type of valuable asset.

This means that if the borrower defaults, the lender will be able to take full ownership of the note. In the case of a co-signer, he will be liable for the full amount due, including any penalties or late fees.

After agreeing on the basic terms of the note, the lender and borrower must meet to finalize the formal agreement. See the “How to Write” section for line-by-line instructions for completing the document.

Signature – After signing, money must be exchanged. A witness is not required to sign the form, but is encouraged. For very large amounts (over $10,000), a notary is recommended.

Free Secured Promissory Note Templates (us)

The borrower must return the borrowed money on time and to the letter. If not, fees may be applied to the full balance. When the total amount is fully repaid to the lender, a Loan Release form is created and provided to the borrower, releasing them from any obligations on the note.

If it is less than 1 year. If it is a monthly or quarterly payment, then divide the above amount by the part of the year it will take to repay the loan. For example: If you pay in 3 months you would have to divide the total by 4, because it is only 1/4 of the year. In addition, each month must be divided by 12 because it is 1/12 of the year.

It is also known as the maximum interest rate that a lender can charge. It is important that Lenders do not charge more interest than their state allows. Below are links to each state’s Usury Rate Laws.

For loans less than $25,000, 5% more than the 12th Federal Reserve District rate on the date the loan is made, or 10%, whichever is greater. If the amount is more than $25,000, there is no maximum rate.

Collection Letter_following Promissory Note Template

There is no limit to written credit agreements. If it is not in writing, the rate is 10% per annum.

The interest rate cannot exceed a maximum of 17%

Personal promissory note template, promissory note word document, promissory note template ohio, promissory note template nevada, free promissory note template word document, promissory note template michigan, loan promissory note template, promissory note document template, installment promissory note template, promissory note template utah, promissory note template florida, business promissory note template