Printable Last Will And Testament Forms Free – Submit the nj model by email, link or fax. You can also download, export or print it.

Working on documents with our easy-to-use, comprehensive PDF editor is simple. Complete the steps below to quickly and easily complete nj last wills and testaments online: Log in to your account. Sign in with your email and password or create a free account to try the service before upgrading. Import a document. Drag and drop the file from your device or import it from other services like Google Drive, OneDrive, Dropbox or an external link. Modify last will and testament of nj. Easily add and highlight text, insert images, check marks, and signs, place new fill-in fields, and rearrange or delete pages from your documents. Enforce New Jersey’s last will and testament. Download your adjusted document, export it to the cloud, print it from the editor, or share it with others via a share link or as an email attachment. Take advantage of , the simplest editor to quickly manage your documentation online!

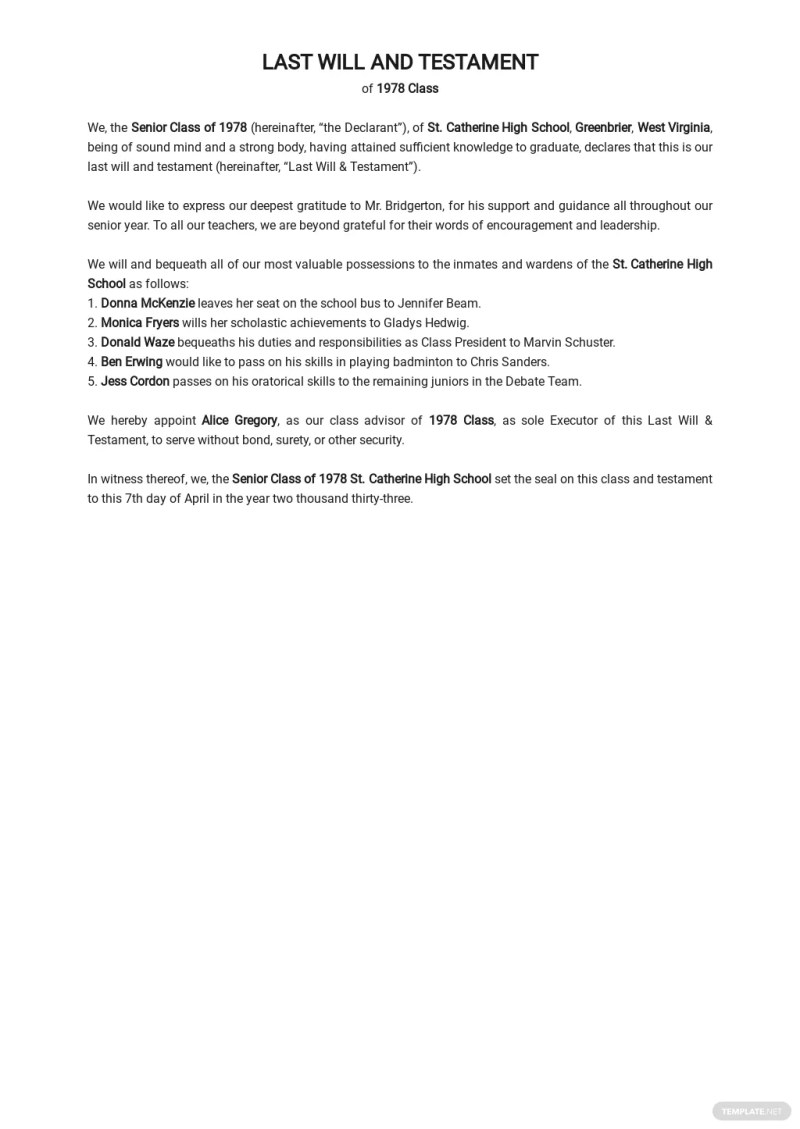

Printable Last Will And Testament Forms Free

We have answers to the most frequently asked questions from our customers. If you can’t find an answer to your question, please contact us.

Missouri Will Forms

Cost of a Will Using a web service to write a will on your own in New Jersey costs about $100. If you consult an estate planning attorney, it could cost you around $1,000. Complex wills that take more time can exceed $1,000.

Registration is entirely voluntary and choosing not to register with the Secretary of State’s Office has no effect on the validity of the will.

A will is legal in New Jersey if it is handwritten or typed by a competent adult and witnessed by two other people. It is self-certifying if it has also been notarized.

Once a will is registered, it is placed in the custody of the registrar and cannot be altered, destroyed, mutilated, or stolen. However, the non-registration of a will does not give rise to any inference against its authenticity. It is not necessary to grant it before a notary.

Illinois Will Forms

New jersey will form free will template simple will template blank new jersey will form nj nj will witness requirements must be notarized in new jersey new jersey last will and testament pdf

Have you used the prequalification tool found on our website at http://irs. Treasury. gov/oicprequalifier/ before completing…

The NDIS AT complexity level classification is available on the NDIS website. AT Assessors is reminded of its obligations…

Although in general terms wills and codicils must also be executed in the presence of two witnesses to be presumed valid, when a client already has such witnesses, allowing a notary public or attorney to authenticate a will or codicil will make the document self-verifying. . u201d under New Jersey law,…

Free Last Will And Testament Forms

For example, if a person has a mental disability that prevents them from understanding the purpose of a will, their will is invalid in New Jersey. Alternatively, it can happen if an elderly person suffers from dementia and is generally unaware of the extent of their possessions.

However, New Jersey allows you to make your will “self-probable” and you will have to go to a notary if you want to do this. A self-verifying will speeds probate because the court can accept the will without contacting the witnesses who signed it.

Drafting a Will in New Jersey The most common ways to draft a will are: Hire an attorney who specializes in estate planning. Make a will online. A last will or testament allows a person (the “testator”) to declare under oath which person or persons (beneficiary) will receive real and personal property after their death. Most states require two (2) disinterested witnesses to sign for the will to be valid. After signing, copies should be given to all beneficiaries and the testator’s attorney.

Je, [NOM], résidant dans la ville de [VILLE], comté de [COMTÉ], État de [ÉTAT], étant sain d’esprit, n’agissant pas sous la contrainte ou sous une influence indue, et understanding pleinement la nature et l’étendue de tous mes proprieté et de cette disposition de celle-ci, faites, publiez et déclarez por la presente que ce document est mon dernier testament, et révoquez por la present tous les autres testamentes et codicilles que j’ai faits until now.

Illinois Legal Last Will And Testament Form With All Property To Trust Called A Pour Over Will

1. EXPENSES AND TAXES. I direct that all my debts and expenses for my last illness, funeral and burial be paid immediately upon my death, to the extent possible, and hereby authorize my personal representative to liquidate and liquidate his discretion any claim made against my domain.

I further direct my personal representative to pay out of my estate all estate taxes and estate taxes due on my death with respect to all items included in the calculation of such taxes, whether transferred in under this Will or otherwise. Said taxes will be paid by my personal representative as if said taxes were my debts without recovery of any part of said tax payments from any person who receives an item included in this calculation.

2. PERSONAL REPRESENTATIVE. I name and appoint [NAME], of [CITY], County of [COUNTY], State of [STATE] as Personal Representative of my estate and request that he/she be appointed as Temporary Personal Representative if (he/she) applies. If my personal representative fails or fails to perform her duties, I appoint [NAME] of [CITY], county of [COUNTY], state of [STATE] to serve.

3. DISPOSAL OF ASSETS. I bequeath and bequeath my assets, both immovable and movable, and wherever they may be, as follows:

Kansas Will Forms

1st Beneficiary: [NAME], currently from [ADDRESS], as my [RELATIONSHIP] whose last four (4) digits of their Social Security Number (SSN) are xxx-xx-[SSN] with the following property: [PROPERTY TO BE LIGHT]

2nd Beneficiary: [NAME], currently from [ADDRESS], as my [RELATIONSHIP] whose last four (4) digits of their Social Security Number (SSN) are xxx-xx-[SSN] with the following property: [PROPERTY TO BE LIGHT]

3rd Beneficiary: [NAME], currently from [ADDRESS], as my [RELATIONSHIP whose last four (4) digits of his Social Security Number (SSN) are xxx-xx-[SSN] with the following property: [ LEGACY PROPERTY ]

If one of my beneficiaries predeceases me, any property they would have received had they not predeceased me will be distributed equally among the other beneficiaries.

Free Florida Living Will Form

If any of my property cannot be readily sold and distributed, it may be donated to any charity of my personal representative’s choosing. If a property cannot be sold or given away, my personal representative can dispose of it. I authorize my personal representative to pay the administration costs of my estate.

4. LINK. I direct that my executor shall not be required to post any bond or surety for the performance of her duties.

5. DISCRETIONARY POWERS OF THE PERSONAL REPRESENTATIVE. My personal representative shall and may exercise the following discretionary powers, in addition to any common law or statutory powers without the need for a license or court approval:

A. Possess any property for as long as my personal representative deems appropriate, and invest and reinvest in any property, both real and personal.

Free Virginia Last Will And Testament Template

B. Sell and grant purchase options on all or part of my property, both real estate and personal property, at any time, in public or private sale.

D. Pay, pledge, settle, or otherwise adjust any claim, including taxes, asserted for or against me, my estate, or my personal representative.

E. Make any separation in shares in whole or in part in kind and distribute the different types and disproportionate amounts of assets and undivided participations in the property among the shares.

F. Make elections in accordance with the tax laws that my personal representative deems appropriate and determine whether adjustments between income and capital should be made as a result of any election so made.

Simple Will Template California

G. Make any election permitted under a pension, profit sharing, employee stock ownership, or other benefit plan.

H. Employ others in the administration of my estate and pay reasonable compensation in addition to my personal representative’s compensation.

I. Vote shares or other securities personally or by proxy; assert or waive the rights or privileges of any shareholder to subscribe or acquire additional shares; deposit securities in a voting trust or with a committee.

J. Borrow and pledge or mortgage any property as collateral, and make secured or unsecured loans. No person or entity lending property to my personal representative or trustee shall be obligated to assert such property.

Free (blank) Last Will And Testament Forms (word

K. My personal representative will also determine, in his or her discretion, the allocation of any GST exemption available to me at the time of my death to property transferred under this will or otherwise. The decision of my personal representative with respect to any election or award shall be binding on all persons involved.

6. BENEFICIARY IN CONFLICT. If any beneficiary under this will, or any trust referred to herein, disputes or attacks this will or any of its provisions, any share or interest in my estate granted to such disputed beneficiary by virtue of this testament.

Seven.

Free printable last will and testament template, printable forms for last will and testament, printable last will testament forms, printable last will and testament forms, blank printable last will and testament forms, free printable last will and testament forms, free printable forms for last will and testament, free printable last will testament blank forms, free printable uk last will and testament forms, printable simple last will and testament forms, free printable last will and testament blank forms, free downloadable last will and testament forms