Payroll Deduction Authorization Form Template – We use cookies to improve security, personalize the user experience, improve our marketing activities (including collaboration with our marketing partners) and for other commercial uses.

Click “here” to read our cookie policy. By clicking “Accept” you agree to the use of cookies. no reading

Payroll Deduction Authorization Form Template

To cover all my Smith College expenses. • I understand that the deduction will start after the date I sign this form. I also understand that this option will remain in effect until I am billed by Smith College. Smith College Identification Number: _____________________ Print Name: ________________________________________ Signature: ______________________________ Date: __________.

Payroll Deduction Form

Get your template online and fill it out using the advanced features. Enjoy smart fillable fields and interactivity. Follow the simple instructions given below:

Gone are the days of being afraid of complicated legal and tax documents. The whole process of submitting official documents with US legal forms is stressful. Best Manager is right at your fingertips and provides a variety of helpful tools for you to fill out the Smith College Employee Payroll Authorization form. The following instructions along with the editor will help you through the whole process.

Experience the faster way to fill out and sign forms on the web. Access the most comprehensive library of templates available.

Use professional pre-made templates to quickly fill out and sign documents online. Access thousands of forms.

Fillable Online Payroll Deduction Uniforms09

USLegal has received the TopTenREVIEWS Gold Award for 9 years in a row as the most comprehensive and useful online legal forms service on the market today. TopTenReviews wrote “there is a wide range of documents covering many topics that you are unlikely to find anywhere else”.

USLegal is ranked below 9 other form sites. Form 10/10, Feature Set 10/10, Ease of Use 10/10, Customer Service 10/10. We use cookies to improve security, personalize the user experience, improve our marketing activities (including collaboration with our marketing partners) and. Other commercial uses.

Click “here” to read our cookie policy. By clicking “Accept” you agree to the use of cookies. no reading

Payroll Deduction Authorization Form The easy and convenient way to manage your payments! Payroll deductions run from October through June and are only $10.00 per paycheck. I hereby authorize the University.

Sample Employee Letter Overpayment Lctcspr22.01 2012 2022

Get your template online and fill it out using the advanced features. Enjoy smart fillable fields and interactivity. Follow the simple instructions given below:

Understand all the benefits of completing and submitting documents online. Using our services It only takes a few minutes to fill out the Washington Club University Payroll Deduction Authorization Form. We make it possible to give you access to our feature rich editor with the ability to change/edit the original text content of the document, add special fields and add your signature.

Complete the Washington Club Payroll Discount Authorization Form in a few moments by following the instructions listed below:

Submit your Washington Club Payroll Discount Authorization Form electronically as you complete it. Your information is safe and secure as we keep the most up-to-date information on security requirements. Be one of the millions of happy customers who are already filing legal documents directly from their homes.

Télécharger Gratuit Standard Payroll Deduction Form

Experience the faster way to fill out and sign forms on the web. Access the most comprehensive library of templates available.

Go paperless, fill out and edit your online form using expertly designed templates. This video guide will give you all the knowledge and understanding you need to get started now.

Use professional pre-made templates to quickly fill out and sign documents online. Access thousands of forms.

USLegal has received the TopTenREVIEWS Gold Award for 9 years in a row as the most comprehensive and useful online legal forms service on the market today. TopTenReviews wrote “there is a wide range of documents covering many topics that you are unlikely to find anywhere else”.

Free Employee Loan Agreement

USLegal is ranked below 9 other form sites. Forms 10/10, Features 10/10 Layout, 10/10 Ease of Use, Customer Service 10/10. Payroll deduction is an amount taken from an employee’s salary. These deductions are used for many purposes, such as paying taxes, contributing to a retirement plan, and paying for benefits such as health insurance. Salary deduction can be voluntary or involuntary. To better understand payroll deductions, keep reading. Or, use the link below to jump to a specific deduction or salary section for more information.

Payroll deductions are payroll deductions taken from employees’ paychecks to pay for expenses for payroll and income taxes, employee benefits, and more. Payroll deductions determine an employee’s gross pay (the amount written into their contract) and net pay (also known as take-home pay). Employers must pay mandatory deductions, such as federal, state and local taxes, while employers have the option of voluntary deductions, such as health benefits. Additionally, pre-tax and after-tax deductions can be made as long as the employer gives written permission.

Employers are required by law to send mandatory deductions to tax authorities. Federally assessed taxes, such as FICA taxes and federal income taxes, are standard payroll taxes that must be withheld from an employee’s pay. Many employers choose to use a payroll service provider to automate deductions and reduce errors. Take a look at the ins and outs of each mandatory payroll deduction below.

The federal Insurance Contribution Act tax (FICA tax) includes the Social Security tax and Medicare tax. Both employee and employer contributions are the same, with 6.2% of the employee’s gross pay going toward Social Security and 1.45% toward Medicare. Employees matched these two shares at 15.3%. If a company does not report these taxes, they may be in trouble with the law. The amount an employee pays in FICA taxes depends on their pre-tax deductions, which reduces their taxable income.

Credit Tpfcu Deposit

FICA taxes are used to pay benefits to retirees, people with disabilities, and children. Employers report these taxes on IRS Form 941, or Form 944 if you are a small business. This federal tax is then paid through EFTPS, the Treasury Department’s tax payment service.

All employees must pay federal income taxes to the IRS. How much money an employee is owed depends on their gross pay and the number of paychecks they claim on their W-4 form. Gross salary is determined by taking into account gross income such as wages, tips, wages and commissions as well as non-earning income such as interest and dividends. Employees fill out IRS Form W-4 and can use Publication 15-T to view income tax withholding tables and other related federal income tax information. Federal income taxes are used to support public services, such as education, social safety net programs, transportation, and the military.

Similar to federal income taxes, state payroll taxes and local taxes are also used to support public programs. State income taxes are set by each state, so you may need to check with your state government to make sure you comply with all the rules. The amount an employee pays in state and local taxes is determined by their gross income and pre-tax deductions.

Salary payments to employees with unpaid debt may be deducted from their paychecks. Wage garnishments are ordered by a court or government agency such as the IRS and require employers to withhold money from an employee’s wages. These after-tax wages usually go toward debts that haven’t been paid, such as taxes, damages, child support, and delinquent debt. The pay letter will state how much of the employee’s salary is to be withheld and where the money is to be sent.

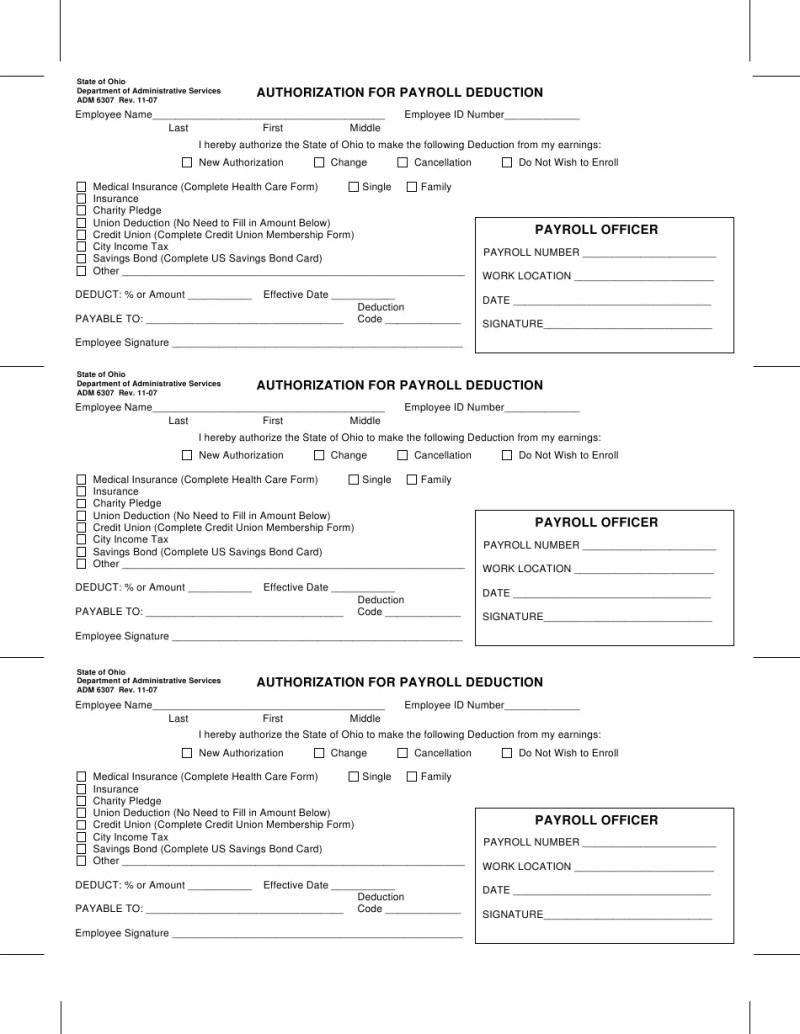

Form Adm6307 Download Printable Pdf Or Fill Online Authorization For Payroll Deduction Ohio

Employers must comply with Title III of the Consumer Debt Protection Act, which limits how much can be charged from an employee’s salary each week. The law also prohibits employers from firing workers who require wages to pay off debt.

Unlike mandatory deductions, voluntary payroll deductions are not required by law. With the consent of the employee, certain deductions can be taken from their wages. An employee must choose whether they wish to participate in certain benefits. Below, you’ll find some of the most common voluntary payroll deductions that employers agree to.

Another employee benefit that companies offer are employer-sponsored retirement plans, such as a 401(k) retirement account that allows employees to save for retirement. Employees can put a portion of their paychecks into an IRA. There are many retirement options that an employer can offer, and the type of retirement plan will determine whether it is pre-tax or after-tax. For example, money put into a traditional 401(k) may be pre-tax, while money put into a Roth IRA must be after-tax.

Union members usually make regular payments to the union of which they are members. These loans are after-tax, which means they will not offer tax benefits. Union dues can go toward an employee’s membership, along with other taxable benefits offered by the union, all of which are tax-deductible.

Promissory Note And Payroll Deduction Authorization

Other work expenses that an employee can deduct include food, travel, uniforms, home office supplies, parking, transit, and medical exams. These labor-related expenses are also deducted on an after-tax basis. However, some employment expenses may not be deductible depending on the state in which you work.

A pre-tax deduction is taken from an employee’s gross salary before any tax is withheld. The pre-tax deduction reduces the employee’s taxable income, that is

Payroll deduction authorization form, voluntary payroll deduction authorization form, payroll authorization form template, payroll deduction authorization template, sample payroll deduction authorization form, employee payroll deduction authorization form template, employee payroll deduction authorization form, employee payroll deduction form template, payroll deduction authorization, payroll deduction form template, authorization for payroll deduction, free payroll deduction form template