Operating Agreement Template – An LLC operating agreement is the legal document that governs your limited liability company. The Articles of Organization do NOT govern your LLC. An operating agreement states who owns and manages the LLC, how profits are handled, and how any problems the LLC may or may face in the future will be resolved. An LLC operating agreement is not required in every state in the US – although it is important.

This free LLC operating agreement was created as a general template that will work in every state. (We also offer country-specific operating agreements below.) Can be single or multi-member. We’ve written it where you should be able to complete it in less than 5 minutes and understand what it means. As with all our forms, this template is for individual use.

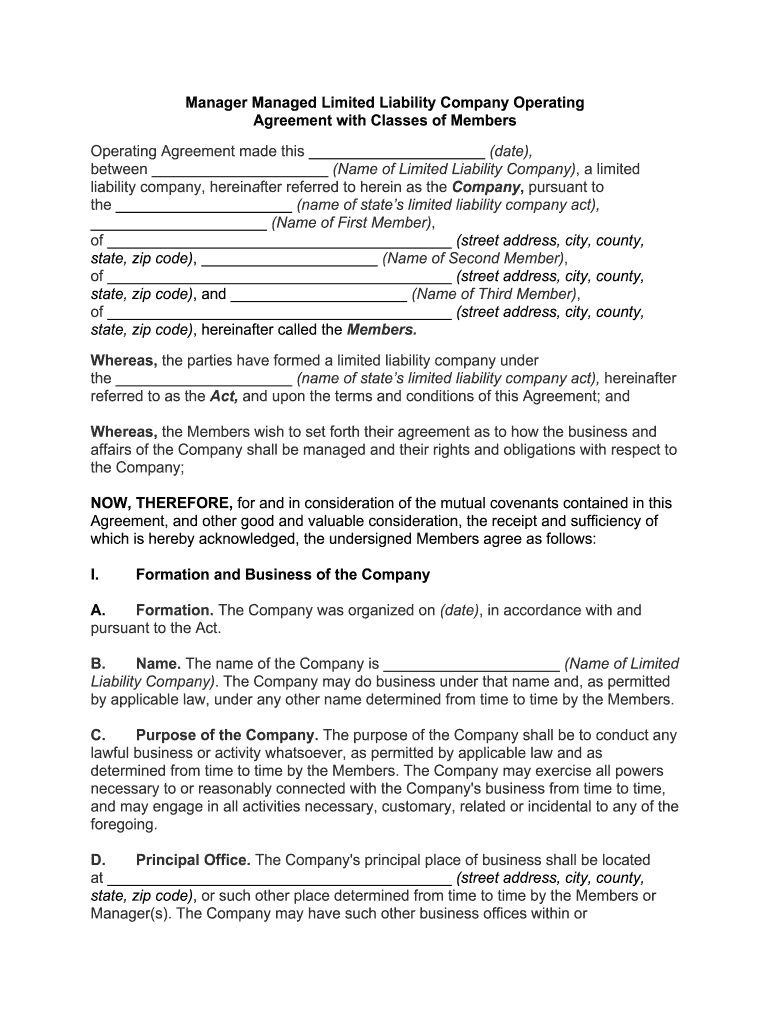

Operating Agreement Template

While our general LLC operating agreement is comprehensive and easy to modify, we offer template operating agreements useful for specific types of LLCs as well:

Free Operating Agreement Template For A Member Managed Llc

Want to know if your state requires an operating agreement? Or how have issues with operating agreements affected current litigation in your state? Select your country from the drop down menu below.

Many of these sites also include FREE state operating agreement templates – and our library of forms is growing fast! Need an operating agreement for Wyoming Close LLC? What about a manager-led California LLC? See our specific operating agreement pages to see which templates are available.

Our LLC Operating Agreement is not only free, but also carefully written in a language you understand. There is no reason for 30 pages of dense litigation. Or paragraphs that restate information that is already in state statutes. Your state’s laws will remain the same no matter what you write in your operating agreement.

So with that in mind, we edited our LLC operating agreement down to the bare essentials. You could read it to your friends or family and they would understand it. We pride ourselves on making LLCs easier to manage – our LLC operating agreements have been used to operate over 1.5 million LLCs.

Business Partnership Agreement Template

We won’t – unless you hire us to form your LLC – but you are free to download our template and use it yourself. If you sign up for our LLC formation services, we will include your original LLC goals and create an LLC operating agreement for you. Our business formation also includes registered agent service, lifetime customer support, and helpful tools and resources to help you maintain your LLC. Learn more about starting an LLC in our free LLC guide. Or, get started fast and sign up for our LLC formation service now!

All members must “buy into” the LLC with initial capital contributions. These contributions are cash or other assets that are exchanged for an ownership interest. In this section, you enter the total value of these donations. This article also notes that members are not obligated to contribute more later.

Everyone wants to know how and when they will see some money. This article explains that profits and losses are determined annually and distributed to members according to their percentage ownership interest. After payment of expenses and liabilities, distributions may be made at any time. If the company or membership interests are liquidated, distributions follow Treasury Regulations.

So how are decisions made? This section explains that members will vote for managers and that one manager will be elected as Senior Manager. CEM manages operations and makes managerial decisions. This article sets out responsibilities for managers, including making decisions, enforcing contracts and agreements, keeping records and responding to members’ requests for information.

Download Multi Member Llc Operating Agreement Template

Don’t want managers? If the members are managing your LLC, you can still use this form with minor modifications—or better yet, check out our free multi-member LLC operating agreement.

This article also notes that as long as the managers act in good faith, they are not liable for loss or damage to the LLC. Similarly, members and managers acting in good faith for the LLC are exempt from lawsuits or other actions—meaning losses from costs or judgments are covered by the company.

There are situations where the LLC may have members or managers for services or expenses. Article V of the LLC operating agreement states that managers are entitled to compensation for their services. Members or managers must be reimbursed for out-of-pocket LLC expenses.

Article VI describes how the books are kept. Managers are responsible for keeping financial records, including separate capital and turnover accounts for each member. This section states that the LLC must keep books for one calendar year. At the end of the year, the books are closed and the managers prepare a statement for each member.

Llc Operating Agreement

When you’re driving membership interest, you don’t want to risk outsiders coming in and mocking what you’ve worked so hard to create. Essentially, this article provides some protection by giving other members the first opportunity to purchase the interest. If the members do not purchase the interest or unanimously agree to the transfer, whoever receives the interest will only be entitled to profits and compensation – not participation in the LLC.

Members can vote to terminate the LLC during the dissolution process. This article notes that the LLC is responsible for paying the debts of the e

Here is the signature page. Members sign acknowledging that they agree to abide by the terms of the agreement.

At the end of the LLC’s operating agreement, there are additional empty showrooms. These screens include places where you can list individual manager information, member information, and capital contributions.

Free Single Member Llc Operating Agreement

Every state says it should, but guess what? Almost all state statutes state that failure to keep LLC operating agreements for your LLC will not cause you to lose your liability protection. We have yet to see an actual state agency requiring you to maintain an LLC operating agreement.

Yes, of course, especially if you will have several members. Even if the state doesn’t require it, it would be foolish to form an LLC with another person without an LLC operating agreement that you both agree to. Operating agreements will explain how to handle disputes, money, and techniques like the right of first refusal—things that will shape the future of your company. If you’re going into business with another person, chances are you’ll eventually have to participate. The operating agreement between you defines how the breach will occur.

We will! We have templates for meeting minutes, articles of organization and more. Or select “LLC Forms” for a complete list of free forms we offer for LLCs. A LLC is a legal document that describes the function, structure and rules of a limited liability company. It acts as a guide for the company, providing its members with a clear vision of long-term direction on a number of key issues.

By reading a business operating agreement, one learns who the members are (and ownership percentage), how the business will be financed, its future plans, how profits and losses will be handled, each member’s voting rights, and the plans being implemented. . . for emergencies and other unforeseen events.

Free Arizona Llc Operating Agreements (2)

Regardless of state requirements, it is highly recommended to create an operating agreement at the outset of an LLC because of the organizational and structural advantages they provide.

An LLC operating agreement sets out the basic guidelines and operating procedures of a new company. It allows the founder of the business to describe the short-term and long-term plans of the economic entity. A simple game plan makes it easier to navigate the inevitable obstacles beginners face. It is important to know that the agreement is not set in stone, but can (and should) be changed to fit the company’s vision and goals as it evolves.

Each state has its own requirements for declaring an LLC. However, most have the following two (2) requirements:

Special names, such as those ending in “bank,” “trust,” “credit union,” “insurance,” etc., usually require additional fees, paperwork, or a special license. . Members should use their state’s Secretary of State’s entity database to reference possible LLC name options.

Guide To Making A 50/50 Partnership Agreement

A registered agent is a person responsible for receiving important documents related to the economic entity. If someone sued the LLC, the registered agent would be the person served. They are also date recipients for official government documents and other important communications. The registered agent must be a resident of the state where the business operates.

To formalize the LLC, it must be registered with the Secretary of State. Note that your state may call the Articles of Incorporation by a different name. This can often be done online (click on one of the states above to learn how to file). Information required by most states includes the following:

An EIN (Employer Identification Number) is assigned by the IRS to business entities for tax administration purposes. A company may have only one (1) EIN. It is not a requirement for all businesses, but it is necessary if the LLC opens a business bank account, hires employees and files certain tax returns. A complete list can be found by going to the article IRS Do

Operating agreement llc virginia template, simple llc operating agreement template, missouri llc operating agreement template, nevada llc operating agreement template, llc operating agreement colorado template, company operating agreement template, operating agreement template california, ny llc operating agreement template, arizona llc operating agreement template, operating agreement template georgia, single member operating agreement template, operating agreement llc texas template