Multi Step Income Statement Template Excel – On the other hand, the tax returns also tell us how much we are losing. So, watch out for that.

Since you’re reading this post, I’m assuming you’re eager to dive right in, which is good news because we’re about to embark on a mystical journey analyzing the critical information you need to start using P&L for smarter decisions.

Multi Step Income Statement Template Excel

The income statement, also known as the P&L, shows the financial performance of a company over a specific period.

Solved Prepare A Multiple Step Income Statement Based On

For example, annual and quarterly income statements are often created for taxes, investors and lenders, but these times are not so useful from a management point of view. Managers often need more relevant information immediately to make informed decisions.

Another important feature of the income statement is that it is historically facing. That is, it represents previous financial transactions that have already taken place.

There are “forward looking” or projected income statements — called “Pro Forma” — but they are less official, and that’s a topic for a different post.

The dates are always clearly marked, so it should be easy enough to figure out how old the information is.

Reading Financial Statements I Free Accounting Course I Cfi

Now that we are well oriented in time, space and purpose, you can see that the document is divided into four main sections. The first one is income.

**I briefly mention that the following description only applies to “multi-stage” P&L accounts. After searching for this post, I came across “

“income statements, and I have no idea why they exist. They only consist of two sections (one for income, one for expenses), and I imagine they are only used in situations where the reader fears most of the details.**

The entry is obviously the best part. This is where we get back all the money we are making by providing great products and services.

Profit And Loss Statement Template

We calculate income by multiplying the sale price of goods or services by the total number of sales transactions.

What happens when, instead of paying on the spot, your customer promises to pay in the next 30 days? Something commonly experienced in custom projects and B2B transactions.

I don’t want you to worry, though. Wherever there is chaos in the world, we can be sure that a team of specialists are working tirelessly to organize every scenario into a few delicacies. This is where accounting standards such as Generally Accepted Accounting Principles (GAAP) (IFRS for international standards) come into play.

These are the rules that tell us when we should “recognize” the income. I recommend reading them by a cozy fire.

Accounting Multi Step Income Statement

Revenue recognition guidelines vary widely, so to keep things simple we say that revenue is reflected in the income statement once it is earned.

Each entry in the revenue section represents a series of behind-the-scenes decisions and activities, with varying degrees of complexity, that are coordinated to produce earned revenue.

For example, Tesla shows car sales as one of their revenue streams. It properly collects the income produced from the sale of cars. However, behind this point of line are sophisticated supply chains, manufacturing processes and distribution networks designed to optimize the efficiency of delivering vehicles to customers.

The complexity of our journey to market often determines the costs involved in maintaining a smooth revenue generating engine. These costs are divided into two categories: cost of entry and operating costs.

Sensitivity Analysis In Excel

The cost of revenue includes money spent directly on manufacturing a product and providing services to customers.

For the purposes of this post, we will be using revenue expense to represent the different names in the “Expenses of” family. These names may indicate slight differences in accounting, but they are intended to separate the direct costs of generating revenue from the money spent to support the business.

Because of its direct relationship to revenue, we can often expect the expenses reported in this section to increase as revenue increases, especially if you sell or manufacture physical products.

Businesses that sell digital goods generally experience less variability in input costs as there are typically no direct costs associated with selling an additional unit of a digital product.

Income Statement Templates

The sources that drive the costs of entry have significant implications for the scalability of the business model. The results reported in gross profit clearly show these consequences.

Gross profit is what we are left with after deducting the costs of producing the income from the income we have earned. The result is a story about the company’s efficiency in generating revenue.

This efficiency is often measured by converting gross profit into a percentage called “gross margin” (gross profit divided by revenue).

Looking at profitability through a gross margin lens allows us to evaluate the relationship between costs and revenues as they change over time.

Solved Acc 120

Standards for acceptable margins will vary between companies even within the same industry, but it also allows a standardized basis for comparing performance with similar businesses.

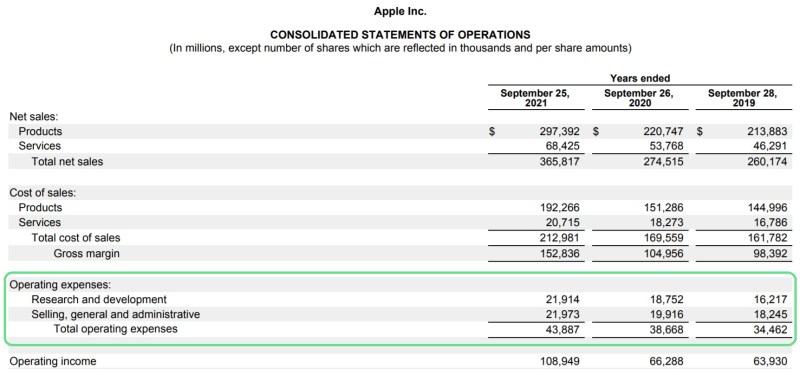

The operating expenses section is where we find all the expenses associated with running and supporting the business.

These are generally costs that are not directly related to the cost of producing a single unit of product, and are the first place to look for frivolous behavior.

Once we have considered all of our business expenses, we are left with one of the most important items on the income statement.

Financial Reporting Template For Sage 300

Operating profit, sometimes called EBIT, is what we are left with after paying all the costs of doing business.

EBITDA has an exceptional status among the ranks of MBA students worldwide. It is considered the holy grail of financial performance, and they even organize weekly seminars in honor of EBITDA.

Of course I’m joking about that last part, but EBITDA plays a significant role in the world of management.

The influence of EBITDA is a result of what it tells us about profitability. It is often used as a more accurate measure of profit from operations and is consequently considered a rough approximation of operating cash flow.

The Ultimate Excel Accounting Template For Bookkeeping

The last section of the income statement can muddy the profitability waters too much if we’re just trying to figure out how much money the company is generating.

The Other Income and Expenses category is for sources and uses of cash that are not considered standard results of running the business.

For example, your local dry cleaner may include rental income received from property they own in this section. While the dry cleaner can make significant rental income, it is not an income stream that should be considered in operating profit, as it has nothing to do with running the dry cleaning business.

With all this in mind, we can begin to see why it is popular to leave this section out when analyzing profits. Net income combines everything together, which can be misleading if there are significant non-recurring events and we want to understand the underlying business strength.

Business Plan Excel Template

Finally we have reached the end of our glorious journey and we have reached the net income. This is the total amount of money earned or lost from the business.

Theoretically, a positive net income value means you have cash left over to reinvest in the business, service debt, or distribute to shareholders.

However, before you get everyone partying at Dave & Busters, keep in mind that net income can be misleading because of the revenue (and expense) recognition rules we discussed earlier. Just because we got an income doesn’t mean it’s still in our bank account. To understand how much we actually spend and cash in, we have to look at the cash flow statement.

Here’s a spreadsheet that includes the income statements of some of the world’s favorite companies. I have separated each of them from the four sections that we discussed above, so that you can see how you can put your new knowledge into practice.

Free Income Statement Templates For Excel

Here’s a video with some additional information on how to use a simple 5-step process to interpret the results of an income statement:

Brandon is co-founder and CEO of Poindexter. He likes to question his own existence and convince outsiders that we are trapped in a simulation. Looking for a professional multi-step income statement for a manufacturing company? If you feel stuck or lack motivation, download this template now!

Do you have an idea of what you want to draw, but still can’t find the right words to write or lack the inspiration to do it? If you’ve been feeling stuck, this multi-step income statement template for a manufacturing company can help you find inspiration and motivation. This multi-phased income statement for the manufacturing company covers the most important topics you are looking for and helps you structure and communicate professionally with the people involved.

Note: Income Statement is also called Revenue Income Dividends: Other Income Operating Income and Non-Operating Income Operating income includes income and expenses that are directly related to the main activities of the company that generate income (eg, income) Non-operating income operational Includes certain gains and losses related to peripheral or ancillary activities of the company (eg, sale of investments special gains infrequent or unusual losses, but not both). Income statement (single stage) Appropriate heading Revenue Profits Expenses Losses Income statement (multiple stages) Appropriate heading Gross profit Operating expenses Non-operating items or,

The Contribution Margin Income Statement

Income statement multi step, budgeted income statement template excel, projected income statement template excel, restaurant income statement template excel, income statement forecast template excel, simple income statement template excel, income statement multi step format, personal income statement template excel, income statement template excel, multi step income statement template, multi step income statement examples, classified multi step income statement