Mileage Log Printable – Send vehicle mileage log PDF via email, link or fax. You can download, export or print it.

Plus, making changes to your documents takes just a few simple clicks. Follow these quick steps to convert PDF printable mileage log for free:

Mileage Log Printable

![]()

Here are answers to our customers’ most popular questions. If you cannot find an answer to your question, please contact us.

Best Printable Travel Logs

Download a mail tracker app that has an automatic trip logging function that takes the hassle out of logging trips. Once you start driving, the distance until your vehicle stops will be detected. The app is also free for iOS and Android, making it easily accessible.

If a person drives for both business and personal purposes, only business miles can be deducted. However, business fairs are considered only from the person’s principal place of business. Pierce explained.

The problem is that the IRS requires you to keep adequate records or provide sufficient evidence to support your statement. If you state that you don’t have a record, or don’t know what your mileage is, you won’t be able to claim the deduction.

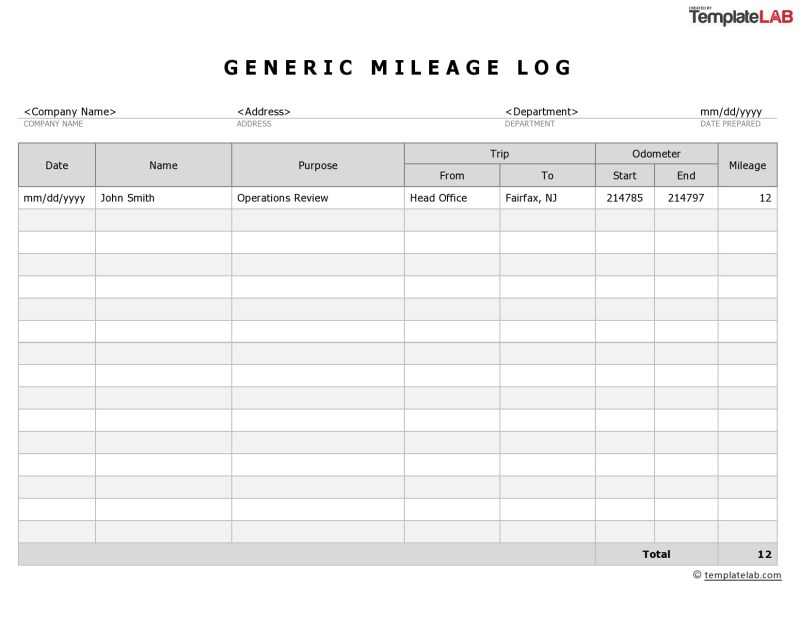

At the start of each trip, record the odometer reading and enter the destination, starting point, ending point, and date of the trip. At the end of the trip, the final odometer should be recorded and then subtracted from the initial reading to find the total mileage for the trip. 3

A6 Ring Mileage Log Printable Set

You can track these miles manually using your odometer and a spreadsheet, expense system, or paper logbook. Or, you can track them automatically using a mileage tracking app. But no matter how you track your mileage, be sure to do it on time.

MALCA-AMIT USA LLC MALCA-AMIT MALCA-AMIT Group of Companies New York 580 Fifth Avenue New York NY Ph…

Employee Information Last Name First Name M. I. Address City Home Phone State Work Phone Group Number Employer Name/Gro…

![]()

Human Rights Tribunal of Ontario Appeals under section 34 of the Human Rights Code (Form 1) www.

Day 23: Mileage Log

How do you keep a mileage log? Keep a separate bank account or credit card for business expenses This can be a good way to keep personal and driving expenses separate. … record the mileage on paper or in a spreadsheet. … use a mail tracking app. … Use your Uber or Lyft app to track mileage discounts (not recommended).

It’s a myth that the IRS requires you to record your odometer at the start and end of your trip. There is currently nothing in the law that requires you to log odometer readings at the beginning and end of each year and when you start using a new vehicle.

If you forgot to save your driving log, fear not! Rideshare, Uber and Lyft drivers are also protected even if they don’t have a mileage record. They have access to records because they have more corroborating evidence than typical independent contractors. It’s a good idea to use an app to track mail.

There are two ways to claim a mileage tax deduction when driving for Uber, Lyft or a food delivery service. Standard Mileage Multiply your business miles driven by the standard rate (56 cents in 2021). … Actual Car Cost Track all your driving expenses yourself. Send complete mileage log PDF via email, link or fax. You can download, export or print it.

Ride Sharing Log,driver Mileage Log Graphic By Watercolortheme · Creative Fabrica

Plus, making changes to your documents takes just a few simple clicks. Follow these quick steps to edit PDF Mileage Sheet PDF for free:

Here are answers to our customers’ most popular questions. If you cannot find an answer to your question, please contact us.

A mileage logbook is a monthly or annual record of your business travel that the IRS or your employer claims for tax deduction or refund purposes.

If a person drives for both business and personal purposes, only business miles can be deducted. However, business fairs are considered only from the person’s principal place of business. Pierce explained.

Mileage Log Template

The problem is that the IRS requires you to keep adequate records or provide sufficient evidence to support your statement. If you state that you don’t have a record, or don’t know what your mileage is, you won’t be able to claim the deduction.

You collect business miles every time one of your vehicles is used for business purposes. You can track these miles manually using your odometer and a spreadsheet, expense system, or paper logbook. Or, you can track them automatically using a mileage tracking app.

Before starting the trip, the taxpayer must record the odometer reading and write down the destination, starting and ending locations, and the date of the trip. Record the final odometer reading at the end of the trip. Subtract the final reading from the reading at the beginning of the trip to get the total mileage.

A. No. 9504 Itemized Deduction Sec 34 A to J NIRC Compensation Income II 012 16 Additional Exemption Bus Claim…

Top 10 Excel Mileage Log Templates On Wps Office

Start Excel and select the “File” tab. Click on “New” in the search box and type “mileage” and press “Enter”. Click a template to preview it and click “Create” to open a new workbook with the template you want to use.

Why is mileage important? Car mileage is important because the number of miles you see on the odometer is a great way to determine the value of a used car. This tells you that the car has been around for years. A car with high mileage will cost more than a car with low mileage.

It’s a myth that the IRS requires you to record your odometer at the start and end of your trip. There is currently nothing in the law that requires you to log odometer readings at the beginning and end of each year and when you start using a new vehicle.

It’s easy to track your total mileage for the year. Take odometer readings on the day you start using the vehicle for business and at the end of the year. The miles that count as part of your business mileage deduction include the number of miles you actually drive for business. Your web browser no longer supports older versions to ensure user data remains secure. Please update to the latest version.

Mileage Log And Reimbursement Form Sample

Mileage Log Printable – Vehicle Mileage Tracker – Mileage Tracker – Car Mileage Printable – PDF – A4 – A5 – Letter – Half Letter.

ZIP files containing high-resolution PDFs will be available to you immediately after your purchase, which can be viewed and downloaded indefinitely from the ‘Purchases and Reviews’ section of ‘Your Account’.

Due to the nature of inventory, digital products, returns, refunds and exchanges are not possible after purchase. However if any issues arise with the purchase I will be more than happy to assist and work towards a satisfactory outcome.

I also accept personalization requests (including changing sections of text and changing or adding colors to the document).

Direct Sales Planner

Instant download items do not accept returns, exchanges or cancellations. Please contact the seller with any problems with your order.

Purchase Protection: Shop with confidence knowing that if something goes wrong with an order, we’ve got you covered on all eligible purchases – see program terms.

It has helped me in many ways. I didn’t realize milestones could be written. With this template, it has become very easy!

Expense Log Printable – Expense Tracker – Expense Sheet – Shopping Log – Personal Finance Printable – PDF – A4 – A5 – Letter – Half Letter Planner Room Sale Price $1.79 $1.79 $2.39 Original Price $2.39 (25% Off)

Mileage Log Template For 2022

Vehicle Maintenance Log – Vehicle Service Tracker – Vehicle Repair Expense Tracker – PDF – A4 – A5 – Letter – Half Letter Planner Room Sale Price $1.79 $1.79 $2.39 Original Price $2.39 (25% Off)

Expense Tracker – Expense Tracker Printable – Expense Log – Purchase Record – Transaction Log – PDF – A4 – A5 – Letter – Half Letter ThePlannerRom Sale Price $1.79 $1.79 $2.39 Original Price $2.39 (25% Off)

Income and Expense Tracker Printable – One Page – Minimal Financial Log – Simple Budget Tracker – PDF – A4 – A5 – Letter – Half Letter Planner Room Sale Price $1.79 $1.79 $2.39 Original Price $2.39 (25% Off)

Rent Payment Ledger Printable – Tenant Payment Tracker – Rent Payment Log – PDF – A4 – A5 – Letter Planner Room Sale Price $1.79 $1.79 $2.39 Original Price $2.39 (25% Off)

Mileage Log Pdf: Fill Out & Sign Online

Cleaning Log Printable – Cleaning Tracking – Home Maintenance Printable – PDF – A4 – A5 – Letter Planner Room Sale Price $1.79 $1.79 $2.39 Original Price $2.39

Free printable mileage log pdf, free printable mileage log template, printable mileage log 2020, mileage log template printable, printable mileage log book, printable mileage log sheets, printable mileage log for taxes, free printable mileage log form, free printable mileage log, printable mileage log form, printable mileage log, free printable mileage log sheet