Irs Form 1040 V 2020 – His check was cashed at the US Treasury almost a year ago. But taxpayers say they are now receiving letters from the Internal Revenue Service asking them to file their 2020 federal income tax returns immediately.

“Please file today,” the letter began. “Send your signed return to the above address. We will pay the tax you owe and refund your payment if you have no other tax or liability.”

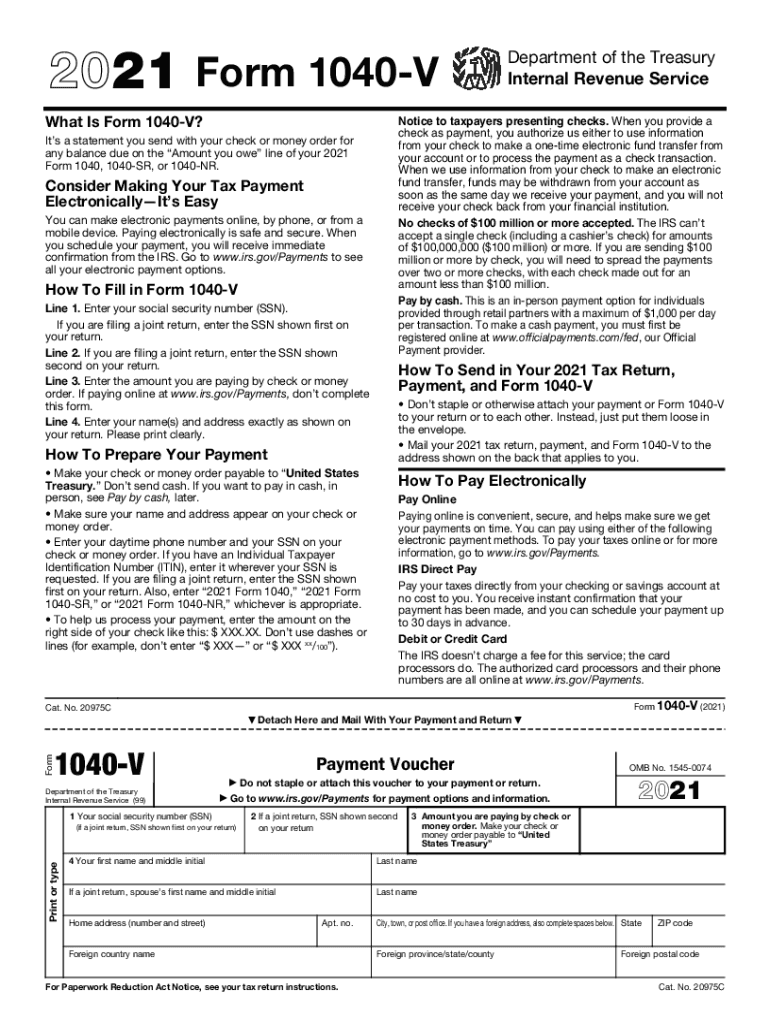

Irs Form 1040 V 2020

“It’s not a text message, it’s not an email, it’s a letter,” said Ann Howell, 72, who recently received the IRS letter on Jan. 24.

Tax Forms From The Irs. Form 1040 Is Used By U.s. Taxpayers To File An Annual Income Tax Return. Editorial Stock Image

According to a letter sent to the couple in Gibraltar, the credit on the account is $1,056. The IRS letter warns of more problems ahead “if we don’t hear from you.”

“If you do not file a return or contact us,” the letter said, “you may lose this credit. The Internal Revenue Code sets strict deadlines for repayment or transfer of loans.

Howell, who keeps track of her checking account transactions, knows the money was withdrawn last year, and she realized the money was listed as a credit on her taxes.

Howell, who retired as a consultant to technology companies, knows that scammers often use email or text. But he wondered if the scammers had become more sophisticated and created real emails to request a copy of the tax return.

Economic Impact Payment For People That Are Not Required To File A Tax Return And Balance Due Efw

It seems that understanding fraud is more important than thinking that the IRS can send a letter to someone who has already paid their taxes and filed.

If the federal government pays the check, he and others wonder, doesn’t that mean the IRS gets the return in the mail because the return and the check are sent at the same time? Why doesn’t the IRS have tax returns?

That’s a good question, and frankly, it might surprise you when you think about all the work involved in filing a tax return. It’s very annoying to get an IRS notice if you think you’ve done everything by the book. Presented in time. Send the amount due.

The less scary thing here, of course, is that the IRS isn’t trying to collect money from the couple.

How The Irs Determines The Statute Of Limitations On Collections

Emails sent to me by readers mention “CP80 News”. And the letter I saw was sent from Kansas City, Missouri.

The letter further stated: If you have submitted this declaration, please send a newly signed copy to the above address. Be sure to attach copies of all schedules and other documents included in the original return.”

As of December 4, 2021, the IRS said it had 6.7 million unprocessed individual returns and 2.6 million unprocessed individual returns.

Mark Luscombe, principal analyst at Wolters Kluwer Tax & Accounting, said the IRS is still processing millions of 2020 returns, and the notice goes out automatically when the IRS believes it hasn’t received a return.

Form 4562: Do I Need To File Form 4562? (with Instructions)

While it appears the delays are long enough that the IRS can’t find many paper returns, many experts say that’s not the case. Automated notifications can be sent to many people who should not receive them.

Edward Karl, vice president of tax policy and advocacy at the American Institute of CPAs, said the CP80 announcement played an important role in the process. These notices are usually sent when a tax return is not received for a particular year, even though the taxpayer may have paid a large amount into the system, for example through a tax assessment.

Someone forgets to pay back when they have a credit on their account, money that can be borrowed to pay back when there is a distressing event such as an injury, divorce, death or natural disaster.

A CP80 notice lets taxpayers know that a return has not been filed and they can file it in time to claim any refund owed.

Irs Backlog Has People Wondering: Why Resend 2020 Returns?

In some cases, the original return claiming the refund must be filed within three years of the date the IRS issued the refund.

The IRS, like the rest of the country, has faced more challenges since the COVID-19 pandemic. To prevent an outbreak of the virus, the IRS must close its centers until the pandemic, and IRS employees must be protected, but the pile of unprocessed returns.

“They have a recycling backlog,” Carl said. “The epidemic has put them in a deep hole.”

The IRS announced Thursday that it will “delay notice in situations where we have paid taxes to pay but do not have records of tax returns.”

Taxes From A To Z 2020: V Is For Voluntary Withholding |

The IRS said in a statement. “In many situations, tax returns may be part of the current paper tax inventory and simply not processed.”

Unfortunately, many taxpayers have already opened the mail and read the notice before the IRS announces that some of the mail is available.

Diana Vollmeier of Rochester Hills said she and her husband sent in a copy of their 2020 return with a “certified/return receipt.”

“We keep track of all transactions,” he said, noting that he was also notified through credit notices to the spouses’ accounts. He made tax payments, but filed his 2020 paper return last spring and paid the balance on his return.

Irs Completes Issuing Refunds For Taxpayers Who Overpaid Tax On 2020 Unemployment Compensation

He said a friend of his also received one of these letters, but hired a CPA to review his 2020 taxes and fix the situation.

The IRS does not provide a clear explanation of what to expect on the statement because it does not list the CP80 on the statement.

In an email response to the Free Press, the IRS said it has delayed issuing notices CP80 and CP080 (Unfiled Tax Return – Credit on Account).

The IRS says a CP80 is a notice that informs a taxpayer that an agency has made payments and/or other credits to a tax account during a particular tax period, but the agency has not received a tax return.

Irs Form 1040 Nr ≡ Fill Out Printable Pdf Forms Online

The IRS has yet to announce a number of notices coming out this month. But it was confirmed that the letter was not a hoax.

“If taxpayers received a notice on their 2020 return, they don’t have to file it again,” said Luis Garcia, an IRS spokesman in Detroit.

“For taxpayers who timely filed their 2019 tax returns, including extensions, and received a notice to refile their returns,” Garcia said.

Taxpayers can also set up and access their tax accounts online at IRS.gov to see their tax status and any correspondence the IRS sends them.

Irs Tax Forms On A White Background Stock Photo

Karl argues that taxpayers currently receiving notices on their 2020 returns do not need to send a copy of their return if they have already filed their 2020 return and know the payment was made.

If you don’t file a return, obviously you may have money you may owe based on the notice and want to file a refund claim.

If you get a notice on your 2019 return, Carl said, you should send another signed copy.

The AICPA is part of a stakeholder group called the Tax Professionals United for Taxpayer Relief Coalition, which is seeking more relief for taxpayers due to the challenges of the pandemic.

Form Irs 1040

The coalition’s recommendations to the IRS include “suspending automatic compliance actions until the IRS is prepared to devote the necessary resources to a timely resolution; A similar recommendation is also included in the National Taxpayer Advocate’s 2021 report.”

Automated systems make more sense in more normal times when the backlog is not so great. But the current flurry of news, experts say, poses a huge risk of alerting many taxpayers to unreal problems.

“They will make mistakes in most cases because of the crowding,” said Carl. He said Thursday’s news was welcome, but more needed to be done.

The group also wants to see, among other changes, the IRS provide taxpayers with targeted relief from underpayment and late payment penalties for the 2020 and 2021 tax years.

The Irs Wants To Know About Your Crypto Transactions This Tax Season

The IRS asserts that “making significant operational changes to our system, including discontinuing the printing and delivery of certain notices, may require programming and other operational changes. With an outdated technology ecosystem, these are changes that can’t be made as efficiently as we can. would, and that’s why investing in IRS IT modernization is so important.

Requesting one of these letters, of course, raises other questions, such as why is the check payable to the IRS if the return filed is not processed?

Carl notes that cashing the check upon receipt is part of the normal process. It is not a cause for alarm.

“That’s wise,” said Carl.

Filing During The Coronavirus? Here Are Some Answers To Tax Questions

Irs form 1040-v, 2011 irs form 1040 v, irs 1040 fillable form, irs 1040 form 2017, irs 1040 v 2020, irs 1040 ez form 2020, 2015 irs form 1040 v, irs 1040 online form, irs gov form 1040 v, irs tax form 1040 v, irs 1040 fillable form 2020, irs gov 1040 form