Gold Price Graph 10 Years – Spot gold prices broke through $2,067 a troy ounce today, another record high. Since the 1930s, the dollar has lost 99% of its value against gold.

The world’s reserve currency is supposed to be the biggest store of value, but due to unlimited money printing, the U.S. dollar cannot compete with gold for a long time. In 1932, the price of gold was $20.67 an ounce. Today it is over $2,067.

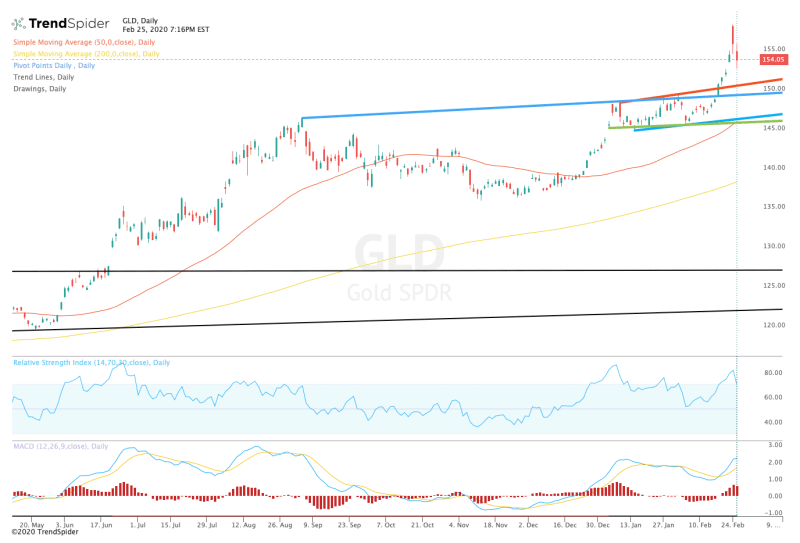

Gold Price Graph 10 Years

This is a 99% depreciation of the dollar against gold. Other reserve currencies such as sterling and the yen fared worse. Over 100 years, the yen has lost 99.98% of its value against gold. Note that the graph below is on a logarithmic scale.

Gold To Silver Ratio

Gold doesn’t contribute if you don’t lend it, but it’s the only accepted financial asset with no associated risk. Because of its immutable nature, gold continued to be the sun in our financial world after the gold standard was abolished in 1971. Despite price peaks like now, central banks around the world continue to hold gold. This is due to Gresham’s Law, “bad money drives out good money.” If the price of gold rises, central banks are more inclined to hoard gold (good money) and spend depreciated money (negative money).

In the chart below, you can see that the purchasing power of gold is very stable. As the price of gold rises over time, it often compensates for the devaluation of fiat currencies as well as goods and services. In other words, the price of gold rose in tandem with the price of consumer goods. Gold even shows a trend of increasing purchasing power, which may explain the low inflation reported by the government. Another theory holds that as technological advances make goods cheaper to produce, the purchasing power of money (such as gold) should rise.

You might think that interest-bearing dollars like U.S. Treasuries have outperformed gold since the gold standard was abolished in 1971. but it is not the truth. Gold has outperformed Treasuries.

In my opinion, the price of gold will continue to rise and will be integrated into the new global financial system. All-time highs in dollars or euros are just another benchmark. Gold has never looked better when inflation is taken into account. What’s more, I expect central banks to draw down even more money in the coming years because the world has never had such debt. Global debt levels are generally unsustainable and can be brought down through debt reduction or inflation. The Fed and other central banks say they have chosen to raise prices. A few months ago, ECB President Christine Lagarde said: “We should be happier having a job than having our savings protected.” This was a clear acknowledgment that (in this case) euro reserves would be wiped out.

Gold Price Recap: March 7

Reducing the debt burden through inflation is “the most effective, least known, and most important method of debt restructuring.” It has been done many times in history (see photo below), and it will be done again. Owning physical gold stored outside the banking system protects your purchasing power from foreign exchange losses.

After World War II, the U.S. government kept interest rates low while increasing inflation. The result is negative real interest rates (interest rates without inflation).

Jan Nieuwenhuijs is an accountant and gold analyst at Gainesville Coins. Nieuwenhuijs focuses on gold, covering topics such as the global physical gold market, derivatives market, central bank gold policy, and international monetary policy.

If you have an ad blocker, you may not be able to proceed. Please turn off your ad blocker and refresh. Happy Friday, traders. Welcome to our weekly market roundup as we look back over the past five trading sessions, focusing on the market news, economic data and headlines that have had the most impact on gold prices. And likely to continue into the future – again as an anchor for silver, the US dollar and other major related assets.

Why Gold Could Rise For The Next 10 Years

Despite Tuesday’s rally, gold prices were on track to start the week with only modest gains on Sunday to end the week.

As the war that began with Russia’s invasion of Ukraine in February continues, investors and money managers at financial institutions across the globe are dealing with what the aftermath of this conflict — after the horrors of war — could mean for the economy. Already struggling to ease inflation in the ‘post-crisis’ cycle in the US and elsewhere, and due to climate change, gold spot prices have created broad and profitable this week: Gold charts end up around $1,000/oz this week The high/low delta.

The negative business environment at the start of the week appeared to be the result of subdued investor sentiment, as the weight of many risk factors increased as the crisis in Europe drew attention. The risk assessment that crushed equities on Monday and Tuesday (and on Friday afternoon, with U.S. equities poised to close another week in the red) is bullish for gold, which is moving past historical resistance at $2,000. Ounces are going higher and better, setting the history of gold prices in the modern market.

Fears of “stagnation” in the U.S. economy — an unwelcome state of play with persistently high inflation and slowing economic growth — seemed to slow down this week for many managers and investors and should now begin in a ( Painful) way to get the market’s attention: the last time the U.S. economy was really turbulent was during the energy crisis of the 1970s, and this week the energy markets (especially even energy markets) are here. crude oil) is everyone’s biggest concern. (Especially after the U.S. and U.K. announced bans on Russian oil imports.) Of course, any negative impact on inflation would always be a big plus for gold prices as investors flock to the precious metal. Value as a traditional means of defense, as we have seen this week.

Did You Know… Since 1900, The Us Dollar Has Lost 96% Of Its Value While The Gold Price Has Increased 7,800% ⋆ My Precious Metals

Financial managers and economists are not just concerned about inflation that appears to be running out of steam: as the Fed prepares to start raising rates in response to the highest levels of U.S. consumer inflation in the past few years (relatively speaking: holding back U.S. growth, Ukraine The war – and the ensuing sanctions on the Russian economy, and the disruption of critical (and already disorganized) supply chains) – has the potential to continue to inflate through inflation and shortages, and further hinder the global economy through the same Bloat and supply chain disruption enable growth.

Shorter version: The Fed (and other, worse things) could end up slowing the US economy, and we may have to wait a lot longer for inflation to cool as hoped.

These issues lead to much of what happens in markets (focusing more on the geopolitical risks we are learning, from experience, from the realities of world wars in Europe) and as a result of market violence judicial developments. Globally, consumer goods markets were fiercely competitive on Monday and Tuesday. Crude oil prices rose sharply before the Russian import ban was confirmed, and of course since. But metals markets — both industrial and precious — saw some notable improvements: Nickel prices soared as West Texas Intermediate crude climbed above $120 a barrel, forcing the London Metal Exchange to suspend trading at the same time. When the price of gold rises to a new all-time high, over $2000/oz (or even $2050).

Surprisingly, during Wednesday’s trading session, for no specific reason that can be shown (so far), the market has shifted and appears to be buying the dips (stocks) and/or selling the tops (commodities). .) The Dow climbed more than 600 points midweek and the S&P notched its best one-day gain in more than a year. Inflation had a dramatic reversal, with WTI giving back more than 10% on the day; Gold fell below support below $2,000/oz.

Gold, Silver Prices Fall In 2021, But Bullion Sales Excel

Even by the middle of next week, the U.S. Treasury market was the only major asset moving in the same direction, little changed. Since the start of trading on Monday, possibly in anticipation of next week’s FOMC meeting expected to formally begin the Fed’s 2022 rate hike cycle, bond prices have fallen and boosted yields amid negative interest rates in March, which led to a 10-year U.S. period treasury bonds. Increased by 2.0%.

Gold prices failed to break or continue to attract buyers above $2,000 an ounce after trading ended on Wednesday. Gold Chart Occasional Volatility

Gold price graph 2 years, gold price in last 10 years graph, gold graph last 10 years, gas price graph 10 years, gold price graph 20 years, gold price graph 30 years, gold price graph 100 years, gold price graph 5 years, gold price graph 50 years, gold graph 10 years, silver price graph 10 years, gold price graph last 10 years