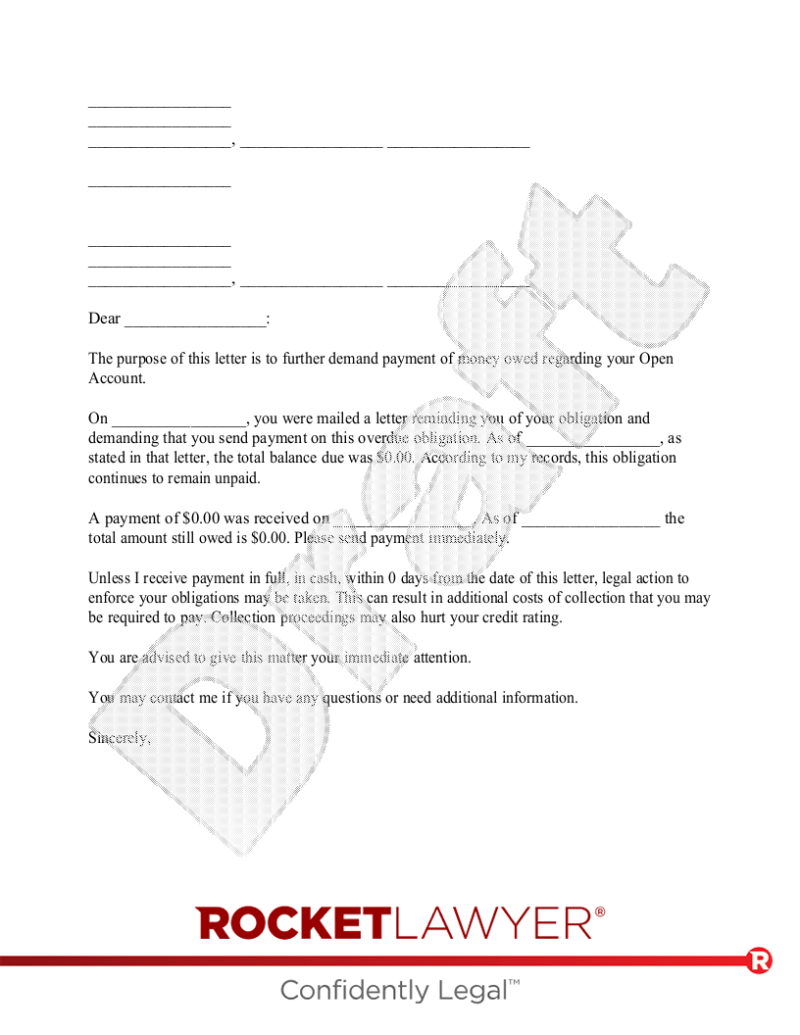

Example Of Final Demand For Payment Letter – A final demand letter is a letter sent to collect or repay a debt. The letter is sent before the debt collector or financial institution takes legal action against the debtor.

The header should include the company or person requesting payment with contact information. The date of the letter should also be included.

Example Of Final Demand For Payment Letter

The amount owed by the debtor must be included in the Final Demand Letter. Please note that any taxes, interest or penalties must be added to an amount. If there is proof of the amount owed, for example, an invoice should be attached.

Meaning And Example Of Demand Letter 2023 (8 Examples)

Fill in the debtor’s details, including their name, when the balance is due and why.

Enter your payment options (select as many as you like). The basic approach is to enter the amount you owe, then a reduced amount if the debtor pays within a certain period of time. Additionally, if the borrower is living paycheck to paycheck, it’s best to have an installment plan ($/week or $/month).

At this point, the creditor should include the penalties and conditions that will arise if payment is not made. This includes, but is not limited to, sending the debt to a collection agency and the fact that an unpaid balance can affect the debtor’s credit report.

All demand letters should always be sent by certified mail with return receipt requested to ensure receipt by the debtor.

Free Final Demand Letter For Payment Legal Sample

This is our last attempt to collect your past dues and our FINAL NOTICE. As of the date of this letter, you have an outstanding balance of $10,595.00 for services rendered by Johnson and Johnson Construction on June 1, 2017.

Keep in mind that this amount has reached 120 days in old age. Several notices were sent by mail and attempts were made to make contact by phone, but there was no response. Signed on May 25, 2017 and the previous contract was not honored because payment was due in full by June 15, 2017. If payment is not received to the address below within 10 days of receipt of this letter, we will take legal action. to act within the law.

Make the payment immediately to avoid damage to your credit rating and further legal action. It should be noted that you may be held liable and subject to additional fees as Johnson and John Construction attempts to collect this debt and take all legal action to the extent permitted by local state law.

By using the website, you agree to the use of cookies to analyze website traffic and improve your experience on our website. A demand letter is a demand for payment of a debt, usually the final notice issued by a creditor. The obligee must contain language that induces the debtor to pay. For example, offering a discount if the debtor decides to pay or threatening to send the debt to collections.

Free Final Reminder Letter Template

Small Claims Limits ($) – If the amount owed is less than the state minimum, you can go to small claims court to resolve the issue. This allows a creditor to place a lien or charge on a person’s assets to force payment.

A demand letter is a formal notice demanding money, possession of property, or action on a legal matter. It is most often used when asking for money for an overdue amount. A demand letter is usually a last-ditch effort to reach a settlement with the other party before taking legal action.

An eviction notice is a demand for back rent. This notice is determined by each state, which gives the tenant a certain number of days to pay the debt. If the tenant does not pay within the time period required by the state, the tenant must vacate the premises.

An effective demand letter requires careful thought and consideration to ensure that it is clear, concise and to the point. The demand letter must contain all facts and legal claims.

A Legal Demand Letter, Cease And Desist Letter And Their Reply

It is important to keep the amount below the small claims maximum in your state. The creditor must also describe the amounts owed in the request by finding invoices or contracts proving that the debtor actually owes the money. Under the Fair Lending Practices Act, a creditor can only charge for documents on file.

Gather all the relevant documents to make sure you have proof that you owe. This includes receipts, invoices, law enforcement documents, proof of business, copies of returned checks, and more. can be included. Documentation must be provided to ensure that previously agreed terms are not met. All resulting damages must be itemized and itemized with an amount for each line and a final total at the end.

The demand letter should include a clearly written deadline for the recipient. Once the letter is completed, the demand letter should be sent by certified mail and, if possible, sent electronically. This will ensure that the person understands the matter as a high priority and reduces the risk that the involved party will not receive the letter.

Small Claims Court (less than the amount required by the state) – If the buyer has not responded satisfactorily, a lawsuit may be filed. This is to obtain a judgment against the receiving party, which may lead to settlement. Buyer may also be responsible for all attorney fees.

Sample Final Demand Letter

If agreed, the payer can provide immediate payment. However, if the matter goes to small claims court, it may result in a settlement.

Demand letter for money owed – Strictly for debts or unpaid balances. It should detail the amount owed, noting any penalties or interest, along with any acceptable payment plans.

Breach of Contract Letter of Claim – Strictly for breach of contract. It must describe how the other party can comply or be harmed.

The time required to complete the settlement may vary. The average traditional timeline for the parties to reach an agreement is approximately two to six weeks. This is because there are additional steps once this decision is made, including obtaining all required signatures, processing the checks, and issuing the checks to the appropriate parties.

Collection Letter Samples

$5,000 for municipal courts, $3,000 for city and village courts, $10,000 for New York, $5,000 for Nassau and Suffolk counties

Example 1 – Payment Request John Smith Quick Clean, Inc. 22 Johnson Rd. Clementon, NJ 08021 (555) 555-5555 Sara Johnson 123 Fake Ave. Ossining, NY 10562 May 15, 2019 Dear Sarah Johnson, This letter serves as a formal request for payment of your outstanding balance with Quick Clean, Inc. 1250 dollars. On April 5, 2019, you received cleaning services at Sakhta avenue, 123. Payment for services was due on April 15, 2019. As of this writing, your balance is 30 days past due. A copy of the original invoice detailing the balance is attached to this document. If you do not contact us immediately to discuss how to pay your outstanding balance, we will be forced to take legal action to recover the debt, which may leave you liable for attorneys’ fees, application fees, and your credit history. Note that this letter can be used as evidence in court that you are unable to pay. We would appreciate immediate attention to this matter. Sincerely, John Smith Account Manager Quick Clean, Inc. Example 2 – Breach of Contract Sandy Donovan Kruger Industrial Smoothing, LLC 55 Franklin Rd. Avon, CT 06001 BY CERTIFIED MAIL MR. Ashton Stewart 2299 Main St. Bloomfield, CT 06002 January 6, 2019 Dear Mr. Stewart, Kruger Industrial Smoothing, LLC has fulfilled its contractual obligations by restoring the granite overlay under the “Granite Restoration Agreement” dated November 14, (2019). Section 7 of the contract states that you should have paid in full for services rendered by December 1, 2019. To date, you have not yet paid and are therefore in breach of the Agreement. According to our records, your initial balance was $224. A $25 late fee was added to your balance, resulting in a total charge of $249. Contact us immediately to resolve the issue. If you are unable to make payment by January 10, 2019, please note that we are prepared to pursue all legal means necessary to recover the debt, including but not limited to legal action against you for the aforementioned claims. Sincerely, Sandy Donovan Kruger Industrial Smoothing, LLC Example 3 – By Law Offices of McMaster & Cranston, LLC 234 Silver Lake Rd. Adamsville, RI 02801 February 7, 2019 Ms. Allison Hanover Vandelay Window Installation, Inc. 65 Park St. Barrington, RI 02806 RE: Reimbursement for improper installation of waterproof flashing Dear Mrs. Hanover, This letter is being sent on behalf of our client, Mr. Terry Calloway.

Letter of demand for payment template, final demand payment letter, final demand for payment, example of demand letter for payment, final letter of demand for payment sample, final demand letter for payment, demand letter example for payment, demand for payment letter california, final demand letter for payment template, demand of payment letter example, final demand letter for payment sample, final demand letter example