Balance Sheet Reconciliation Template Xls – Save time, protect financial assets and do the right thing with free business sharing templates. You can modify all the templates provided below for business or personal use. For more financial management tools, download cash flow and other financial models.

Calculate the balance of the company’s assets, liabilities and equity to get a picture of its financial position at any given time. This formula includes lines for assets as well as liabilities, including cash, accounts receivable, inventory and investments, accounts payable, loans, and accounts payable. . Add your own line items to this Excel sheet and the formulas will automatically be calculated.

Balance Sheet Reconciliation Template Xls

Use this template to track payments, including vendor names, account numbers, payments, and payment completions. This spreadsheet makes it easy to manage important account information. Customize the template by adding or deleting columns to suit your business needs.

Bank Reconciliation Statements

Companies or individuals can use general ledger (GL) reconciliation for bank reconciliation. Businesses can also use it to adjust account balances, such as accounts payable, by changing the format to show the appropriate information on the account. Enter the balance from your bank statement or account with the general ledger and adjust the amount as deposits and checks. The model then shows the differences in the data. If they don’t match, you can check the file for errors or other inconsistencies that need to be resolved.

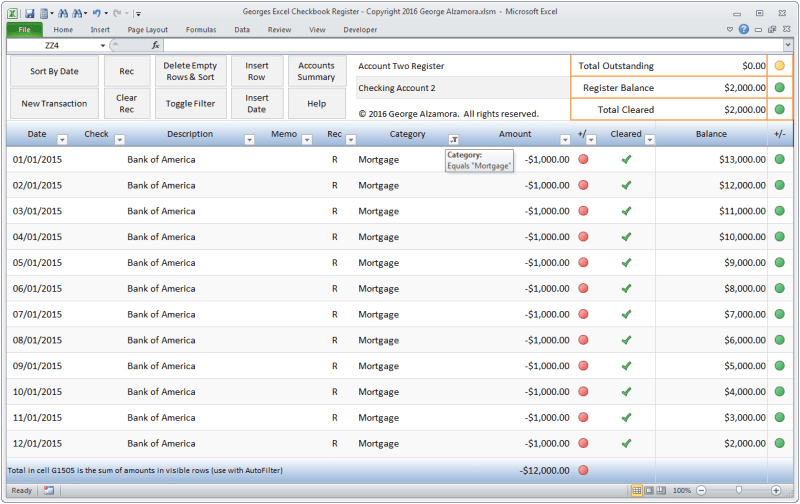

This simple bank is designed for personal or business use and you can download it as an Excel file or Google Sheets template. Enter your financial information and the model will automatically calculate the amount so that you can view your bank statement and financial ledger. To create a regular database, copy and paste the blank template for each month of the year into a new tab.

Most businesses use small amounts of money for small expenses. You can use this template to compare small amounts of cash to help make sure your accounts receivable and cash balance are accurate. How often you have to restore the account will depend on how much it is used.

Reconcile the business credit card account with receipts and create a spending report for the records. Update the model to include business expenses to track. Next, enter the date and account number as well as the amount of each charge. This model can be used for travel, entertaining customers, or other business expenses. Make sure your credit card matches the transactions posted on the reconciliation model.

Ultimate Guide To Account Reconciliation

This cash flow report allows you to view the breakdown of daily receipts, payments and expenses. Enter the first day of the month and the model will fill in the following days, giving detailed information about the daily cash flow. The template also shows the closing balance so you can quickly see if it matches your balance sheet.

The process of comparing a company’s ledger or key accounting records with a company’s ledger or bank account to identify and resolve discrepancies. Because you can perform this process with internal subledgers for account balances or external bank records, the process is also called

. It is an important part of monthly accounting to ensure accurate information, prepare for internal audits, detect fraud quickly and manage cash flow. Individuals can communicate with the bank every month with personal information to know their actual bank balance and avoid overpayments.

Reconciling an Accounts Payable (AP) account involves comparing the general ledger balance with the AP subscription ledger (or other information showing AP transactions). If the two lists match, the income matches. If not, the two lists should be compared to identify errors such as missing or incorrect.

Accounting Excel Template

This process is usually done monthly for efficiency and to prevent mistakes from one month or year to another. Depending on your business size and financial needs, reimbursements can be done manually or with software.

Information is important for all aspects of accounting, and most organizations have reconciliation procedures that they must follow, including deadlines for submitting reconciliations. Here are the simple steps and things to follow when you return the money:

Reconciling money on a regular basis will help maintain an efficient process, reduce mistakes in the long term and limit the stress of dealing with financial discrepancies.

Empower your people to go above and beyond with a flexible platform designed to fit your team’s needs – and adapt as those needs change.

Trust Account Reconciliation Template

The platform makes it easy to plan, capture, manage and report on work from anywhere, helping your team to be more efficient and successful. Report on key metrics and get real-time visibility into results with reports, dashboards, and automated workflows designed to keep your team connected and informed .

When the team has a clear understanding of the task, there is no telling how much they can accomplish at the same time. Try it for free today.World Financial Finance Excel Financial Finance Excel Report Bad Excel Report Excel Excel Templates Excel Templates for Best Business Excel Templates Project Management Excel Templates xls xlsx Template Excel Financial Statement Excel Template Excel Template Excel Template Excel Template

The bank reconciliation process is done to match an organization’s accounting records for cash with the corresponding records in their bank statements. The objective is to identify the differences between the two and record the changes in the accounting records as appropriate. Whether you are managing finances at your office or at home, adequate communication is necessary and important. Keeping track of financial information accurately is not only important for managing the day-to-day operations of your small or medium-sized business, but also important when seeking funding from investors. or loans to take your business to the next level.

For financial professionals, it is important to be sure and double check everything. Our basic or advanced financial documents are easy to understand and available in various formats (such as PDF, WORD, PPT, XLS. Excel spreadsheets also have suitable formats. Therefore, we recommend that you download Leave this sample bank return in an Excel template. Now.

Free Account Reconciliation Templates

Using the Bank Reconciliation Template in Excel template will save you time, money and effort and help you reach the next level of success in your project, education, work and business. Download now!

Looking for more? We write financial documents, forms, letters and presentations including templates designed specifically for small business owners, individuals or financial professionals. Find a financial forecast to calculate your starting costs, payment expenses, sales forecast, income, profit, balance sheet, balance analysis, financial ratio, cost of goods sold, amortization and depreciation. This financial model also works with OpenOffice and Google Spreadsheets, so if you are running your business on a budget, you can make this financial model work for you as well.

In accounting, the bank statement is the process of explaining the differences over time in the bank accounts shown in the organization’s financial statements. company, as provided by the bank, and the corresponding amount shown in the organization’s financial statements.

Bank Reconciliation (Example), The purpose of Bank Reconciliation is to provide the real cash of the church., It is recommended to complete the Bank Reconciliation at least once a month., Open the Financial Accounts – 1.4.07. 07 (according to bank statement), 2150, Add: Non-bank receipts (see detailed list below), 645, Less: Checks written but not delivered ( see the list below), -545, 2250, B, , , different (A-B), 0, Note: A must equal B, , the receipt has not been deposited as of 30.4. 07, item, , money, bank date, Treasurer Sunday Cash Collections – 29.4.07, , 250, 1.5.07, Mission Donations – 29.4.07, , 195, 1.5.07, Total, 445, , Churchwarden, Form List No Limits Issued on 30.4.07, Accounts Payable, Chq.. It is best practice to have an equal balance sheet. Improve the efficiency of your month-end closing process through an integrated and reliable system. The balance of this reconciliation map is all – based on the change model, the legal reform and the common process. This equation is free to download and contains no macros – just a simple but effective one!

Discounted Cash Flow Excel Template Free: Financial Statements And More

Give special people special money. Make sure the owner is fully aware of what is being sent to the account reconciliation and understands the purpose of the reconciliation and the escalation process.

A few years ago we created a bank return template, which is the most downloaded template since we tracked downloads. (As of the date of this letter).

Our final sample is the month-end closing list. In addition to this

Balance sheet reconciliation, balance sheet reconciliation tool, sample balance sheet reconciliation template, business balance sheet template, balance sheet xls template, balance sheet account reconciliation template, balance sheet reconciliation steps, balance sheet account reconciliation, balance sheet reconciliation template excel, balance sheet reconciliation template, balance sheet reconciliation software, blackline balance sheet reconciliation