Balance Sheet Reconciliation Template Excel – A standardized balance reconciliation is a well-known best practice. Improve the efficiency of your month-end process by incorporating a consistent and reliable framework. This balance sheet reconciliation is based on dynamic formulas, conditional formatting and a simple method. This balance reconciliation is free to download and contains no macros – just a simple but effective tool!

Assign specific people to specific accounts. Ensure that the owner of the account being reconciled has full understanding and the objectives of the reconciliation and enhancement procedures are understood.

Balance Sheet Reconciliation Template Excel

Several years ago we created a bank reconciliation template that has been the most downloaded template ever since we tracked downloads. (As of the date of this post).

Monthly Balance Sheet Excel Template Finance Tracker

Our last template was a closed month checklist. With this checklist, we decided to create a simple balance sheet reconciliation template.

We used the Bank Reconciliation template but kept it in two columns for simplicity. Since it’s best practice to have consistent format and functionality – it just makes sense.

A key element of this poll template that helps both creators and reviewers is the two-column format. Like the bank reconciliation template, this balance reconciliation template allows the user to quickly understand what is happening with the account. Are the issues in the general ledger or subledger (or if there is no subledger, in the underlying statement)?

Because one section focuses on the general ledger and the other section focuses on the subledger, you can see where problems are developing. When a difference has occurred and a corrective entry is made, be sure to evaluate why. Once the root cause is identified, it may be possible to adjust or modify it in some way (such as a change in control or some form of automation) that will eliminate the problem.

Balance Sheet By Fund Report For Public Sector Organizations

After downloading Reconciliation, make copies to reconcile each of your account balances. The download has two tabs. The first tab is a blank ready-to-use poll. The second tab contains an example of a reconciliation to receive.

As you think about the various accounts that will be reconciled, try putting together a tip sheet for reconciling. We suggest thinking about:

Other than entering specific information into your account, there is nothing special about using this template. For those of you unfamiliar with grouping, see the image on the left. You’ll notice at the bottom of the template that there’s a little plus sign. These can be expanded by left clicking on them. Under each grouping we put a red capital letter. A red capital letter corresponding to each note should be placed next to the tuning point in the main section of the template. For those not used, just turn grouping off.

What do you do when you have a difference? Sometimes it feels overwhelming when you’re not sure about the first step. Here are some tips to get you started:

Deposit And Gl Reconciliation Report For Banks

Note, keep in mind that the data in this balance reconciliation template is sample data only. Items that are not relevant to your situation may be included or missing items that are necessary for your vote. In addition, as assumptions are made about the nature of voting entries, changes in these assumptions can affect how the entries are recorded.

THE SOFTWARE PRODUCT AND ANY RELATED DOCUMENTATION ARE PROVIDED “AS IS”. MAKES NO WARRANTIES, EXPRESS OR IMPLIED, AND EXPRESSLY DISCLAIMS ALL REPRESENTATIONS. Reconciliation reports are considered data control tools and are used by auditors to ensure that debt-related transactions are linked to the general ledger. Some of the main functionality of this type of report is that for any given GL account selected by the user, it will list and match the corresponding credit transactions. The columns show the months up to the current period to make it easier to track historical balances You will find an example of such a report below.

Banks use loan and GL reconciliation reports to automate and speed up the monthly closing process and ensure that loan transaction data matches the corresponding GL entries. Used as part of good business practices in accounting departments, a bank can improve the efficiency of its accounting staff and reduce the likelihood of errors in financial reporting.

Here is an example of a Loan and GL reconciliation report with custom entity and account parameters

Download Reconciliation Balance Sheet Template

Progressive accounting departments sometimes use various loan and GL reconciliation reports along with detailed loan reports, profit and loss reports, balance sheets, cash flow statements, and other management and control tools.

Actual (historical transaction) data typically comes from loan management systems and ERP systems such as: Microsoft Dynamics 365 (D365) Finance, Microsoft Dynamics 365 Business Central (D365 BC), Microsoft Dynamics AX, Microsoft Dynamics NAV, Microsoft Dynamics GP, Microsoft Dynamics SL , Sage Intact, Sage 100, Sage 300, Sage 500, Sage X3, SAP Business One, SAP By Design, Acumatica, NetSuite and others.

In analyzes where budgeting or forecasting is used, planning data often comes from internal Excel spreadsheet models or professional enterprise performance management (CPM/EPM) solutions.

Https:///wp-content/uploads/2021/09/Industry_Bank10-scaled-1.jpg 1438 2560 Nils R. https:///wp-content/uploads/2019/10/solver-logo-final.png Nils R. 2021-09-09 12:49:15 2021-09-09 12:49:15 Debt and GL Reconciliation Reports for Banks Save time, protect financial assets, and increase accuracy with free bank reconciliation templates. You can customize any of the templates below for business use or personal account reconciliation. For more financial management tools, download cash flow and other accounting templates.

Trended Balance Sheet With Kpis

Calculate the balance sheet of the company’s assets, liabilities and equity to get a snapshot of the company’s financial position at any point in time. The template includes lines of assets such as cash, receivables, inventory and investments, along with liabilities including accounts payable, loans and wages. Add your own line items to this Excel sheet and the template will automatically calculate the total.

Use this template to track accounts payable transactions, including vendor name, invoice number, amount owed, and money paid. This spreadsheet template makes it easy to organize important account information, which can be referenced for accounts payable reconciliations. Customize the template by adding or subtracting columns to suit your business needs.

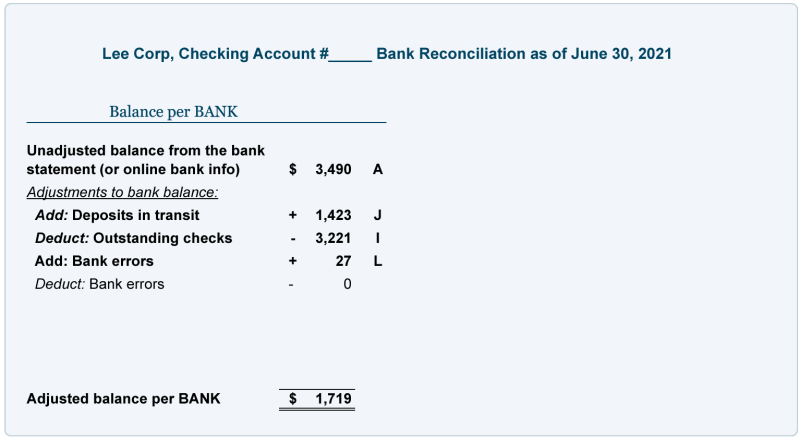

Companies or individuals can use this General Ledger Reconciliation (GL) template for bank reconciliation. Businesses can use it to reconcile balance sheet accounts, such as accounts payable, by editing templates to show relevant account information. Enter the balance from your bank statement or subledger with the general ledger balance and adjust the amount based on outstanding deposits and checks. The template will then reflect any discrepancies between the records. If they don’t match, you can check the records for errors or other inconsistencies that need to be resolved

This simple bank reconciliation template is designed for personal or business use and you can download it as an Excel file or Google Sheets template. Enter your financial details and the template will automatically calculate the totals so you can quickly see if your bank statements and financial statements match. To create a rolling record, copy and paste the blank template into a new tab for each month of the year.

Free Example Of Bank Reconciliation Statement

Many companies use cash for small expenses. You can use this template to reconcile petty cash accounts to help ensure that you account for current income and that cash amounts are correct. How often you need to reconcile your account depends on how often you use it.

Reconcile a business credit card account with transaction receipts and create an expense report for documentation. Edit the template to include tracked business expenses. Then enter each debit amount along with the date and account number. This template can be used for travel, entertaining clients or other allowable business expenses. Make sure your credit card statement matches the transactions reported on the reconciliation template.

This comprehensive cash flow template lets you see a summary of total income, payments and expenses on a daily basis. Enter the first day of the month and the template will fill in subsequent dates, providing a detailed look at daily cash flow. The template also shows the closing cash position so you can quickly see if it matches your balance.

The process of comparing a company’s general ledger or primary accounting records with subordinate or bank statements to identify and resolve discrepancies. Because you can perform this process with internal sub-ledgers for specific balance sheet accounts or external bank statements, the process is also known as

How To Create A Checkbook Register In Excel

. It is an important part of monthly accounting to ensure accurate records, prepare for internal audits, detect fraud quickly and manage cash flow. Individuals can also reconcile monthly bank statements with personal records to ensure they know their actual bank account balances and avoid overdrafts.

Reconciling an Accounts Payable (AP) account involves matching the AP subledger (or other record showing AP transactions) to the general ledger balance. If the two accounts agree, the accounts are reconciled. If not, the two accounts must be closely compared for identification

Basic balance sheet template excel, business balance sheet template excel, balance sheet template excel, excel balance sheet reconciliation template, personal balance sheet template excel, balance sheet account reconciliation template, balance sheet reconciliation template xls, balance sheet account reconciliation template excel, reconciliation sheet template excel, balance sheet reconciliation template, blank balance sheet template excel, excel format balance sheet reconciliation template