Accounting Worksheet Template Excel – Sometimes life forces you to use a spreadsheet. If you plan to do your small business calculations in Excel, this is one of those times.

But there are ways to make the process easier. We’ll show you how to use the Excel Income Statement Template to get started.

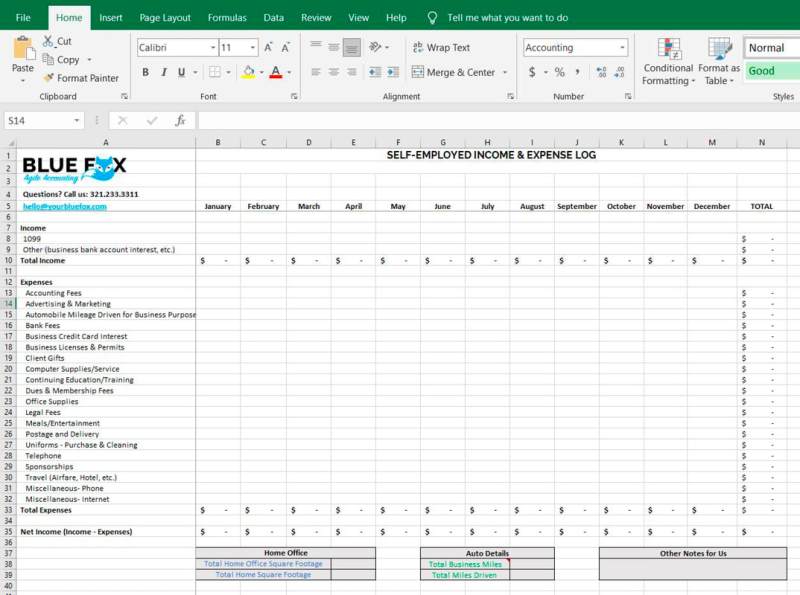

Accounting Worksheet Template Excel

Microsoft Excel (and its simpler, cousin Google Sheets) can be customized. The better you know how to use it, the more you can do. That being said, even if you are good enough at Excel to compete internationally, you can do a lot with it in terms of DIY calculations.

Account Receivable Excel Template » The Spreadsheet Page

Before we get started with the DIY calculation, download a copy of the Income Statement Template. Later, you may prefer to use a different template, or even create your own. But when you’re just getting started, the income statement template is clean and accessible. And it has everything you need for single file backup in Excel.

Single-entry accounting is a good option if you run a simple small business with a low volume of transactions. Every time money comes into or goes out of your business, it is recorded once as a positive (income) or negative (expense) value.

More speed promotes double-entry calculations. The double-entry accounting system is standard for larger, more complex businesses. It is more effective than single entry for monitoring cash flow and preventing errors and fraud. However, it’s also extra work to maintain—and it’s harder to do in Excel. If you’re at the point where you think your business needs double-entry accounting, it’s time to use accounting software. Or, consider writing a bookkeeper (eg ).

Before you get started with the income statement template, be sure you understand the difference between single-entry and double-entry accounting. You will also need access to spreadsheet software such as Excel or Google Sheets.

Free Download: Schedule C Excel Worksheet For Sole Proprietors

This lists all the accounts that make up your books. Think of each account as a category. Every transaction you record is classified into one of these categories.

It retrieves your customer information and does basic calculations. It then summarizes how much revenue your business earned and spent on a specific date.

The information in the copy of the income statement template you downloaded is for placeholder purposes only. Here’s how to optimize your business.

The chart of accounts includes an account named “Gas & Auto”. But if you don’t drive to work, you don’t need this line to remove it. The same applies for any other accounts that are not related to your business.

Password Keeper Excel Template

Also, if there are any transaction categories that you need for your business that are missing from the chart of accounts, you should add them.

By default, the income statement includes information for each account listed in the chart of accounts. If you added or removed accounts from the chart of accounts, make the same changes on the income statement. For example, if you don’t have “Gas and Auto” as an expense, delete the row.

To generate a monthly income statement, you’ll need a separate sheet for each month. Make twelve copies of the original income statement, one for each month of the year.

Then, on each income statement sheet, change the date range (starting value and end date) to cover the appropriate months. Name the paper after the month it covers.

Free Excel Bookkeeping Templates

When you enter income from invoices paid in your transaction sheet, include the invoice number in the description. That way, you can refer to it and avoid mistakes—like forgetting to enter a payment on an invoice, or entering the same invoice twice. It’s a lot easier if you have a separate sheet for keeping track of your invoices.

First, download a free invoice template for Excel, or get one for Google Sheets. Then, add a new sheet to the duplicate income statement template and paste the data from the invoice template you downloaded into the new sheet.

Keep your invoice tracking tab on the right side of your transaction sheet, but on the left side of your monthly income statement. Reference checking would be easy.

Excel spreadsheets are not limited to the task of creating a proper financial statement that you can present to investors. However, even with your personal plan, you can still plan your cash flow each month on a simple spreadsheet.

Solved Submit The Completed Income Statement. Use The

To get started, check out the Google Sheets Cash Flow Template. Copy and paste this on a blank sheet of paper next to your transactions.

Whenever a transaction occurs—whether you’re moving money, cash or credit—you need to enter a transaction sheet, its row. So you have to solve it.

Your transactions are automatically downloaded and sorted for you when you use them. But with DIY calculations in Excel, you will do it yourself.

At the end of each month, your income statement should contain all the information needed to summarize your savings for that period. Be sure to separate your income sheet, organized monthly.

Free Excel Templates

You may want to make a copy of each at the end of the month, and archive it or upload it to the cloud. Come tax season, your accountant will need your income statement for the year.

If you want to go beyond calculations and start delving deeper into your finances in Excel, we recommend that you start with basic tables.

This pivot table gives us a quick summary of how much we spent at each vendor and how often we bought from them.

You can do a lot with pivot tables. If you want to learn more, check out the Microsoft Office training page on Pivot Tables.

All Excel Accounting And Bookkeeping Solution

And if you want some great Excel design tips to get you up and running, check out this in-depth blog article on HubSpot.

This post is to be used for informational purposes only and does not constitute legal, business or tax advice. Each person should consult with his or her own attorney, business advisor, or tax advisor with respect to the matters covered in this document. assumes no responsibility for actions taken based on the information contained herein.

Receive a weekly dose of educational guides and resources from experts to help you confidently make the right decisions to grow your business. No spam subscribe every time.

Included in this page, you’ll find an accounting journal template, an accounts payable template, an accounting template, and more.

Free Billable Hours Template [download]

An accounting journal is an accounting worksheet that allows you to track each step of the accounting process step by step. The accounting journal format includes payment and credit sections for each step, and pre-made templates for calculating the balance for each column.

We’ve also included a link to Equal Spreadsheets, a spreadsheet-inspired task management tool that makes working with spreadsheets easier and more collaborative than Excel.

When purchasing large items such as inventory, supplies or equipment, it may be necessary to take out a loan, which may result in multiple monthly payments to different vendors or suppliers due to different deadlines. Using the accounts payable form will help you keep track of what each party owes you, and give you a quick overview of the total outstanding balance and due dates.

Every company should have a system in place for managing dues. Using the accounting structure available will help streamline the process by giving your company one place to track outstanding balances and helping you prioritize collection efforts.

Wholesale Price Calculator Excel Template

For any company that provides products or services, it is important to use a professional looking invoice that can be customized to suit your needs. This easy billing process will help you get started quickly. Include your company details and payee information, provide a concise list of the description, quantity and price of each item you’re charging, and include instructions on how your customer can send payment.

A bill of lading is a document that details how goods will be shipped from the seller to the recipient. This includes details about the items being shipped, the number of items included in the shipment, and the destination address. Use the Bill of Lading form to ensure that you complete this document for each shipping transaction. This template includes a signature section where you must sign, then the shipping company and finally the recipient, so that if the shipment is lost, the signature details will help identify where it got lost and who is responsible.

Billing statements are useful if you receive regular bi-monthly or monthly payments from your customers. Use this billing template to track customer invoices, account statements, and billing status, all in one place. Furthermore, this model looks professional and can be customized to suit your needs.

A cash flow statement is important for giving a good picture of the inflows and outflows of cash within your company. It shows where money came from (cash receipts) and where it went (cash disbursements). Use the cash flow statement chart along with the balance sheet and income statement to provide a complete picture of your company’s financial position. Cash flow model includes

Accounting Excel Template

Simple accounting excel template, accrual accounting excel template, excel accounting template, worksheet template excel, project accounting template excel, microsoft excel accounting template, basic accounting excel template, excel template accounting worksheet, accounting invoice template excel, trust accounting excel template, free excel accounting worksheet template, free excel accounting template