Monthly Budget Template For Google Sheets – I have an unusual fascination with spreadsheets, and I wanted to share a budget template I created on Google Sheets that I’ve been using and building on for over five years.

I’ll cover everything you need to know in this post, but if you want to know more about it, you can read my summary of the book below.

Monthly Budget Template For Google Sheets

RECOMMENDED I’ll Teach You How to Get Rich—Summary, Notes, + Quotes The best introduction to personal finance and how to enjoy spending money.

Free Budget Templates That’ll Help You Save Without Stress

What makes this Google Sheet budget template better than others All settings are on one page

In just one configuration tab, you’ll fill in all your information: income, account name, budget, etc. All other tabs pull data from this Configuration tab so you don’t have to enter information twice.

That’s why I wanted to create a guided setup to make it extremely easy for everyone to get started. When you open the template, you’ll be greeted with easy-to-follow instructions so you know what to do next.

After completing the configuration settings, a checklist shows you where to go next in the template to enter your expenses and account balance.

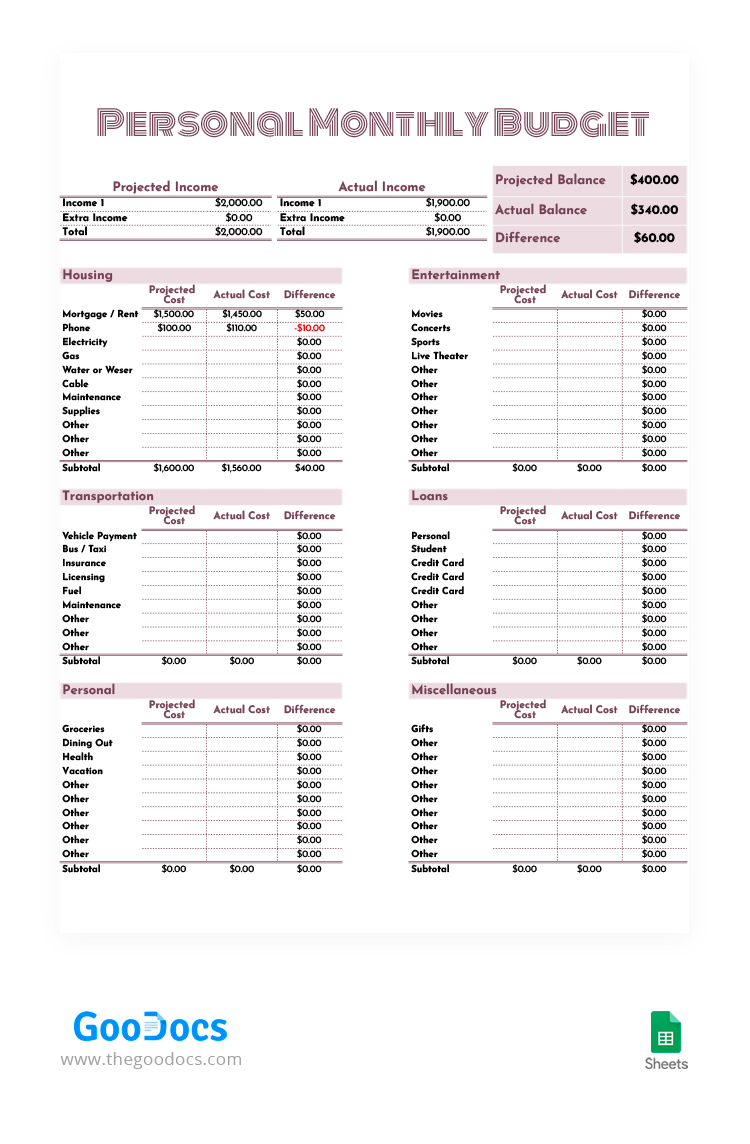

Free Purple Personal Monthly Budget Template In Google Docs

As you fill in your expenses, there is a “module” that allows you to see exactly how many budget categories you have used so far in the current month and know exactly how much you have left.

If you overspent in one budget category, the template will allow you to take the remaining budget from another category to make up for it.

This makes it fun to populate your expenses each day and easy to temporarily pull your budget from another category to cover expenses you’ve overspent on.

This template is also made to cover irregular expenses that you may spend money on or only have to pay a few times a year. After you enter a list of things you want to create an annual budget for, the template will calculate how much you need to save each month to cover it. And that amount is deducted before you prepare your monthly budget.

Free Google Docs Budget Templates

Which is a concept taken from the book “I will teach you to be rich”. Because the budget template is designed to help you set aside money for savings before creating your monthly budget, it means you don’t have to feel guilty about spending the money you have left over.

Most of my friends use budget apps like Mint, and I’ve tried them too. But this app doesn’t actually help me spend less money – it just tells me where I spend my money and tries to guess (badly) which category it is.

And that’s why I like budgets made on spreadsheets. I can customize it exactly as I need it to help me spend my money more wisely. About things I care less about and more about things I really care about.

A bad budgeting system only shows you where your money is going. A good budgeting system will create changes in your behavior.

My Google Sheets Budget Template (for Millennials)

If you want to try my Google Sheets budget template, make a copy and give it a try.

There are simple and clear instructions with additional notes on cells that have an asterisk (*) – just hover over that cell to see the notes.

Remember, a cell with an asterisk (*) means that there is a note with more information on that cell. Hover over it to see what it says.

In the upper left box on the Config tab, enter your income. Follow the orange cells as an indication of which section to complete next. If you don’t contribute to a 401k or don’t typically receive additional monthly income, enter $0.

Monthly Budget Planner Spreadsheet Template For Google Sheets

This budget template is made for two sources of income only. If you have more than one source of supplemental income, you can count them together and enter the total amount as one number for your monthly supplemental income.

All income entered here will be available for your budget. Before you leave the Configuration tab, you can choose how much money will go to savings, SRAs, loans, etc., but you’ll need to name your account first.

You must provide a nickname for each type of bank account, asset, and liability you have. This type is required for formulas on dashboard and balance sheets and cannot be changed. If you do not have an account with the specified type, leave it blank and skip it.

If you have more accounts than the available type, you can count them as one. For example, if you have four credit cards, you can count the two together and give credit card no. 3 Nicknamed Amex & Citi Cards.

Free Excel Spreadsheet For Business Expenses In 2022

The reason you budget for annual expenses before monthly ones is to encourage you to set aside money to better prepare for irregular expenses.

Start by adding things you pay once a year or irregularly to the Annual Budget box. You can find examples and suggestions by hovering over budget category cells*.

Once you’ve entered all the annual and irregular expenses you can think of, the budget template will break that amount down into monthly amounts under Fixed Monthly Expenses.

At the top of the list is the monthly amount that should be set aside for your annual budget, and the second item is your after-tax retirement account. If you have one and assign it a nickname in the Asset Name box, the nickname will be used for this line item.

Month Budget Template (excel And Google Sheets)

If you don’t have one or don’t plan to contribute to the one you have, enter $0 for it.

There is room for eight additional fixed monthly charges. There are suggestions in the budget category cell notes*. Along with budgeting for annual and retirement expenses, I highly recommend setting aside more money for additional savings.

“The goal [of paying yourself first] is to ensure that enough income is saved or invested before monthly expenses or discretionary purchases are made.” Investopedia

Now you’re left with your total guilt-free budget, which is what you have left for discretionary spending.

Ultimate List Of Budget Categories [free Printable]

As explained earlier, this is called your guilt-free budget because it’s what’s left after setting aside money for savings, retirement, and future annual expenses. It’s your money to spend however you want.

In the Guilt-Free Budget box, enter the spending category and the allocated amount. Again, there is a suggestion in the budget category cell notes*.

If you’ve budgeted over the amount you have in your total no-fault budget from the Fixed monthly expenses box, the sum of these numbers will be red i. The number below the total is the balance you have left in your no-fault budget

Your monthly and annual budgets are now ready! The next step is the preparation of the Balance Sheet.

Ultimate Budget Template For Google Sheets

Before you go deeper into the balance, you just need to enter the start date in the orange cell.

One of the biggest possible downsides to budgeting in Google Sheets is that you have to enter your expenses manually, but that’s a real blessing. Manually entering expenses has a huge and positive psychological effect on your spending behavior. It makes you “feel the pain” of every dollar you spend.

Manually recording your expenses every week will make you review every transaction, feel the pain of every dollar spent, and make you think “is this really necessary?”

Another advantage is that you can easily split the expenses into two different budget categories, which has helped me many times.

Annual Budget Spreadsheet Google Sheets Budget Template

Above the header, you’ll see the guilt-free budget category and your annual budget from the Configuration tab. When entering expenses, start with the date in column a, the name of the place where you spent the money in column b, and then tab to the column with the appropriate budget category for that expense.

Go ahead and enter all your expenses starting from the start date you entered in the balance sheet. Do not enter charges or transfers that you have calculated in the Fixed monthly charges box on the Configuration tab.

Once at the beginning of each month, you will fill out the Balance sheet for the previous month. This is where you’ll add up all the money you have and owe in your account so you can see if your wealth and net worth are growing or decreasing.

Before continuing, make sure the first three items are marked as complete in the setup checklist on the Configuration tab.

Free Orange Monthly Budget Template In Google Docs

In the balance sheet sidebar, you’ll see the accounts you’ve named in the Configuration tab. At the beginning of the month when you fill this out, you will enter the balance of each account in the previous month column. For example, if I filled this out today, February 7th, I would enter the balance in the ’20’ column. January’. So if your start date is the first of the month, you don’t need to complete anything until the month is over.

You just need to enter the state in the white line. You can skip

Free budget template google sheets, monthly budget template google sheets, semi monthly budget template google sheets, monthly budget spreadsheet template google sheets, simple monthly budget template google sheets, google sheets monthly budget template reddit, personal monthly budget template google sheets, construction budget template google sheets, free monthly budget template google sheets, project budget template google sheets, business monthly budget template google sheets, monthly budget sheets template