Reconciliation Sheet Template – Making standard balance sheet adjustments is a well-known best practice. Improve the efficiency of your month-end closing process by incorporating a consistent and trusted framework. This balance sheet reconciliation has full functionality based on dynamic formulas, conditional formats and simple methodology. This balance sheet reconciliation is a free download and contains no macros. A simple yet effective tool.

Assign specific individuals to specific accounts. Make sure the owner fully understands the account being reconciled, the purpose of the reconciliation, and escalation procedures.

Reconciliation Sheet Template

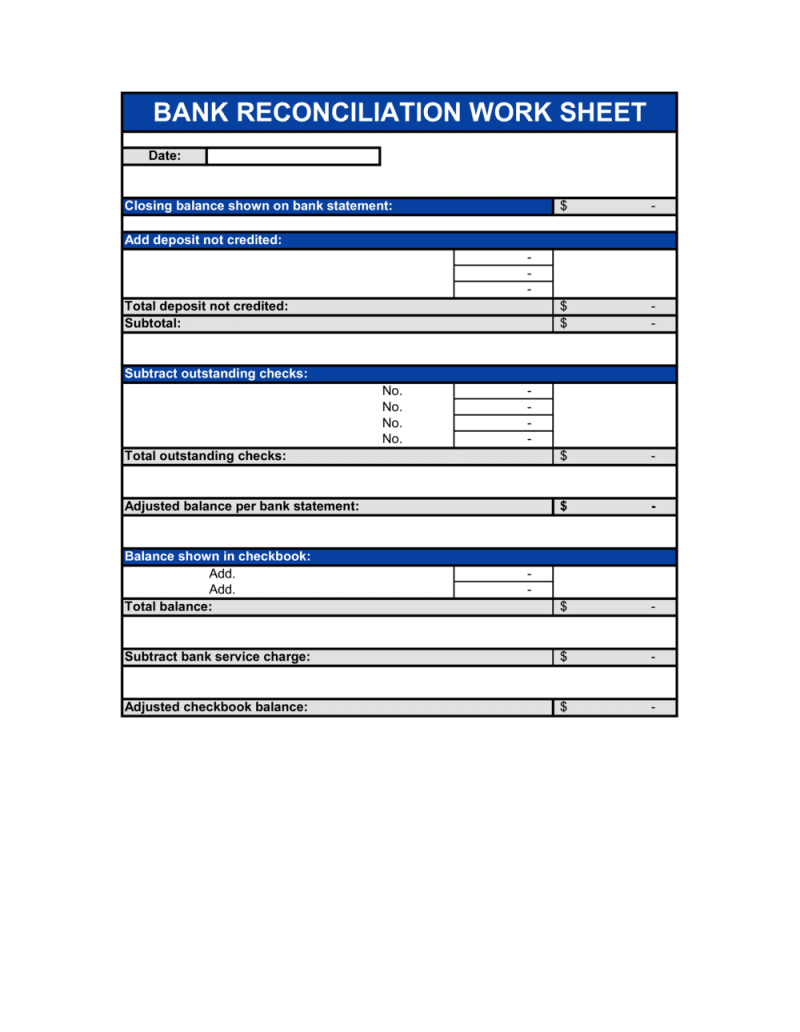

A few years ago we created a bank reconciliation template. This is the most downloaded template since we started tracking downloads. (as of the date of this post).

Free Cash Flow Statement Templates For Excel

The final template is a month-end cover checklist. To accompany this checklist, I decided to create a general balance sheet reconciliation template.

We’ve leveraged the bank reconciliation template, but we’ve broken it down into two columns for clarity. This makes sense because it’s a best practice to have a consistent form and function.

One of the key elements of this alignment template is the two-column layout, which is useful not only for authors, but also for reviewers. Similar to the bank reconciliation template, this balance sheet reconciliation template allows users to quickly understand what is happening with their accounts. Is the problem in the general ledger or in the subledgers (or in the underlying line items if there are no subledgers)?

One focuses on the general ledger and the other on the subledger so you can see where things are going wrong. If there are discrepancies and correction entries are required, be sure to evaluate the reasons. Once the root cause is identified, it may be possible to tweak or change it in a way that eliminates this problem (i.e. changing controls or some kind of automation).

Cash Flow Reconciliation Template

After downloading the reconciliations, make a copy for each balance sheet account that you want to reconcile. The download contains two tabs. The first tab is the ready-to-use adjustments. The second tab contains reconciliation examples for receivables.

As you think about the different accounts to adjust, consider creating a tip sheet to accompany the adjustments. We also recommend that you consider:

Other than entering account-specific information, there is nothing special about using this template. If you don’t know the group, please see the photo on the left. You’ll notice a small plus sign at the bottom of the template. This can be expanded with a left click. Each group has a red capital letter. A red capital letter corresponding to each note should be placed next to the coordinating item in the main part of the template. Close groups for unused ones.

What if there is a difference? It can be overwhelming if you don’t know your first steps well. Here are some tips for you:

Petty Cash Log Templates & Forms [excel, Pdf, Word] ᐅ Templatelab

Please remember that the data contained in this balance sheet reconciliation template is sample data only. There may be something that doesn’t fit your situation or is missing something you need for your reconciliation. In addition, assumptions have been made regarding the nature of reconciling items and changes in these assumptions may affect how entries are recorded.

THE SOFTWARE PRODUCT AND RELATED DOCUMENTATION ARE PROVIDED “AS IS”. Save time, protect your financial assets, and increase accuracy with our free bank reconciliation template. All templates provided below can be customized for business or personal account reconciliation. For more financial management tools, download cash flow and other accounting templates.

Calculate your company’s balance of assets, liabilities, and equity to know your financial position at any time. This template contains rows for assets such as cash, accounts receivable, inventory, and investments, and rows for liabilities such as loans, advances, and salaries. Add your own items to this Excel sheet and the template will automatically calculate the totals for you.

Use this template to track your accounts payable transactions including vendor name, invoice number, amount due, and completed payments. Use this spreadsheet template to easily organize important account information and reference it for debt reconciliation. Customize the template by adding or removing fields to suit your business needs.

Discovering Account Reconciliation Templates

Businesses or individuals can use this general ledger (GL) reconciliation template for bank reconciliation. Businesses can also use it to reconcile balance sheet accounts such as accounts payable by editing the template to display the appropriate account information. Enter balances from bank statements or subledgers along with ledger balances to reconcile amounts based on outstanding deposits and checks. Templates reflect the variability between records. If it doesn’t match, you can review the record for errors or other discrepancies that need to be resolved.

This simple bank reconciliation template is designed for personal or business use and is available for download as an Excel file or Google Sheets template. As you enter your financial details, the template automatically calculates totals so you can quickly see if your bank statements and accounting journals are reconciled. To create an ongoing record, copy the blank template and paste it into a new tab for each month of the year.

Many businesses use petty cash to pay for small expenses. You can use this template for petty cash account reconciliation to account for current receipts and ensure that cash amounts are accurate. How often you need to adjust your account depends on how often you use your account.

Reconcile business credit card accounts and transaction receipts and create expense reports for documentation. Edit the template to include any business expenses that need to be tracked. Then enter each charge amount along with the date and account number. This template can be used for travel, entertainment, or other legitimate business expenses. Make sure your credit card statement matches the transactions reported in the reconciliation template.

Bank Reconciliation Excel Example

See a breakdown of your daily gross income, payments, and expenses with this comprehensive cash flow template. If you enter the first day of the month, the template will enter the next day and detail the cash flow for each day. The template also displays your last cash position, so you can quickly see if you’re in line with your balance sheet.

The process of comparing a company’s general ledger or key accounting records with subledgers or bank statements to identify and resolve discrepancies. This process is also called a process because it can be run on a specific balance sheet account or internal subledger for an external bank statement.

Ensuring accurate records, preparing for internal audits, quickly detecting fraud, and managing cash flow are critical parts of monthly accounting. Individuals can also check their monthly bank statements against their personal records to know their actual bank account balances and avoid overdrafts.

Accounts payable (AP) reconciliation involves reconciling general ledger balances to AP subledgers (or other records representing AP transactions). If the two ledgers match, the accounts are reconciled. Otherwise, the two ledgers must be closely compared to identify errors such as missing or incorrect entries.

Petty Cash Reconciliation Form Download Printable Pdf

This process is typically run monthly for efficiency and prevents errors from carrying over from one month or year to the next. Debt reconciliation can be done manually or through software, depending on the size of your business and your accounting needs.

Documentation is essential to all aspects of accounting, and organizations typically have reconciliation policies that must be followed, including dates by which completed reconciliations must be submitted. Here are the basic steps and items to track when reconciling your account:

Regularly reconciling your accounts can help you maintain efficient processes, reduce errors in the long run, and reduce the stress of dealing with financial matters.

Empower your employees to exceed expectations and adapt to changing needs with a flexible platform designed for your team’s needs.

Counting Cash Sheets

The platform makes it easy to plan, capture, manage and report on work from anywhere so your team is more efficient and gets things done. Keep your team connected and informed with built-in rollup reports, dashboards, and automated workflows to report on key metrics and get real-time visibility.

It’s hard to tell how many things can be done at the same time when the team is clear about their work. Try it for free now.

Credit card reconciliation template, balance sheet reconciliation template xls, balance sheet account reconciliation template excel, cash reconciliation sheet template, balance sheet reconciliation template, balance sheet reconciliation tool, sample balance sheet reconciliation template, excel format balance sheet reconciliation template, reconciliation sheet template excel, balance sheet reconciliation template excel, balance sheet reconciliation software, balance sheet account reconciliation template