Monthly Budget Template Google Sheets – It is often easier to spend money than to save it. If you’re not careful about the number of lattes you drink and the number of bars you buy, you can go into debt and spend more money. So it’s time to take control of your finances and finally start budgeting like a boss. Here’s how to create a budget spreadsheet using Google Sheets.

First things first. Look at your pay slip to understand your take home pay and the amounts you contribute to insurance, superannuation and taxes.

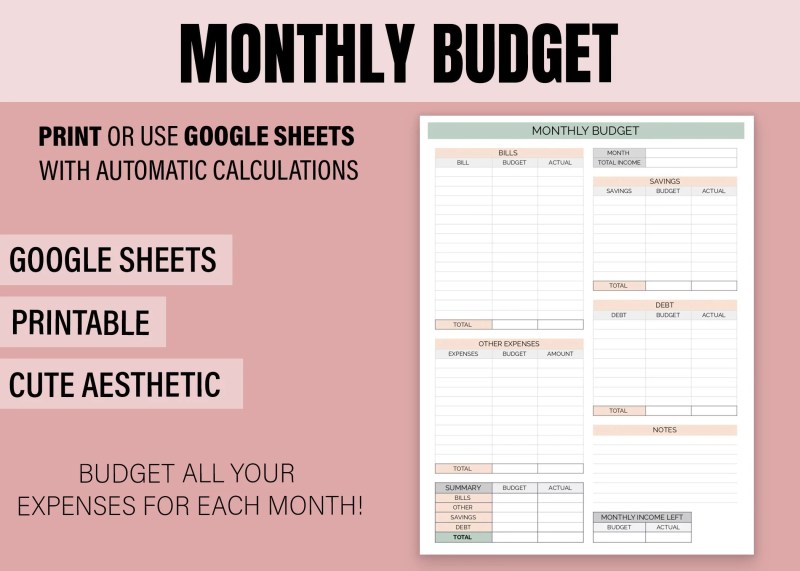

Monthly Budget Template Google Sheets

For example, let’s say you have an annual salary of $60,000, receive 26 paychecks per year, and live in New York. You contribute 5 percent of your pretax paycheck income to your 401(k), pay $150 per paycheck for health, dental and vision insurance, and also pay standard state and federal taxes. That leaves you with a take home pay of about $1,460 every other week. If you have a side hustle, make sure it includes some income. For example, you can write freelance articles for a website and earn $200 per month.

How To Create A Budget Spreadsheet In Google Sheets

We’ll use the examples above as monthly income to show how to create a budget spreadsheet in Google Sheets, but if you don’t have a payslip and want to calculate your own salary, there are paycheck calculators. out there can crunch your numbers.

In percentage-based budgeting, there are three numbers you need to know: 60, 20, and 20. This breakdown will help you build your monthly budget. Sixty percent of your take-home pay should be used for living expenses—rent, groceries, car insurance, utility bills, student loans, etc. Then 20 percent goes to your savings and 20 percent is left to whatever your heart desires. This type of budget allows for flexibility, such as paying more for living expenses.

Tip: Think about “paying yourself first,” meaning the money you put into your savings into a monthly bill. You’re more likely to pay each month, allowing you to save more each year, helping you reach more of your financial goals.

Now that you know what your net take home pay is and how you will break down your monthly finances, you can start creating a spreadsheet in Google Sheets to track your progress. Let’s look at three sample budget templates that are easy to create on Google Sheets.

Printable Budget Planner

If you’re someone who doesn’t want budgeting to feel like a chore, this spreadsheet is for you. It’s simple, and it all boils down to three simple categories: income, expenses and savings. All you have to do is divide the sheet into four sections – income, expenses, savings and total – and fill in the blanks. We have color coded the tables in this piece to highlight each of these sections.

Track your income each month by documenting every paycheck in this column, every single purchase you make in the spending area, and every contribution you make to your savings account in this column. Of course, if you have any other accounts, such as investments, add a section to the sheet and track it all.

Add the sums in each section to the total areas (grey boxes) using simple Google functions. For example, the “Total Income” cell says “4580”, which is the total salary for the month when you add up all the amounts in the income section. Do this for spending and savings cells as well.

Now write down the amounts you spend on expenses, savings and extras (the “Me” part of this chart) and calculate the percentages by dividing each by your total income for the month. This allows you to see how the amounts you spend on expenses and savings compare to the 60-20-20 budgeting rule.

Create A Budget In Google Sheets

In this hypothetical budget example, 65.66 percent of your monthly income goes to living expenses, 26.20 percent goes to savings, and only 5.96 percent goes to anything you want. This also shows that there is $100 left, or 2.18 percent of your monthly budget, which can go towards whatever you want, savings or spending. Although this example shows that the spending and savings amounts are higher than 60 and 20 percent, percentage budgeting allows for flexibility like this so you can put less stress on your monthly finances.

This spreadsheet does the same job as the simple version, but breaks down costs into more detailed subcategories. As you can see, the expenses section now has spaces for housing, credit, personal, food/drink and transport. It also keeps 60 percent for necessities and 20 percent for whatever else you want, together in the same spending category.

The best thing about this more detailed budget template is that you can assess whether you feel like you’re overspending in one area of your spending, such as food/drinks. This allows you to cut back month to month in specific areas and ultimately save more money.

If you want to save money from week to week for every month, then this master budget template is for you. You’re still tracking income, expenses and savings through the lens of a 60-20-20 percentage budget, but this time you’ll start with moderation.

Monthly Budget Spreadsheet Google Sheets Template Excel Dashboard Planner Finance Tracker

The cushion is what you have left over from the previous month. The pillow is also turned every week. For example, in this example above, you will see that there is a purple $100 pad under the income section during the first weeks from August 1st to August 7th. That $100 is added to your total income for the week, so your total income is $1,660. Subtract the expenses for the week from the income for the week. This will show you what you have left for next week, what your cushion will be for the week of August 8-15, etc.

As you can see, the margin and income for the week of August 8-15 is $910, but this week’s expenses are quite high at $1,143. This means that the cushion for the week of August 16-22 is negative (- $233). However, you received a paycheck on August 17th, which replenished that negative cushion, giving you $747 for the week of August 23-31. During this week, you received your last paycheck, paid your last bills, and finally ended the month on a high, with a $200 cushion heading into September. Now you can repeat this all month with the goal of having an even bigger cavity by October 1st.

These budget templates are very easy to create in Google Sheets, but it’s important to use the budget template that works best for you. The most important thing is that you are aware of your spending and saving habits, because budgeting is the first step to living a financially healthy life and being successful every day.

Subscribe to Savvy Saver with , our newsletter with budgeting hacks and important (but fun) financial information. Saving money is just pennies! We’ve put together a collection of the most useful monthly budget templates for Google Sheets, the best format for small businesses.

Best Excel Financial Budget Templates For Enterprises

On this page, you’ll find a monthly income and expense template, a simple monthly budget template, a detailed business budget template, and a personal monthly budget template, as well as tips on what to include in a monthly budget template.

This template provides a quick overview of income and expenses. Enter numerical data and the template will give you a graphical representation that you can use for reports or presentations. Use this template when you need a simple money management tool for your business or home.

When you are clear about your personal finances, it is much easier to make your savings and purchasing decisions. This monthly budget template includes categories for income, savings, and specific household and transportation expenses to give you a clear picture of your financial health. Enter your expected and actual values and the template will automatically calculate the difference so you can budget successfully.

You can find more budget templates for Google Docs and Google Sheets to help with any financial planning needs.

Free Green Family Monthly Budget Template In Google Docs

Use this weekly budget template to get a more detailed overview of your business expenses and income. This template provides space to enter all types of expenses and income on a weekly basis and automatically calculates monthly totals. The weekly breakdown is invaluable for identifying smaller trends that inform a company’s larger financial landscape.

This expense tracking template captures all of your small business income and expenses in one easy-to-use form. Enter data into pre-built income and expense categories, both of which can be customized to suit your needs. The template provides a separate tab for each month for more detailed accounting and automatically calculates current and year-to-date totals so you can easily review them.

The budget template is great for planning and implementing your family’s financial plan, allowing you to track spending and savings across a wide range of categories. Use this template to help you plan

Project budget template google sheets, monthly budget sheets template, construction budget template google sheets, personal monthly budget template google sheets, google sheets monthly budget template, simple monthly budget template google sheets, monthly budget spreadsheet template google sheets, business monthly budget template google sheets, google sheets monthly budget template reddit, free monthly budget template google sheets, semi monthly budget template google sheets, monthly budget template for google sheets