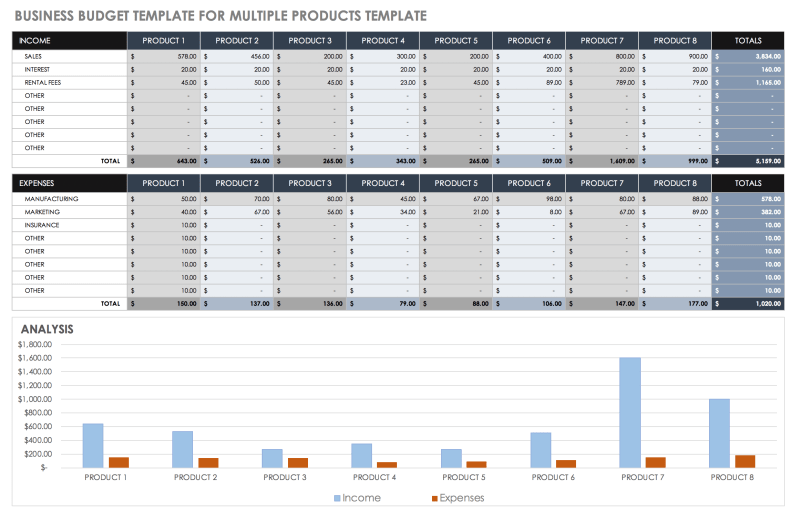

Free Small Business Budget Template – As a business owner, expense tracking is taxable. When promoting your products or services, keeping your promises, and developing new offers, you need to document every detail to make sure you stay within your spending limits. A business budget worksheet can help you stay organized. Having a template to work with reduces the time it takes to write down budget details, helps you prioritize projects and allocate resources to get them done, and reveals trends in money spent versus results achieved. Depending on the complexity of your business, you may need to supervise several separate budgets while managing your overall spend. The following business budget worksheets cover a variety of templates, from product marketing to website redesign, to comprehensive templates that cover all aspects of your marketing plan. Let’s get down to business so you can take control of your budget like never before. How to write a business budget 1. Use budget templates Building a business budget from scratch can be overwhelming; You need to collect detailed information about the estimated budget for each month, the actual expenses and the cumulative sum of each of them. If you’ve never written a business budget or are looking for a specific marketing worksheet, you can start with HubSpot’s Marketing Budget Templates. This download includes eight well-designed and detailed templates to help you manage your finances with Microsoft Excel or Google Sheets. A quick overview explains how to use each template so you can easily start filling in your own information. Download now 2. Set Your Strategy and Goals To get the most out of your budget, you need to know what goals you want to achieve and what strategy you have to achieve them. If you are working on increasing your sales (goal) and planning to improve your website (strategy) to attract potential customers, you need to invest money in a redesign project. If your business is just getting started, check out these strategic planning models to help you set your long-term goals. This way, your budget will reflect the financial resources needed to achieve your goals. 3. Add up the numbers Every business has different needs, so no two budgets will be exactly the same. For example, your branding and creative budget will contain completely different line items than your website redesign budget. No matter what budget you are preparing, you will need all relevant expenses to get a complete overview. Key numbers you may want to include are: Earnings Forecasts: Consider your past financial performance and your projected income from growth. Fixed Cost Forecasts: Fixed costs (ie employee salaries, office rent, business software, insurance and utilities). Variable Cost Forecasts: Costs that can change from month to month (for example, overtime pay, procurement costs, or software that will vary by use). Annual Project Expenses: The total cost of meeting all of your company’s goals for the year. Individual Project Expenses: Costs associated with each project that should be tracked on each budget sheet. Target Profit Margin: Indicator that shows how much money a business is making. Knowing your profitability – and budgeting it – is a useful guide to what you hope to achieve during the year and a good benchmark when looking at monthly financial trends. Depending on your budget, you can also include cash, inventory, accounts receivable, net fixed assets, or long-term debt. How to Manage Your Business Budget No budget is an island. All businesses are hit by poorly managed budgets, especially small startups. When your budget is just one piece of the puzzle, you’ll likely need to get approval from your manager or management team before spending any money. If you run your business on your own or in a small team, it’s a good idea to ask a trusted associate or financial expert to look at your numbers. They can mark areas to reduce costs, reallocate resources or create higher margins. Want to make sure you’re on the way? Determine how much you should allocate to a marketing budget that meets your goals. Once your budget is ready, checking it once a year isn’t enough – you need to (at least) check it every month to make sure your spending isn’t getting out of hand. After you set up your annual budget, review it at the beginning and end of each month. If you want to stay tuned, you can even set a mid-month review time to see if everything is okay. When a new project appears, add it to the existing operating budget worksheet and make adjustments to overheads. The same is true for abandoning the project. The company’s priorities are constantly changing and your budget has to adjust. Small Business Budget Sheets You have reviewed past financial records, made forecasts for the future, planned future projects, and have all the information you need to create a well-rounded budget. Now it’s time to choose the best business budget spreadsheet for your purposes. Fortunately, all of these options make it easier to keep your finances under control. HubSpot Marketing Budget Templates If you need a worksheet for any marketing area, HubSpot is for you. One download gives you access to eight budget templates: Home Marketing, Product Marketing, Content, Paid Advertising, Public Relations, Branding & Creation, Website Redesign and Events. Image Source Small Business Budget Templates Simplicity is the leitmotif of these Smartsheet budget sheets. Each Excel template is free to download, with options for multiple products, business expenses, startups, and more. Image Source Business Expense Template Need a brilliant budget for business expenses? Microsoft Office takes care of this well-designed Excel template that summarizes the costs of employees, marketing, office space, travel and training. Just fill in the blanks and submit for approval. Image Source Annual Budget Template To easily see how your income and expenses are changing from year to year, this Excel template from Quickbooks is all you need. Image Source Freelance Budget Templates Working for yourself often means combining personal and business expenses. Therefore, these Excel templates in Business Load include revenue forecasts and personal costs. You can even plan your tax, 401k, and contingency fund expenses on the same page – because you probably have more than enough to manage. Image Source Sample Business Budget Spreadsheet Personally, I’d rather endure the monotony of typing in lines than spend all day organizing numbers in a blank spreadsheet. But with an example to work with, it’s easy to make sure everything is alright. If you share this mindset, here’s a complete example of a business budget spreadsheet to help you get started. The example shows the budget needed for a website redesign project, and each expense is categorized in an organized and easy-to-read manner. You can see what the budget is going on (UX tests) and where the savings are (CMS software). Creating your own business budget with these templates is so quick and easy that you can edit your numbers right away. The sooner you start, the better your budget (and your business) will be in the coming months and years.

Get specialized marketing tips straight to your inbox and become a better marketer. Subscribe to Marketing below.

Free Small Business Budget Template

We care about your privacy. HubSpot uses the information you provide to us to communicate with you about our related content, products and services. You can unsubscribe from these communications at any time. Check out our Privacy Policy for more information. We’ve compiled the most useful small business budget templates in Microsoft Excel and Google Sheets formats, and give you some useful details on how to fill out these templates.

The Right Way To Prepare Your Budget

You’ll find many useful small business budget templates on this page, including a simple small business budget template and a business budget template. Also, find out why you need a budget template for a small business and how to create a budget template for a small business.

Use this small business budget template to monitor and manage your company’s finances. This easy-to-complete template features a monthly income page, another page for calculating monthly expenses, and a third page for recording cash flow balances that affect your cash flow and debit balances. Easily track and view your monthly income and expenses to calculate your total profit. The completed budget will help you gauge how close you are to achieving your financial goals.

This detailed, comprehensive budget template is the perfect choice for small business owners looking to keep an eye on their company’s finances. The template includes columns for budgeted and actual work hours, rate, materials, unit cost, and over / under calculated values. Use a template to easily compare budgeted amounts to actual expenses to learn more about how well you’re on budget.

Track your small business’s monthly finances with this easy-to-fill 12-month business budget template. The template includes profit and loss category rows

The Best Free Business Budget Worksheets

Small business budget template free, small business budget template free download, free small business budget template excel, small business budget template, free event budget template, business expense budget template, small business monthly budget template, business budget template excel free, free business budget template, small business budget template excel, free small business budget spreadsheet template, budget for small business template