Personal Budget Pie Chart – I am a girl. Always have, and always will. I see things in numbers and percentages. It’s easy to budget and track my expenses. But if you are a sighted person, you will find it a little difficult to stay focused on your financial situation.

So today I want to look at spending money a little differently – by using a cookie sheet. Your financial health is made up of many factors – your income and expenses, assets and liabilities, and future goals/spending plans. But perhaps the biggest thing you can do to change your financial situation is to divide your income between savings and expenses.

Personal Budget Pie Chart

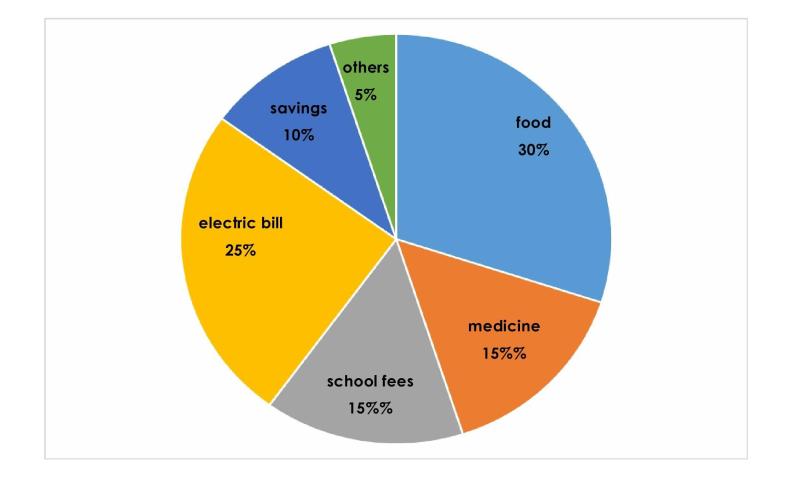

When I took my financial planning course, my professor gave us some general metrics to use when evaluating our clients’ finances. He then uses a pie chart to show what the average person’s income distribution should look like:

Review Of Ohio’s 2022 23 Budget

As you can see, only about 20% of your pre-tax income should be spent on everyday expenses! This includes things like expenses, food, clothing and entertainment.

You can use Excel to create a pie chart for you, or you can make one by hand. To use Excel, you can download the best pie chart and fill in the numbers that apply to you.

If you want to do your pie chart by hand, do your best to break down your income into each of the categories above. For each category, divide that amount by your gross income, then multiply by 100. This will convert your expenses in each category to a percentage. Draw a large circle and divide it in half. Draw four lines in half to create a total of 10 sections. Each of these sections represents 10%. Write on paper with different colored pencils or markers, write in fractions of 10 to represent groups that are more or less than 10%.

Everyone’s cookie sheet will be slightly different. The “ideal” diet plan I shared above may not be right for you depending on your current situation and future goals. If you have 6 children that you want to send to college, you should put it in the “other savings” category. If your house is paid off, you need to spend less than 28% of your income on taxes and insurance. And if you want to retire at 50, you need to save more than 10% of your income for that purpose! But in general, the above chart is a good starting point for evaluating your personal expenses.

Basalt Officials Say They Boosted Transparency Of Budget During A Tough 2019

If you can help it, you should lower the percentage of housing, other expenses, and everyday expenses. You should maximize the percentage of retirement and other savings.

Risk management (insurance) and taxes will depend on your personal situation, but in general you should spend as little money as possible in both categories while maintaining adequate insurance.

To reduce your taxes, consider putting more money toward retirement or education savings. Adding 401(k) contributions will reduce your taxes; The amount depends on your tax form. Traditional IRA contributions are tax-deductible if you are below the income limit and can deduct the income. Roth IRA contributions will not reduce taxes now, but will help you save on taxes later. You may qualify for the Retirement Savers Credit! And if you’re self-employed, you have many options to save for retirement while minimizing your taxes.

If your pie chart seems to deviate from the ideal pie chart, check out some ways to save money, reduce your debt payments, manage your insurance premiums, and reduce your total debt.

D Pie Graph Family Budget Taxes Stock Vector (royalty Free) 29434912

You can get my newsletter with useful tips and other information directly to your email for free by entering your email address below. Your address will not be sold or used for spam and you can unsubscribe at any time. The question I get asked every day is this: How much money should I spend on _______?

It’s a fair question. So here is the clear answer in writing. Below you will find the ideal home budget.

But here’s what you need to know. If you don’t spend the maximum amount in one category, you can allocate more money to other categories. In other words, let’s say that your transportation costs at home are only 5% of your income, then you can be willing to allocate the “extra” 10% to other groups. This is exactly how I live the financial life I want to live. I have very little transportation costs, so food and housing get a bigger share of my income. Also, I don’t spend much on entertainment, so my savings ratio is more than 10%.

People who do not work on this give and take basis often fall into debt. Many financial families operate at 110% of their income. You just can’t. I encourage you to compare your home expenses with this chart and this idea. I also want to hear your words. Leave a comment on the blog about your favorite changes. Which categories are you ignoring so you can spend more money on others?

Using Excel And Google Sheets For Budgeting: The Rundown

And if you are a tither, this budget is based on your income after your tithe. Also, this doesn’t even include your 401(k) savings which is usually taken from your income before it is considered a “pool” payment. So, if you save 15% of your gross income for your 401(k) and the other 10% of your take home money for savings, then you are a rock star. Check it out. A rock star may not save money.

Peter Dunn. Pete the Planner® is an award-winning financial planner and former comedian. He is a USA Today journalist, author of ten books and host of the popular radio and podcast The Pete the Planner Show. Pete is considered one of the best health experts in the world, but he’s just going to talk you out of bass fishing. Most people know they need to budget, but figuring out how to do it can seem difficult. How much of your income do you decide to spend on food versus entertainment? And what do you do with bills that change every month, like your electric bill? Many people find that having a visual representation of where their money will help them. Making a pie chart can help you create a budget, stick to it, and see your monthly expenses.

A pie chart or pie chart uses the data to divide the whole into different parts, each represented by a circle. When it comes to budgeting, each part of the pie chart represents different costs. Budget pie charts are especially useful for people who like to see their budget every month because it shows you the whole picture of your expenses and can help you make decisions. if you pay more in one category than others.

Pie charts use your financial data to create their graph. This information comes from your monthly bills and expenses. To create an accurate pie chart, you need to know how much you spend each month. This information is collected by collecting all monthly expenses. Using this information, you can create a graph with clear segments for each spending group.

Best Free Personal Monthly Budget Template

This model will often be useful to the financial when preparing the report and setting the company’s budget plan. You can group the expenses or income for the company into a specific category. You can then present the data using a pie chart and identify the categories with the highest value.

This template can also be used by department heads when submitting their department’s annual budget. You can define categories such as employee training, notes, business trips, purchase of raw materials and so on. You can compare the data obtained with the actual costs of last year and identify the reasons for increasing or decreasing the costs of the department.

School teachers can use this model to prepare courses on financial analysis or budgeting. Economists and analysts can also use this model. Startup managers can use images from this template in planning for their business meetings.

PR professionals can use this model when preparing data analysis for social media analysis. You can group responses by age or income level, education or location.

Financial Pie Chart

Budget Pie is a professional and modern template that includes four beautiful and fully customizable templates. The model is designed in warm colors and has many infographics. If necessary, you can change all the elements of the image according to your business needs. This model will be useful for business leaders, bank managers, accountants and financial experts. The Financial Pie Report will be a worthy addition to your collection of advertising. Many people often wonder how much of their income they should spend

Personal budget chart, budget calculator pie chart, california budget pie chart, us budget pie chart, household budget pie chart, federal budget pie chart, pie chart budget maker, pie chart of budget, pie chart budget, wedding budget pie chart, monthly budget pie chart, usa budget pie chart