Business Plan Budget Template – According to the U.S. Bureau of Labor Statistics, 20% of small businesses fail within their first year. And while the reasons vary, their failure is often due to cash flow issues.

Don’t let your business become another statistic. To give your new small business the best chance at survival, you need to learn how to take inventory of your income and expenses—your cash flow—and track what you’re actually earning and spending. In other words, you need a budget.

Business Plan Budget Template

Creating a profitable budget for your small business doesn’t have to be complicated. All you need is a spreadsheet program like Microsoft Excel to create your own budgeting tool. Better news? We’ve created a free small business budget template for you.

Free Excel Spreadsheet For Business Expenses In 2022

Instead of creating a budget spreadsheet yourself, use our budget template spreadsheet to lay out your budget plan. We’ll show you how in four easy steps.

You can’t create a budget without taking inventory of your income. Why not? Because your income determines how much you can spend.

To find out how much you bring in, you can refer to your income statement (P&L), also known as an income statement. An income statement shows how much your business made or how much you lost. It has three components:

For this first step, we are primarily interested in your income. Depending on your business model, you may have multiple sources of income, e.g. B. a subscription service or online courses. To get an accurate budget, make sure all revenue streams are included in your inventory.

The 7 Best Excel Budget Templates (household & Business)

You’ll notice we’ve interchanged the terms revenue and income here. That’s because sales and gross income mean the same thing — the total cash inflow from your primary income-generating activity. Your income can be further divided into two categories: business income and non-business income.

Operating income refers to your earnings before interest and taxes. Non-operating income includes any money you earn from activities unrelated to your main business, such as: B. Interest or rent.

The bottom line? If you make money from it, include it in your income streams. See the image below for an example of how it looks in our template:

Once you’ve inventoried your income, you can deduct fixed costs. Fixed expenses include annual or monthly expenses such as rent, insurance, membership fees, subscriptions, or anything else that you pay the same amount on a regular basis. Planned costs are easy to predict because they are constant.

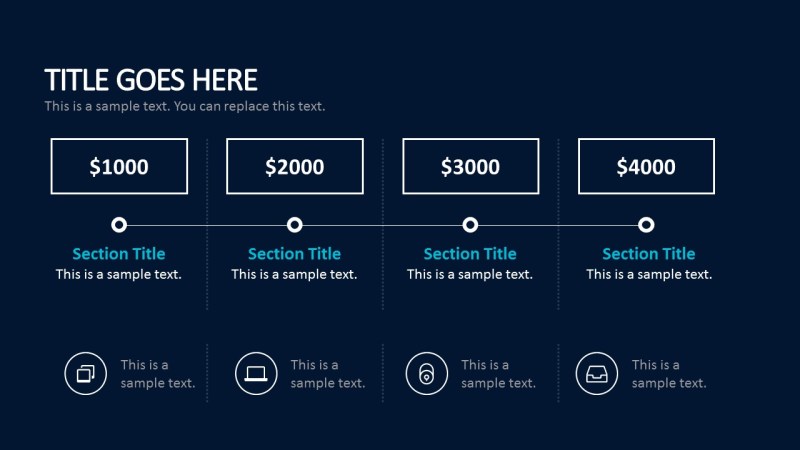

Startup Budget Summary Small Business Business Budget

However, variable costs are a different story. This includes expenses such as utilities, marketing, materials, payroll, and travel, and their costs can change from month to month. To estimate the total for your budget, you can use old receipts and bills.

Note: Speaking of travel expenses or other expenses incurred by individual employees, it can be helpful to have a business expense template that you can provide so you can budget for those expenses. We’ve included one in our free download for you to use.

Once you have determined all the fixed and variable costs, subtract them from your income. You now have your net income.

You’ve estimated what you think you can make and spend – now it’s time to track actual dollar amounts.

Budget Plan Template

Here’s a monthly review of our business budget template to track what you actually spent on each item you entered in Step 2. They do this to see if your estimate reflects the actual cost leaving your account .

Why is this step so important? Because it’s like holding a mirror to your finances. You may have good intentions when it comes to what you do

Spend, but if you don’t fix it in practice, you won’t find much use on a budget. This brings us to our fourth and final step: Use this information to make better decisions for your small business.

Now that we’ve covered how to track your income, expenses, and actual expenses, you can better understand your finances — and make better financial decisions for your small business — by making an income statement.

Best Startup Budget Templates

As mentioned earlier, your income or profit and loss (P&L) statement shows how much your business made or how much you lost. It is useful to have on hand when preparing your business budget as it serves as a baseline. See below for an example.

Once you’ve completed steps 1 and 2 above to calculate your net income, you’ll have all the information you need to prepare an income statement. If your net income is positive, congratulations! Your business is profitable.

You will lose money if your net income is negative, but don’t panic. Knowledge is half the battle, and if you deal with your financial situation, you’re on your way to better budgeting skills.

If numbers aren’t your forte, or if you’d rather use Google Sheets than Excel, you’ve come to the right place. Here are some resources that can provide additional help with budgeting:

Booster Club Budgeting 101

While the steps we’ve covered are a good place to start, they’re meant to serve as a basis for your budget. Once you’re comfortable, you can plan a safety net or review your expenses to adjust the nonessentials. Accounting software can help you manage transactions and provide a real-time analysis of your financial status, including cash flow and expense management.

Lauren Spiller is a Senior Content Writer at Capterra covering customer management, customer service and customer experience with a focus on customer acquisition through SEO. She has an MA in Rhetoric and Composition from Texas State University and has presented her work at European Writing Centers Association, Canadian Writing Centers Association, and International Writing Centers Association conferences. He is currently creating content for a series of SEO writing workshops. She enjoys cooking and spending time outdoors in Austin, Texas. We have collected the most useful free small business budget templates in Microsoft Excel and Google Sheets formats and also provided useful details on how to fill out these templates.

On this page you will find many useful small business budget templates, including a simple small business budget template and a company budget template. Also, learn why you need a small business budget template and how to create a small business budget template.

Use this small business budget template to track and manage your company’s finances. This easy-to-fill template includes a sheet for monthly income, another sheet for calculating monthly expenses, and a third sheet for recording cash flow balances that account for credit balances and debit cash flow. Easily track and view monthly income and expenses to calculate total income. A completed budget will help you assess how close you are to achieving your financial goals.

Annual Business Budget Template In Excel

This detailed, all-in-one budgeting template is perfect for small business owners who want to monitor the financial health of their business. The template includes columns for labor hours, rates, materials, unit costs, and plan and actual figures for counted over/under. Use the template to easily compare budgeted amounts to actual spending to better understand how well you’re staying on budget.

Track your small business finances month by month with this easy-to-fill 12-month business budget template. The template includes profit and loss category sets for cost of sales (GOGS), sales and marketing expenses, labor costs, and earnings before interest and taxes (EBIT). You can also include cash, inventory, accounts receivable, net assets, and long-term debt for monthly, quarterly, and annual insight into your company’s time-sensitive budget.

Use this customizable template to track budgets for one or multiple projects and get a comprehensive picture of your company’s finances. This multi-project business budget template allows you to factor in business revenue (actual vs. budgeted), COGS numbers for each product, and total revenue (non-operating revenue ) so you can quickly find your adjusted gross income. Enter operating expenses to see your company’s financial position and how far you are from achieving your goals.

Get an annual review of your company’s financial health with this annual business budget template. Use the income sheet to enter your sales numbers (fees billed, commission income, service income, etc.) and compare these numbers to individual entries on an expense sheet (COGS, travel , insurance, etc.). Also, use the summary sheet to get an overview of your expenses based on income and expenses. The completed template will show you how well you’re staying on budget and help you make any clarifications or adjustments you may need.

Printable Business Budget Template In Pdf (basic)

For a detailed drill-down on your small business’s spending by cost — and how it affects your company’s budget — this template includes a projected cost sheet that summarizes your projected employee, office, marketing , training, and travel expenses and budgets compare on one sheet to your actual expenses. Use the third cost variance sheet to check the difference between the two (planned vs actual) and cost analysis sheet to get a dashboard view so you can assess the overall financial health of your business.

Use this professional business budget template to make informed decisions about how planned and actual expenses affect your company’s bottom line. Put the personnel and operating expenses on a sheet, compare them to the actual expenses on an actual business expense sheet, and then check them

Sample business budget template, business budget plan template, business expense budget template, marketing plan budget template, business budget sheet template, basic business budget template, business plan budget template excel, small business budget template, business budget excel template, start up business budget template, business plan and budget template, startup business budget template